Microsoft 2011 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

new share repurchase program authorizing up to $40.0 billion in share repurchases with an expiration date of

September 30, 2013 (the “2008 Program”). As of June 30, 2011, approximately $12.2 billion remained of the

$40.0 billion approved repurchase amount. The repurchase program may be suspended or discontinued at any

time without notice.

During the periods reported, we repurchased with cash resources: 447 million shares for $11.5 billion during fiscal

year 2011; 380 million shares for $10.8 billion during fiscal year 2010; and 318 million shares for $8.2 billion

during fiscal year 2009. All shares repurchased in fiscal years 2011 and 2010 were repurchased under the 2008

Program. Of the shares repurchased in fiscal year 2009, 101 million shares were repurchased for $2.7 billion

under the 2007 Programs, while the remainder was repurchased under the 2008 Program.

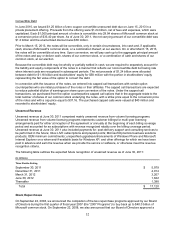

Dividends

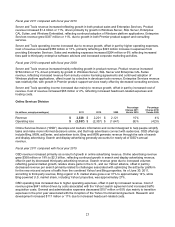

During fiscal years 2011 and 2010, our Board of Directors declared the following dividends:

Declaration Date Dividend

Per Share Record Date Total Amount Payment Date

(In millions)

Fiscal Year 2011

September 21, 2010 $ 0.16 November 18, 2010 $ 1,363 December 9, 2010

December 15, 2010 $ 0.16 February 17, 2011 $ 1,349 March 10, 2011

March 14, 2011 $ 0.16 May 19, 2011 $ 1,350 June 9, 2011

June 15, 2011 $ 0.16 August 18, 2011 $ 1,340 September 8, 2011

Fiscal Year 2010

September 18, 2009 $ 0.13 November 19, 2009 $ 1,152 December 10, 2009

December 9, 2009 $ 0.13 February 18, 2010 $ 1,139 March 11, 2010

March 8, 2010 $ 0.13 May 20, 2010 $ 1,130 June 10, 2010

June 16, 2010 $ 0.13 August 19, 2010 $ 1,118 September 9, 2010

Off-Balance Sheet Arrangements

We provide indemnifications of varying scope and size to certain customers against claims of intellectual property

infringement made by third parties arising from the use of our products and certain other matters. In evaluating

estimated losses on these indemnifications, we consider factors such as the degree of probability of an

unfavorable outcome and our ability to make a reasonable estimate of the amount of loss. To date, we have not

encountered significant costs as a result of these obligations and have not accrued in our financial statements any

liabilities related to these indemnifications.

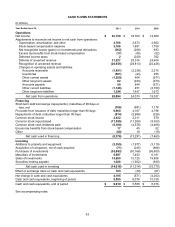

Contractual Obligations

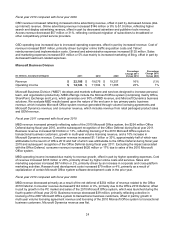

The following table summarizes the payments due by fiscal year for our outstanding contractual obligations as of

June 30, 2011.

(In millions) 2012 2013-2015 2016-2018 2019 and

Thereafter Total

Long-term debt: (a)

Principal payments $ 0 $ 4,250 $ 2,500 $ 5,250 $ 12,000

Interest payments 344 959 720 3,228 5,251

Construction commitments (b) 263 0 0 0 263

Operating leases (c) 481 964 380 127 1,952

Purchase commitments (d) 5,580 355 0 0 5,935

Other long-term liabilities (e) 0 92 22 22 136

Total contractual obligations $ 6,668 $ 6,620 $ 3,622 $ 8,627 $ 25,537

(a) See Note 12 – Debt of the Notes to Financial Statements

(b) These amounts represent commitments for the construction of buildings, building improvements and

leasehold improvements.