Motorola 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

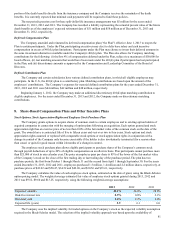

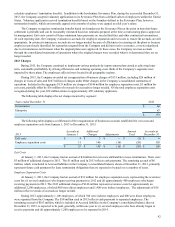

The following table summarizes the proceeds received from sales of accounts receivable and long-term receivables for

the years ended December 31, 2013, 2012 and 2011.

Years ended December 31 2013 2012 2011

Cumulative annual proceeds received from sales:

Accounts receivable sales proceeds $ 14 $ 12 $ 8

Long-term receivables sales proceeds 151 178 224

Total proceeds from receivable sales $ 165 $ 190 $ 232

At December 31, 2013, the Company had retained servicing obligations for $434 million of long-term receivables,

compared to $375 million of long-term receivables at December 31, 2012. Servicing obligations are limited to collection

activities of the sales of accounts receivables and long-term receivables.

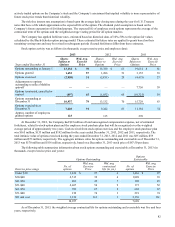

Credit Quality of Customer Financing Receivables and Allowance for Credit Losses

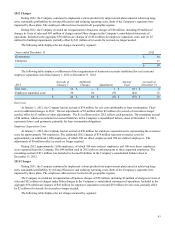

An aging analysis of financing receivables at December 31, 2013 and December 31, 2012 is as follows:

December 31, 2013

Total

Long-term

Receivable Current Billed

Due Past Due Under

90 Days Past Due Over

90 Days

Municipal leases secured tax exempt $ 1 $ — $ — $ —

Commercial loans and leases secured 35 13 2 10

Total gross long-term receivables, including

current portion $ 36 $ 13 $ 2 $ 10

December 31, 2012

Total

Long-term

Receivable Current Billed

Due Past Due Under

90 Days Past Due Over

90 Days

Municipal leases secured tax exempt $ 23 $ — $ — $ —

Commercial loans and leases secured 78 1 2 4

Total gross long-term receivables, including

current portion $ 101 $ 1 $ 2 $ 4

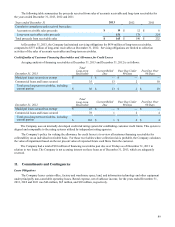

The Company uses an internally developed credit risk rating system for establishing customer credit limits. This system is

aligned and comparable to the rating systems utilized by independent rating agencies.

The Company’s policy for valuing the allowance for credit losses is to review all customer financing receivables for

collectability on an individual receivable basis. For those receivables where collection risk is probable, the Company calculates

the value of impairment based on the net present value of expected future cash flows from the customer.

The Company had a total of $10 million of financing receivables past due over 90 days as of December 31, 2013 in

relation to two loans. The Company is not accruing interest on these loans as of December 31, 2013, which are adequately

reserved.

11. Commitments and Contingencies

Lease Obligations

The Company leases certain office, factory and warehouse space, land, and information technology and other equipment

under principally non-cancelable operating leases. Rental expense, net of sublease income, for the years ended December 31,

2013, 2012 and 2011 was $66 million, $65 million, and $92 million, respectively.