Microsoft 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

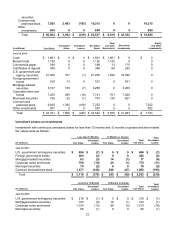

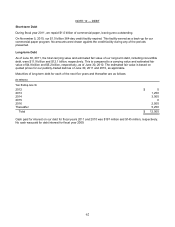

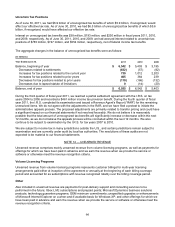

NOTE 12 — DEBT

Short-term Debt

During fiscal year 2011, we repaid $1.0 billion of commercial paper, leaving zero outstanding.

On November 5, 2010, our $1.0 billion 364-day credit facility expired. This facility served as a back-up for our

commercial paper program. No amounts were drawn against the credit facility during any of the periods

presented.

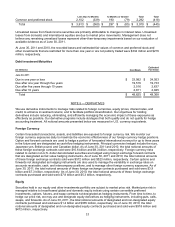

Long-term Debt

As of June 30, 2011, the total carrying value and estimated fair value of our long-term debt, including convertible

debt, were $11.9 billion and $12.1 billion, respectively. This is compared to a carrying value and estimated fair

value of $4.9 billion and $5.2 billion, respectively, as of June 30, 2010. The estimated fair value is based on

quoted prices for our publicly-traded debt as of June 30, 2011 and 2010, as applicable.

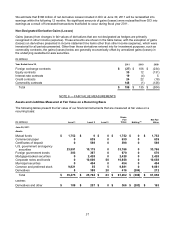

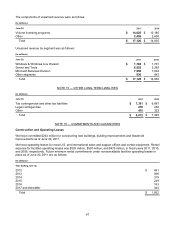

Maturities of long-term debt for each of the next five years and thereafter are as follows:

(In millions)

Y

ear Ending June 30,

2012 $ 0

2013 1,250

2014 3,000

2015 0

2016 2,500

Thereafter 5,250

Total $ 12,000

Cash paid for interest on our debt for fiscal years 2011 and 2010 was $197 million and $145 million, respectively.

No cash was paid for debt interest for fiscal year 2009.