Microsoft 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

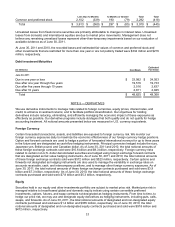

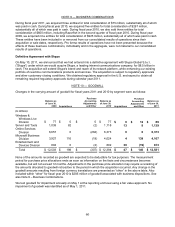

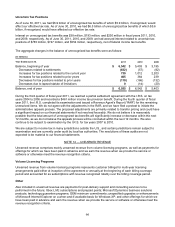

NOTE 9 — BUSINESS COMBINATIONS

During fiscal year 2011, we acquired three entities for total consideration of $75 million, substantially all of which

was paid in cash. During fiscal year 2010, we acquired five entities for total consideration of $267 million,

substantially all of which was paid in cash. During fiscal year 2010, we also sold three entities for total

consideration of $600 million, including Razorfish in the second quarter of fiscal year 2010. During fiscal year

2009, we acquired nine entities for total consideration of $925 million, substantially all of which was paid in cash.

These entities have been included in or removed from our consolidated results of operations since their

acquisition or sale dates, respectively. Pro forma results of operations have not been presented because the

effects of these business combinations, individually and in the aggregate, were not material to our consolidated

results of operations.

Definitive Agreement with Skype

On May 10, 2011, we announced that we had entered into a definitive agreement with Skype Global S.à.r.l.

(“Skype”) under which we would acquire Skype, a leading internet communications company, for $8.5 billion in

cash. The acquisition will extend Skype’s brand and reach of its network platform, while enhancing our existing

portfolio of real-time communications products and services. The acquisition is subject to regulatory approvals

and other customary closing conditions. We obtained regulatory approval in the U.S. and expect to obtain all

remaining required regulatory approvals during calendar year 2011.

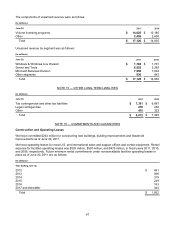

NOTE 10 — GOODWILL

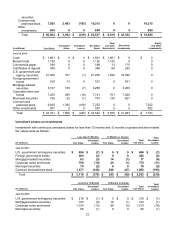

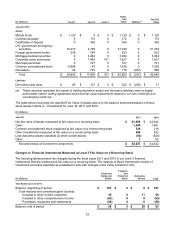

Changes in the carrying amount of goodwill for fiscal years 2011 and 2010 by segment were as follows:

Balance as

of June 30,

2009 Acquisitions

Purchase

Accounting

Adjustments

and Other

Balance as

of June 30,

2010 Acquisitions

Purchase

Accounting

Adjustments

and Other

Balance as

of June 30,

2011

(In millions)

Windows &

Windows Live

Division $ 77 $ 0 $ 0 $ 77

$ 0 $ 12 $ 89

Server and Tools 1,038 82 (2 ) 1,118

13 8 1,139

Online Services

Division 6,657 0 (284 ) 6,373

0 0 6,373

Microsoft Business

Division 3,927 116 (19 ) 4,024

4 139 4,167

Entertainment and

Devices Division 804 0 (2 ) 802

30 (19) 813

Total $ 12,503 $ 198 $ (307 ) $ 12,394 $ 47 $ 140 $ 12,581

None of the amounts recorded as goodwill are expected to be deductible for tax purposes. The measurement

period for purchase price allocations ends as soon as information on the facts and circumstances becomes

available, but will not exceed 12 months. Adjustments in the purchase price allocation may require a recasting of

the amounts allocated to goodwill retroactive to the period in which the acquisition occurred. Any change in the

goodwill amounts resulting from foreign currency translations are presented as “other” in the above table. Also

included within “other” for fiscal year 2010 is $285 million of goodwill associated with business dispositions. See

also Note 9 – Business Combinations.

We test goodwill for impairment annually on May 1 at the reporting unit level using a fair value approach. No

impairment of goodwill was identified as of May 1, 2011.