Microsoft 2011 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

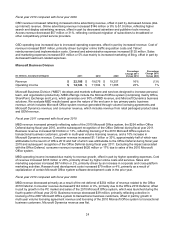

Fiscal year 2010 compared with fiscal year 2009

General and administrative expenses increased due to increased legal charges, as discussed above within

Corporate-Level Activity, and transition expenses associated with the inception of the Yahoo! Commercial

Agreement. These increases were offset in part by a 6% reduction in headcount-related expenses and lower

severance costs. During fiscal years 2010 and 2009, general and administrative expenses included employee

severance expense of $59 million and $330 million, respectively, associated with a resource management

program that was announced in January 2009 and completed in fiscal year 2010.

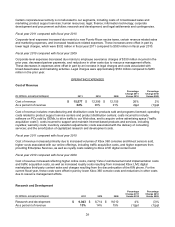

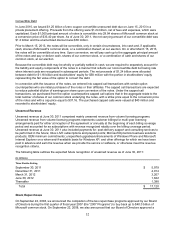

OTHER INCOME (EXPENSE) AND INCOME TAXES

Other Income (Expense)

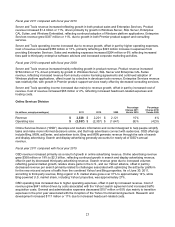

The components of other income (expense) were as follows:

(In millions)

Y

ear Ended June 30, 2011 2010 2009

Dividends and interest income $ 900 $ 843 $ 744

Interest expense (295) (151) (38)

Net recognized gains (losses) on investments 439

348 (125)

Net losses on derivatives (77) (140) (558)

Net gains (losses) on foreign currency remeasurements (26) 1 (509)

Other (31) 14 (56)

Total $ 910 $ 915 $ (542)

We use derivative instruments to manage risks related to foreign currencies, equity prices, interest rates, and

credit; to enhance investment returns; and to facilitate portfolio diversification. Gains and losses from changes in

fair values of derivatives that are not designated as hedges are recognized in other income (expense). These are

generally offset by unrealized gains and losses in the underlying securities in the investment portfolio and are

recorded as a component of other comprehensive income.

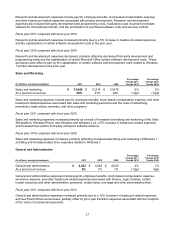

Fiscal year 2011 compared with fiscal year 2010

Dividends and interest income increased due to higher average portfolio investment balances, offset in part by

lower yields on our fixed-income investments. Interest expense increased due to our increased issuance of debt.

Net recognized gains on investments increased due primarily to higher gains on sales of equity securities, offset

in part by fewer gains on sales of fixed-income securities. Derivative losses decreased due primarily to higher

gains on commodity derivatives offset in part by higher losses on currency contracts used to hedge foreign

currency revenue.

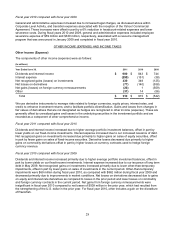

Fiscal year 2010 compared with fiscal year 2009

Dividends and interest income increased primarily due to higher average portfolio investment balances, offset in

part by lower yields on our fixed-income investments. Interest expense increased due to our issuance of long term

debt in May 2009. Net recognized gains on investments increased primarily due to lower other-than-temporary

impairments, offset in part by lower gains on sales of investments in the current period. Other-than-temporary

impairments were $69 million during fiscal year 2010, as compared with $862 million during fiscal year 2009 and

decreased primarily due to improvements in market conditions. Net losses on derivatives decreased due to gains

on equity and interest rate derivatives as compared to losses in the prior period and lower losses on commodity

and foreign currency contracts in the current period. Net gains from foreign currency remeasurements were

insignificant in fiscal year 2010 compared to net losses of $509 million in the prior year, which had resulted from

the strengthening of the U.S. dollar in the prior year. For fiscal year 2010, other includes a gain on the divestiture

of Razorfish.