Microsoft 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

On July 1, 2010, we adopted new guidance issued by the FASB on the consolidation of variable interest entities.

The new guidance requires revised evaluations of whether entities represent variable interest entities, ongoing

assessments of control over such entities, and additional disclosures for variable interests. Adoption of the new

guidance did not have a material impact on our financial statements.

Recent accounting pronouncements not yet adopted

In June 2011, the FASB issued guidance on presentation of comprehensive income. The new guidance

eliminates the current option to report other comprehensive income and its components in the statement of

changes in equity. Instead, an entity will be required to present either a continuous statement of net income and

other comprehensive income or in two separate but consecutive statements. The new guidance will be effective

for us beginning July 1, 2012 and will have presentation changes only.

In May 2011, the FASB issued guidance to amend the accounting and disclosure requirements on fair value

measurements. The new guidance limits the highest-and-best-use measure to nonfinancial assets, permits

certain financial assets and liabilities with offsetting positions in market or counterparty credit risks to be

measured at a net basis, and provides guidance on the applicability of premiums and discounts. Additionally, the

new guidance expands the disclosures on Level 3 inputs by requiring quantitative disclosure of the unobservable

inputs and assumptions, as well as description of the valuation processes and the sensitivity of the fair value to

changes in unobservable inputs. The new guidance will be effective for us beginning January 1, 2012. Other than

requiring additional disclosures, we do not anticipate material impacts on our financial statements upon adoption.

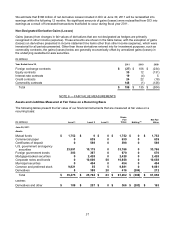

In January 2010, the FASB issued guidance to amend the disclosure requirements related to fair value

measurements. The guidance requires the disclosure of roll forward activities on purchases, sales, issuance, and

settlements of the assets and liabilities measured using significant unobservable inputs (Level 3 fair value

measurements). The guidance will become effective for us with the reporting period beginning July 1, 2011. Other

than requiring additional disclosures, the adoption of this new guidance will not have a material impact on our

financial statements.

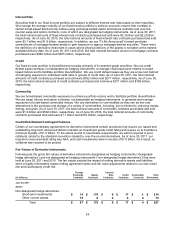

NOTE 2 — EARNINGS PER SHARE

Basic earnings per share (“EPS”) is computed based on the weighted average number of shares of common

stock outstanding during the period. Diluted EPS is computed based on the weighted average number of shares

of common stock plus the effect of dilutive potential common shares outstanding during the period using the

treasury stock method. Dilutive potential common shares include outstanding stock options, stock awards, and

shared performance stock awards. The components of basic and diluted EPS are as follows:

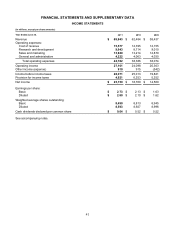

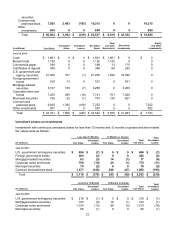

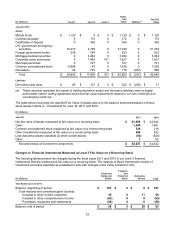

(In millions, except earnings per share)

Y

ear Ended June 30, 2011 2010 2009

Net income available for common shareholders (A) $ 23,150 $ 18,760 $ 14,569

Weighted average outstanding shares of common stock (B) 8,490 8,813 8,945

Dilutive effect of stock-based awards 103 114 51

Common stock and common stock equivalents (C) 8,593 8,927 8,996

Earnings Per Share

Basic (A/B) $ 2.73 $ 2.13 $ 1.63

Diluted (A/C) $ 2.69 $ 2.10 $ 1.62

We excluded the following shares underlying stock-based awards from the calculations of diluted EPS because

their inclusion would have been anti-dilutive:

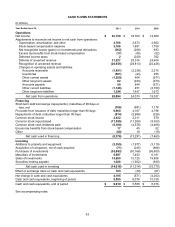

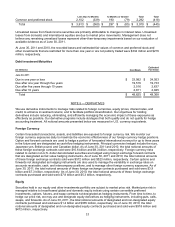

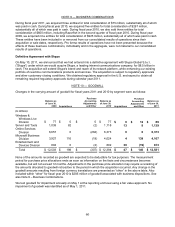

(In millions)

Y

ear Ended June 30, 2011 2010 2009

Shares excluded from calculations of diluted EPS 21

28 342

The decrease in anti-dilutive shares from fiscal year 2009 to 2010 was due mainly to the decrease in employee

stock options outstanding.