Microsoft 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

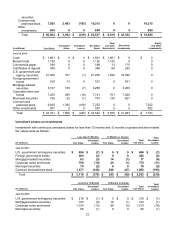

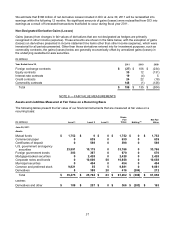

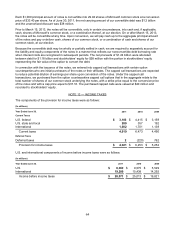

(In millions) Level 1 Level 2 Level 3

Gross

Fair

Value Netting (a) Net Fair

Value

June 30, 2010

Assets

Mutual funds $ 1,120 $ 0 $ 0 $ 1,120 $ 0 $ 1,120

Commercial paper 0 172 0 172 0 172

Certificates of deposit 0 348 0 348 0 348

U.S. government and agency

securities 16,473 4,756 0 21,229 0 21,229

Foreign government bonds 239 294 0 533 0 533

Mortgage-backed securities 0 3,264 0 3,264 0 3,264

Corporate notes and bonds 0 7,460 167 7,627 0 7,627

Municipal securities 0 747 0 747 0 747

Common and preferred stock 6,988 43 5 7,036 0 7,036

Derivatives 22 745 9 776 (207) 569

Total $ 24,842 $ 17,829 $ 181 $ 42,852 $ (207) $ 42,645

Liabilities

Derivatives and other $ 85 $ 137 $ 0 $ 222 $ (205) $ 17

(a) These amounts represent the impact of netting derivative assets and derivative liabilities when a legally

enforceable master netting agreement exists and fair value adjustments related to our own credit risk and

counterparty credit risk.

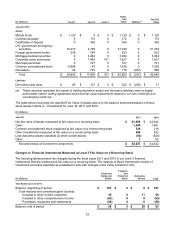

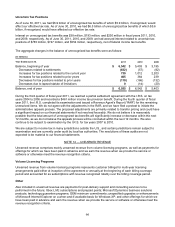

The table below reconciles the total Net Fair Value of assets above to the balance sheet presentation of these

same assets in Note 4 – Investments for June 30, 2011 and 2010.

(In millions)

June 30, 2011 2010

Net fair value of assets measured at fair value on a recurring basis $ 61,058 $ 42,645

Cash 1,648

1,661

Common and preferred stock measured at fair value on a nonrecurring basis 334

216

Other investments measured at fair value on a nonrecurring basis 650

502

Less derivative assets classified as other current assets (54) (544)

Other 1

62

Recorded basis of investment components $ 63,637

$ 44,542

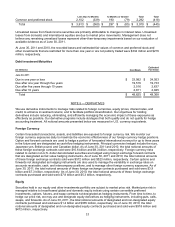

Changes in Financial Instruments Measured at Level 3 Fair Value on a Recurring Basis

The following tables present the changes during the fiscal years 2011 and 2010 in our Level 3 financial

instruments that are measured at fair value on a recurring basis. The majority of these instruments consist of

investment securities classified as available-for-sale with changes in fair value included in OCI.

(In millions)

Corporate

Notes and

Bonds

Common

and

Preferred

Stock Derivative

Assets Total

Y

ear Ended June 30, 2011

Balance, beginning of period $ 167 $ 5 $ 9 $ 181

Total realized and unrealized gains (losses):

Included in other income (expense) 39 0 11 50

Included in other comprehensive income (63) 0 0 (63)

Purchases, issuances and settlements (85) 0 0 (85)

Balance, end of period $ 58 $ 5 $ 20 $ 83