Microsoft 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

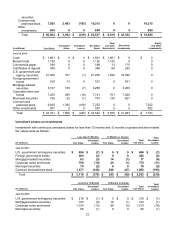

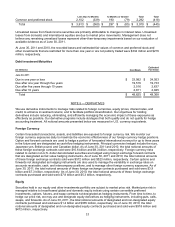

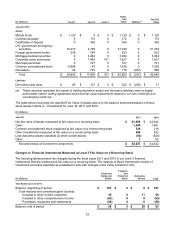

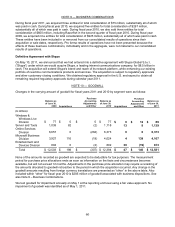

securities

Common and

preferred stock 7,925 2,483 (193) 10,215 0 0 10,215

Other

investments 654 0 0 654 0 4 650

Total $ 60,804 $ 3,052 $ (219) $ 63,637 $ 9,610 $ 43,162 $ 10,865

(In millions) Cost Basis Unrealized

Gains Unrealized

Losses

Recorded

Basis

Cash

and Cash

Equivalents

Short-term

Investments

Equity

and Other

Investments

June 30, 2010

Cash $ 1,661 $ 0 $ 0 $ 1,661 $ 1,661 $ 0 $ 0

Mutual funds 1,120 0 0 1,120 1,120 0 0

Commercial paper 188 0 0 188 13 175 0

Certificates of deposit 348 0 0 348 68 280 0

U.S. government and

agency securities 21,036 167 (1) 21,202 1,822 19,380 0

Foreign government

bonds 518 13 0 531 0 531 0

Mortgage-backed

securities 3,137 135 (7) 3,265 0 3,265 0

Corporate notes and

bonds 7,450 289 (18) 7,721 701 7,020 0

Municipal securities 726 22 (1) 747 120 627 0

Common and

preferred stock 6,640 1,030 (418) 7,252 0 0 7,252

Other investments 507 0 0 507 0 5 502

Total $ 43,331 $ 1,656 $ (445) $ 44,542 $ 5,505 $ 31,283 $ 7,754

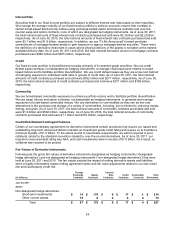

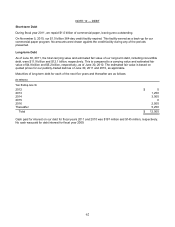

Unrealized Losses on Investments

Investments with continuous unrealized losses for less than 12 months and 12 months or greater and their related

fair values were as follows:

Less than 12 Months 12 Months or Greater

Total

Fair Value

Total

Unrealized

Losses

(In millions) Fair Value

Unrealized

Losses Fair Value

Unrealized

Losses

June 30, 2011

U.S. government and agency securities $ 484 $ (7) $ 0 $ 0 $ 484 $ (7)

Foreign government bonds 365 (2) 0 0 365 (2)

Mortgage-backed securities 63 (3) 14 (1) 77 (4)

Corporate notes and bonds 750 (10) 25 (1) 775 (11)

Municipal securities 79 (2) 0 0 79 (2)

Common and preferred stock 1,377 (146) 206 (47) 1,583 (193)

Total $ 3,118 $ (170) $ 245 $ (49) $ 3,363 $ (219)

Less than 12 Months 12 Months or Greater

Total

Fair Value

Total

Unrealized

Losses

(In millions) Fair Value

Unrealized

Losses Fair Value

Unrealized

Losses

June 30, 2010

U.S. government and agency securities $ 216 $ (1) $ 0 $ 0 $ 216 $ (1)

Mortgage-backed securities 105 (6) 18 (1) 123 (7)

Corporate notes and bonds 1,124 (13) 89 (5) 1,213 (18)

Municipal securities 66 (1) 0 0 66 (1)