Microsoft 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

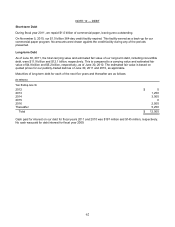

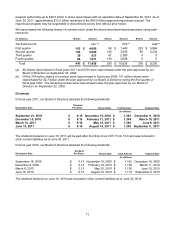

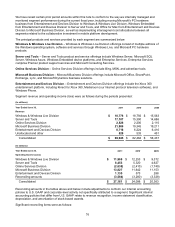

NOTE 19 — OTHER COMPREHENSIVE INCOME

The activity in other comprehensive income and related income tax effects were as follows:

(In millions)

Y

ear Ended June 30, 2011 2010 2009

Net Unrealized Gains on Derivatives

Unrealized gains (losses), net of tax effects of $(340), $188, and $472 $ (632) $ 349 $ 876

Reclassification adjustment for gains included in net income, net of tax

effects of $2, $(173), and $(309) 5 (322) (574)

Net unrealized gains on derivatives $ (627) $ 27 $ 302

Net Unrealized Gains (Losses) on Investments

Unrealized gains (losses), net of tax effects of $726, $263, and $(142) $ 1,349 $ 488 $ (263)

Reclassification adjustment for losses (gains) included in net income, net of

tax effects of $(159), $(120), and $16 (295) (223) 30

Net unrealized gains (losses) on investments 1,054 265 (233)

Translation adjustments and other, net of tax effects of $205, $(103) and

$(133) 381 (206) (240)

Other comprehensive income (loss) $ 808 $ 86 $ (171)

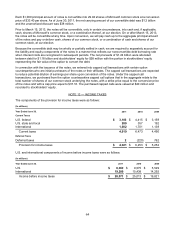

The components of accumulated other comprehensive income were as follows:

(In millions)

Y

ear Ended June 30, 2011 2010 2009

Net unrealized gains (losses) on derivatives $ (163) $ 464 $ 437

Net unrealized gains on investments 1,821 767 502

Translation adjustments and other 205 (176) 30

Accumulated other comprehensive income $ 1,863 $ 1,055 $ 969

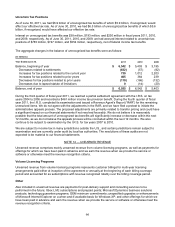

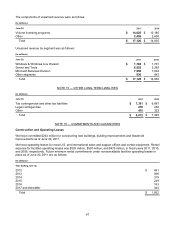

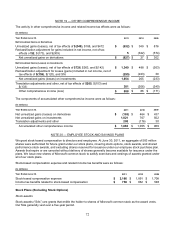

NOTE 20 — EMPLOYEE STOCK AND SAVINGS PLANS

We grant stock-based compensation to directors and employees. At June 30, 2011, an aggregate of 583 million

shares were authorized for future grant under our stock plans, covering stock options, stock awards, and shared

performance stock awards, and excluding shares reserved for issuance under our employee stock purchase plan.

Awards that expire or are canceled without delivery of shares generally become available for issuance under the

plans. We issue new shares of Microsoft common stock to satisfy exercises and vestings of awards granted under

all of our stock plans.

Stock-based compensation expense and related income tax benefits were as follows:

(In millions)

Y

ear Ended June 30, 2011 2010 2009

Stock-based compensation expense $ 2,166 $ 1,891 $ 1,708

Income tax benefits related to stock-based compensation $ 758

$ 662 $ 598

Stock Plans (Excluding Stock Options)

Stock awards

Stock awards (“SAs”) are grants that entitle the holder to shares of Microsoft common stock as the award vests.

Our SAs generally vest over a five-year period.