Microsoft 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

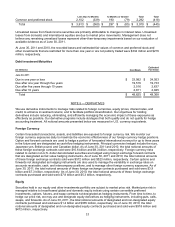

We estimate that $186 million of net derivative losses included in OCI at June 30, 2011 will be reclassified into

earnings within the following 12 months. No significant amounts of gains (losses) were reclassified from OCI into

earnings as a result of forecasted transactions that failed to occur during fiscal year 2011.

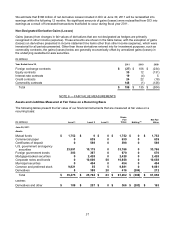

Non-Designated Derivative Gains (Losses)

Gains (losses) from changes in fair values of derivatives that are not designated as hedges are primarily

recognized in other income (expense). These amounts are shown in the table below, with the exception of gains

(losses) on derivatives presented in income statement line items other than other income (expense), which were

immaterial for all periods presented. Other than those derivatives entered into for investment purposes, such as

commodity contracts, the gains (losses) below are generally economically offset by unrealized gains (losses) in

the underlying available-for-sale securities.

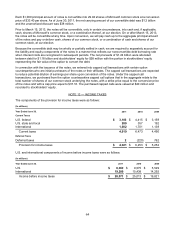

(In millions)

Y

ear Ended June 30, 2011 2010 2009

Foreign exchange contracts $ (27) $ 106 $ (234)

Equity contracts 35 12 (131)

Interest-rate contracts 19 (4) 5

Credit contracts 24 22 (18)

Commodity contracts 148 (1) (126)

Total $ 199 $ 135 $ (504)

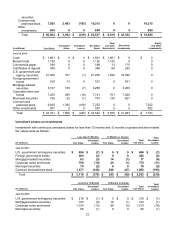

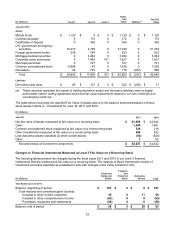

NOTE 6 — FAIR VALUE MEASUREMENTS

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The following tables present the fair value of our financial instruments that are measured at fair value on a

recurring basis:

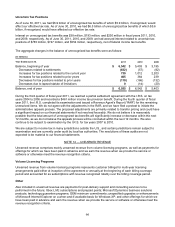

(In millions) Level 1 Level 2 Level 3

Gross

Fair

Value Netting (a) Net Fair

Value

June 30, 2011

Assets

Mutual funds $ 1,752 $ 0 $ 0 $ 1,752 $ 0 $ 1,752

Commercial paper 0 639 0 639 0 639

Certificates of deposit 0 598 0 598 0 598

U.S. government and agency

securities 23,591 10,175 0 33,766 0 33,766

Foreign government bonds 303 367 0 670 0 670

Mortgage-backed securities 0 2,428 0 2,428 0 2,428

Corporate notes and bonds 0 10,600 58 10,658 0 10,658

Municipal securities 0 454 0 454 0 454

Common and preferred stock 9,821 55 5 9,881 0 9,881

Derivatives 8 388 20 416 (204) 212

Total $ 35,475 $ 25,704 $ 83 $ 61,262 $ (204) $ 61,058

Liabilities

Derivatives and other $ 109 $ 257 $ 0 $ 366 $ (203) $ 163