Microsoft 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

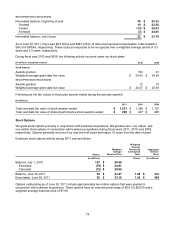

Shared performance stock awards

Shared performance stock awards (“SPSAs”) are a form of SA in which the number of shares ultimately received

depends on our business performance against specified performance targets.

We granted SPSAs for fiscal years 2011, 2010, and 2009 with performance periods of July 1, 2010 through

June 30, 2011, July 1, 2009 through June 30, 2010, and July 1, 2008 through June 30, 2009, respectively. In

August following the end of each performance period, the number of shares of stock subject to the award is

determined by multiplying the target award by a percentage ranging from 0% to 150%. The percentage is based

on performance metrics for the performance period, as determined by the Compensation Committee of the Board

of Directors in its sole discretion. An additional number of shares, approximately 12% of the total target SPSAs,

are available as additional awards to participants based on individual performance. One-quarter of the shares of

stock subject to each award vest following the end of the performance period, and an additional one-quarter of the

shares vest on each of the following three anniversaries of the grant date.

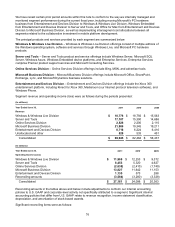

Executive Officer Incentive Plan

Under the Executive Officer Incentive Plan (“EOIP”), the Compensation Committee awards performance-based

compensation to executive officers of the Company for specified performance periods. During the periods

reported, executive officers were eligible to receive annual awards comprised of cash and SAs from an aggregate

incentive pool equal to a percentage of the Company’s operating income. For fiscal years 2011, 2010, and 2009,

the pool was 0.25%, 0.45%, and 0.35% of operating income, respectively.

In September following the end of the fiscal year, each executive officer may receive a combined cash and SA

award with a total value equal to a fixed percentage of the aggregate pool. The fixed percentage ranges between

0% and 150% of a target based on an assessment of the executive officer’s performance during the prior fiscal

year. Following approval of the awards, 20% of the award is payable to the executive officers in cash, and the

remaining 80% is converted into an SA for shares of Microsoft common stock. The number of shares subject to

the SA portion of the award is determined by dividing the value of 80% of the total award by the closing price of

Microsoft common stock on the last business day in August of each year. The SA portion of the award vests one-

quarter immediately after the award is approved following fiscal year-end and one-quarter on August 31 of each of

the following three years.

Activity for all stock plans

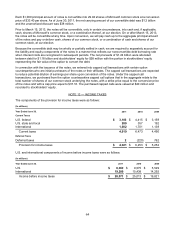

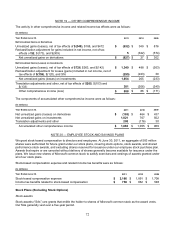

The fair value of each award is estimated on the date of grant using the following assumptions:

Y

ear Ended June 30, 2011 2010 2009

Dividends per share (quarterly amounts) $ 0.13 – $ 0.16 $ 0.13 $ 0.11 - $ 0.13

Interest rates range 1.1% - 2.4% 2.1% - 2.9% 1.4% - 3.6%

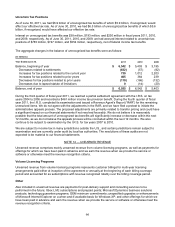

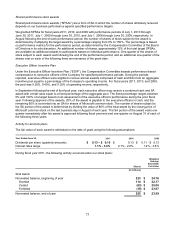

During fiscal year 2011, the following activity occurred under our stock plans:

Shares

Weighted

Average

Grant-Date

Fair Value

(In millions)

Stock Awards

Nonvested balance, beginning of year 223 $ 24.76

Granted 114 $ 22.17

Vested (63) $ 25.00

Forfeited (19) $ 23.97

Nonvested balance, end of year 255 $ 23.59