Microsoft 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

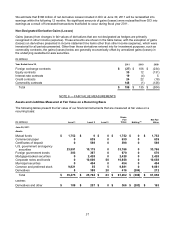

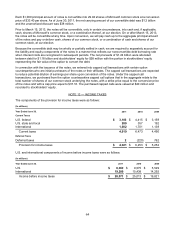

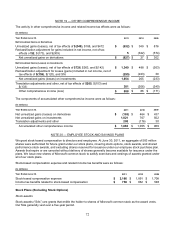

The items accounting for the difference between income taxes computed at the U.S. federal statutory rate and our

effective rate were as follows:

Y

ear Ended June 30, 2011 2010 2009

Federal statutory rate 35.0%

35.0% 35.0%

Effect of:

Foreign earnings taxed at lower rates (15.6)%

(12.1)% (9.3)%

Internal Revenue Service settlement (1.7)%

0% 0%

Other reconciling items, net (0.2)%

2.1% 0.8%

Effective rate 17.5%

25.0% 26.5%

The reduction from the federal statutory rate from foreign earnings taxed at lower rates results from producing and

distributing our products and services through our foreign regional operations centers in Ireland, Singapore, and

Puerto Rico, which are subject to lower income tax rates. In general, other reconciling items consist of interest,

U.S. state income taxes, domestic production deductions, and credits. In fiscal years 2011, 2010, and 2009, there

were no individually significant other reconciling items. The I.R.S. settlement is discussed below.

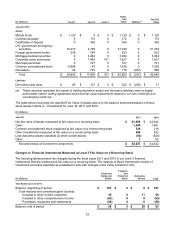

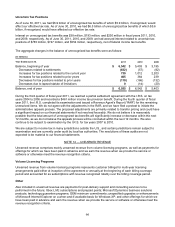

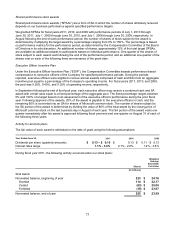

The components of the deferred income tax assets and liabilities were as follows:

(In millions)

June 30, 2011 2010

Deferred Income Tax Assets

Stock-based compensation expense $ 1,079

$ 1,329

Other expense items 1,411

1,696

Unearned revenue 463

556

Impaired investments 424

289

Other revenue items 69

80

Deferred income tax assets $ 3,446

$ 3,950

Deferred Income Tax Liabilities

International earnings $ (1,266) $ (1,056)

Unrealized gain on investments (904) (674)

Other (265) (265)

Deferred income tax liabilities (2,435) (1,995)

Net deferred income tax assets $ 1,011

$ 1,955

Reported As

Current deferred income tax assets $ 2,467

$ 2,184

Long-term deferred income tax liabilities (1,456) (229)

Net deferred income tax assets $ 1,011

$ 1,955

Deferred income tax balances reflect the effects of temporary differences between the carrying amounts of assets

and liabilities and their tax bases and are stated at enacted tax rates expected to be in effect when the taxes are

actually paid or recovered.

We have not provided deferred U.S. income taxes or foreign withholding taxes on temporary differences of

approximately $44.8 billion resulting from earnings for certain non-U.S. subsidiaries which are permanently

reinvested outside the U.S. The unrecognized deferred tax liability associated with these temporary differences is

approximately $14.2 billion.

Income taxes paid were $5.3 billion, $4.1 billion, and $6.6 billion in fiscal years 2011, 2010, and 2009,

respectively.