Microsoft 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

offset in part by a $1.7 billion increase in cash received from common stock issued. Cash used for investing

decreased $4.5 billion due to a $3.3 billion decrease in cash used for combined investment purchases, sales, and

maturities along with a $1.1 billion decrease in additions to property and equipment.

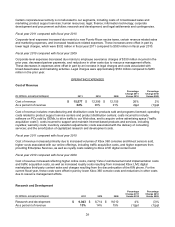

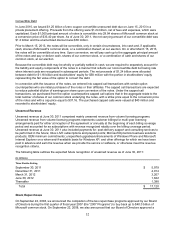

Debt

Short-term debt

During fiscal year 2011, we repaid $1.0 billion of commercial paper, leaving zero outstanding.

On November 5, 2010, our $1.0 billion 364-day credit facility expired. This facility served as a back-up for our

commercial paper program. No amounts were drawn against the credit facility during any of the periods

presented.

Long-term debt

We issued debt during the periods presented to take advantage of favorable pricing and liquidity in the debt

markets, reflecting our superior credit rating and the low interest rate environment. The proceeds of these

issuances were used to partially fund discretionary business acquisitions and share repurchases.

As of June 30, 2011, the total carrying value and estimated fair value of our long-term debt, including convertible

debt, were $11.9 billion and $12.1 billion, respectively. This is compared to a carrying value and estimated fair

value of $4.9 billion and $5.2 billion, respectively, as of June 30, 2010. The estimated fair value is based on

quoted prices for our publicly-traded debt as of June 30, 2011 and 2010, as applicable.

The components of long-term debt, the associated interest rates, and the semi-annual interest record and

payment dates were as follows as of June 30, 2011:

Due Date Face Value

Stated

Interest

Rate

Effective

Interest

Rate

Interes

t

Record Date

Interest

Pay Date

Interes

t

Record Date

Interest

Pay Date

(In millions)

Notes

September 27, 2013 $ 1,000 0.875% 1.000% March 15 March 27 September 15 September 27

June 1, 2014 2,000 2.950% 3.049% May 15 June 1 November 15 December 1

September 25, 2015 1,750 1.625% 1.795% March 15 March 25 September 15 September 25

February 8, 2016 750 2.500% 2.642% February 1 February 8

A

ugust 1 August 8

June 1, 2019 1,000 4.200% 4.379% May 15 June 1 November 15 December 1

October 1, 2020 1,000 3.000% 3.137% March 15 April 1 September 15 October 1

February 8, 2021 500 4.000% 4.082% February 1 February 8

A

ugust 1 August 8

June 1, 2039 750 5.200% 5.240% May 15 June 1 November 15 December 1

October 1, 2040 1,000 4.500% 4.567% March 15 April 1 September 15 October 1

February 8, 2041 1,000 5.300% 5.361% February 1 February 8 August 1 August 8

Total 10,750

Convertible Debt

June 15, 2013 1,250 0.000% 1.849%

Total unamortized discount (79)

Total $ 11,921

Notes

The Notes are senior unsecured obligations and rank equally with our other unsecured and unsubordinated debt

outstanding.