Microsoft 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

Each $1,000 principal amount of notes is convertible into 29.94 shares of Microsoft common stock at a conversion

price of $33.40 per share. As of June 30, 2011, the net carrying amount of our convertible debt was $1.2 billion

and the unamortized discount was $38 million.

Prior to March 15, 2013, the notes will be convertible, only in certain circumstances, into cash and, if applicable,

cash, shares of Microsoft’s common stock, or a combination thereof, at our election. On or after March 15, 2013,

the notes will be convertible at any time. Upon conversion, we will pay cash up to the aggregate principal amount

of the notes and pay or deliver cash, shares of our common stock, or a combination of cash and shares of our

common stock, at our election.

Because the convertible debt may be wholly or partially settled in cash, we are required to separately account for

the liability and equity components of the notes in a manner that reflects our nonconvertible debt borrowing rate

when interest costs are recognized in subsequent periods. The net proceeds of $1.24 billion were allocated

between debt for $1.18 billion and stockholders’ equity for $58 million with the portion in stockholders’ equity

representing the fair value of the option to convert the debt.

In connection with the issuance of the notes, we entered into capped call transactions with certain option

counterparties who are initial purchasers of the notes or their affiliates. The capped call transactions are expected

to reduce potential dilution of earnings per share upon conversion of the notes. Under the capped call

transactions, we purchased from the option counterparties capped call options that in the aggregate relate to the

total number of shares of our common stock underlying the notes, with a strike price equal to the conversion price

of the notes and with a cap price equal to $37.16. The purchased capped calls were valued at $40 million and

recorded to stockholders’ equity.

NOTE 13 — INCOME TAXES

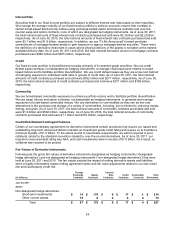

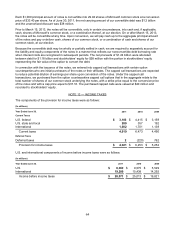

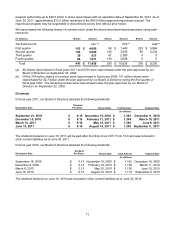

The components of the provision for income taxes were as follows:

(In millions)

Y

ear Ended June 30, 2011 2010 2009

Current Taxes

U.S. federal $ 3,108 $ 4,415 $ 3,159

U.S. state and local 209

357 192

International 1,602

1,701 1,139

Current taxes 4,919

6,473 4,490

Deferred Taxes

Deferred taxes 2

(220) 762

Provision for income taxes $ 4,921

$ 6,253 $ 5,252

U.S. and international components of income before income taxes were as follows:

(In millions)

Y

ear Ended June 30, 2011 2010 2009

U.S. $ 8,862

$ 9,575 $ 5,529

International 19,209

15,438 14,292

Income before income taxes $ 28,071 $ 25,013 $ 19,821