Microsoft 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

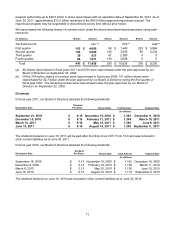

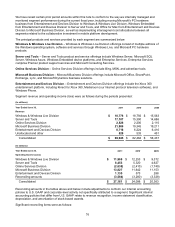

NOTE 22 — QUARTERLY INFORMATION (Unaudited)

(In millions, except per share amounts)

Quarter Ended September 30 December 31 March 31 June 30 Total

Fiscal Year 2011

Revenue $ 16,195 $ 19,953 $ 16,428 $ 17,367 $ 69,943

Gross profit 13,056 15,120 12,531 13,659 54,366

Net income 5,410 6,634 5,232

(a) 5,874

(b) 23,150

Basic earnings per share 0.63 0.78 0.62 0.70 2.73

Diluted earnings per share 0.62 0.77 0.61 0.69 2.69

Fiscal Year 2010

Revenue $ 12,920

(d) $ 19,022

(c) $ 14,503 $ 16,039 $ 62,484

Gross profit 10,078 15,394 11,748 12,869 50,089

Net income 3,574 6,662 4,006 4,518 18,760

Basic earnings per share 0.40 0.75 0.46 0.52 2.13

Diluted earnings per share 0.40 0.74 0.45 0.51 2.10

(a) Includes a partial settlement of an I.R.S. audit of tax years 2004 to 2006, which increased net income by

$461 million.

(b) Reflects an effective tax rate of 7% due mainly to the adjustment of our previously estimated effective tax

rate for the year to reflect the actual full year mix of foreign and U.S. taxable income. In addition, upon

completion of our annual domestic and foreign tax returns, we adjusted the estimated tax provision to reflect

the tax returns filed and recorded an income tax benefit which lowered our effective tax rate.

(c) Reflects $1.7 billion of revenue recognized for sales of Windows Vista with a guarantee to be upgraded to

Windows 7 at minimal or no cost and of Windows 7 to original equipment manufacturers and retailers before

general availability (the “Windows 7 Deferral”).

(d) Reflects $1.5 billion of revenue deferred to future periods relating to the Windows 7 Deferral.