Microsoft 2011 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

Convertible Debt

In June 2010, we issued $1.25 billion of zero coupon convertible unsecured debt due on June 15, 2013 in a

private placement offering. Proceeds from the offering were $1.24 billion, net of fees and expenses, which were

capitalized. Each $1,000 principal amount of notes is convertible into 29.94 shares of Microsoft common stock at

a conversion price of $33.40 per share. As of June 30, 2011, the net carrying amount of our convertible debt was

$1.2 billion and the unamortized discount was $38 million.

Prior to March 15, 2013, the notes will be convertible, only in certain circumstances, into cash and, if applicable,

cash, shares of Microsoft’s common stock, or a combination thereof, at our election. On or after March 15, 2013,

the notes will be convertible at any time. Upon conversion, we will pay cash up to the aggregate principal amount

of the notes and pay or deliver cash, shares of our common stock, or a combination of cash and shares of our

common stock, at our election.

Because the convertible debt may be wholly or partially settled in cash, we are required to separately account for

the liability and equity components of the notes in a manner that reflects our nonconvertible debt borrowing rate

when interest costs are recognized in subsequent periods. The net proceeds of $1.24 billion were allocated

between debt for $1.18 billion and stockholders’ equity for $58 million with the portion in stockholders’ equity

representing the fair value of the option to convert the debt.

In connection with the issuance of the notes, we entered into capped call transactions with certain option

counterparties who are initial purchasers of the notes or their affiliates. The capped call transactions are expected

to reduce potential dilution of earnings per share upon conversion of the notes. Under the capped call

transactions, we purchased from the option counterparties capped call options that in the aggregate relate to the

total number of shares of our common stock underlying the notes, with a strike price equal to the conversion price

of the notes and with a cap price equal to $37.16. The purchased capped calls were valued at $40 million and

recorded to stockholders’ equity.

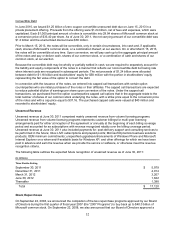

Unearned Revenue

Unearned revenue at June 30, 2011 comprised mainly unearned revenue from volume licensing programs.

Unearned revenue from volume licensing programs represents customer billings for multi-year licensing

arrangements paid for either at inception of the agreement or annually at the beginning of each billing coverage

period and accounted for as subscriptions with revenue recognized ratably over the billing coverage period.

Unearned revenue at June 30, 2011 also included payments for: post-delivery support and consulting services to

be performed in the future; Xbox LIVE subscriptions and prepaid points; Microsoft Dynamics business solutions

products; OEM minimum commitments; unspecified upgrades/enhancements of Windows Phone and Microsoft

Internet Explorer on a when-and-if-available basis for Windows XP; and other offerings for which we have been

paid in advance and earn the revenue when we provide the service or software, or otherwise meet the revenue

recognition criteria.

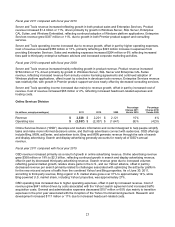

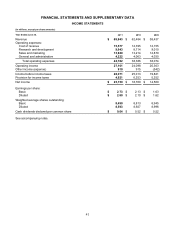

The following table outlines the expected future recognition of unearned revenue as of June 30, 2011:

(In millions)

Three Months Ending,

September 30, 2011 $ 5,979

December 31, 2011 4,914

March 31, 2012 3,207

June 30, 2012 1,622

Thereafter 1,398

Total $ 17,120

Share Repurchases

On September 22, 2008, we announced the completion of the two repurchase programs approved by our Board

of Directors during the first quarter of fiscal year 2007 (the “2007 Programs”) to buy back up to $40.0 billion of

Microsoft common stock. On September 22, 2008, we also announced that our Board of Directors approved a