Microsoft 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

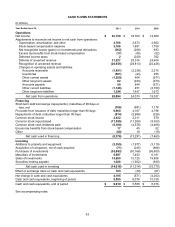

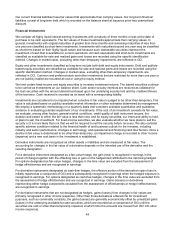

CASH FLOWS STATEMENTS

(In millions)

Y

ear Ended June 30, 2011 2010 2009

Operations

Net income $ 23,150 $ 18,760 $ 14,569

Adjustments to reconcile net income to net cash from operations:

Depreciation, amortization, and other 2,766

2,673 2,562

Stock-based compensation expense 2,166

1,891 1,708

Net recognized losses (gains) on investments and derivatives (362) (208) 683

Excess tax benefits from stock-based compensation (17) (45) (52)

Deferred income taxes 2

(220) 762

Deferral of unearned revenue 31,227

29,374 24,409

Recognition of unearned revenue (28,935) (28,813) (25,426)

Changes in operating assets and liabilities:

Accounts receivable (1,451) (2,238) 2,215

Inventories (561) (44) 255

Other current assets (1,259) 464 (677)

Other long-term assets 62

(223) (273)

Accounts payable 58

844 (671)

Other current liabilities (1,146) 451 (2,700)

Other long-term liabilities 1,294

1,407 1,673

Net cash from operations 26,994

24,073 19,037

Financing

Short-term debt borrowings (repayments), maturities of 90 days or

less, net (186) (991) 1,178

Proceeds from issuance of debt, maturities longer than 90 days 6,960

4,167 4,796

Repayments of debt, maturities longer than 90 days (814) (2,986) (228)

Common stock issued 2,422

2,311 579

Common stock repurchased (11,555) (11,269) (9,353)

Common stock cash dividends paid (5,180) (4,578) (4,468)

Excess tax benefits from stock-based compensation 17

45

52

Other (40) 10 (19)

Net cash used in financing (8,376) (13,291) (7,463)

Investing

Additions to property and equipment (2,355) (1,977) (3,119)

Acquisition of companies, net of cash acquired (71) (245) (868)

Purchases of investments (35,993) (30,168) (36,850)

Maturities of investments 6,897

7,453 6,191

Sales of investments 15,880

15,125 19,806

Securities lending payable 1,026

(1,502) (930)

Net cash used in investing (14,616) (11,314) (15,770)

Effect of exchange rates on cash and cash equivalents 103

(39) (67)

Net change in cash and cash equivalents 4,105

(571) (4,263)

Cash and cash equivalents, beginning of period 5,505

6,076 10,339

Cash and cash equivalents, end of period $ 9,610

$ 5,505 $ 6,076

See accompanying notes.