Microsoft 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

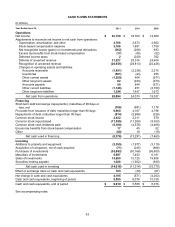

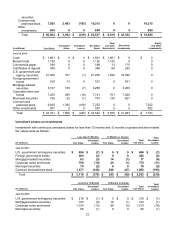

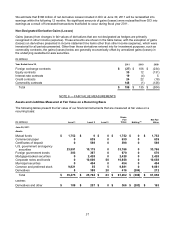

Allowance for Doubtful Accounts

The allowance for doubtful accounts reflects our best estimate of probable losses inherent in the accounts

receivable balance. We determine the allowance based on known troubled accounts, historical experience, and

other currently available evidence. Activity in the allowance for doubtful accounts was as follows:

(In millions)

Y

ear Ended June 30, 2011 2010 2009

Balance, beginning of period $ 375 $ 451 $ 153

Charged to costs and other 14 45 360

Write-offs (56) (121) (62)

Balance, end of period $ 333 $ 375 $ 451

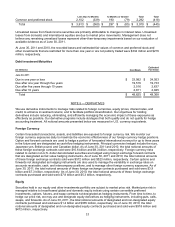

Inventories

Inventories are stated at the lower of cost or market, using the average cost method. Cost includes materials,

labor, and manufacturing overhead related to the purchase and production of inventories. We regularly review

inventory quantities on hand, future purchase commitments with our suppliers, and the estimated utility of our

inventory. If our review indicates a reduction in utility below carrying value, we reduce our inventory to a new cost

basis through a charge to cost of revenue.

Property and Equipment

Property and equipment is stated at cost and depreciated using the straight-line method over the shorter of the

estimated useful life of the asset or the lease term. The estimated useful lives of our property and equipment are

generally as follows: computer software developed or acquired for internal use, three years; computer equipment,

two to three years; buildings and improvements, five to 15 years; leasehold improvements, two to 10 years; and

furniture and equipment, one to five years. Land is not depreciated.

Goodwill

Goodwill is tested for impairment at the reporting unit level (operating segment or one level below an operating

segment) on an annual basis (May 1 for us) and between annual tests if an event occurs or circumstances

change that would more likely than not reduce the fair value of a reporting unit below its carrying value.

Intangible Assets

All of our intangible assets are subject to amortization and are amortized using the straight-line method over their

estimated period of benefit, ranging from one to 10 years. We evaluate the recoverability of intangible assets

periodically by taking into account events or circumstances that may warrant revised estimates of useful lives or

that indicate the asset may be impaired.

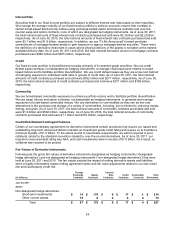

Recently Issued Accounting Standards

Recently adopted accounting pronouncements

On July 1, 2010, we adopted guidance issued by the Financial Accounting Standards Board (“FASB”) on revenue

recognition. Under the new guidance on arrangements that include software elements, tangible products that

have software components that are essential to the functionality of the tangible product are no longer within the

scope of the software revenue recognition guidance, and software-enabled products are now subject to other

relevant revenue recognition guidance. Additionally, the FASB issued guidance on revenue arrangements with

multiple deliverables that are outside the scope of the software revenue recognition guidance. Under the new

guidance, when vendor specific objective evidence or third party evidence for deliverables in an arrangement

cannot be determined, a best estimate of the selling price is required to separate deliverables and allocate

arrangement consideration using the relative selling price method. The new guidance includes new disclosure

requirements on how the application of the relative selling price method affects the timing and amount of revenue

recognition. Adoption of the new guidance did not have a material impact on our financial statements.