Microsoft 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

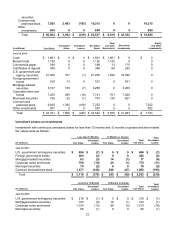

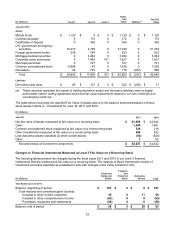

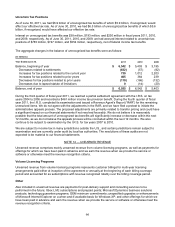

Change in unrealized gains (losses) included in other income

(expense) related to assets held as of June 30, 2011 $ 6 $ 0 $ 11 $ 17

(In millions)

Corporate

Notes and

Bonds

Common

and

Preferred

Stock Derivative

Assets Total

Y

ear Ended June 30, 2010

Balance, beginning of period $ 253 $ 5 $ 5 $ 263

Total realized and unrealized gains (losses):

Included in other income (expense) 6 0 4 10

Included in other comprehensive income (92) 0 0 (92)

Balance, end of period $ 167 $ 5 $ 9 $ 181

Change in unrealized gains (losses) included in other income

(expense) related to assets held as of June 30, 2010 $ 6 $ 0 $ 4 $ 10

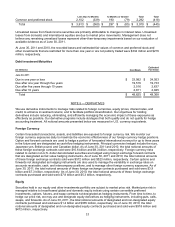

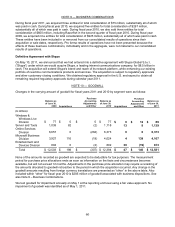

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

During fiscal years 2011 and 2010, impairment charges of $2 million and $5 million, respectively, were recognized

for certain investments measured at fair value on a nonrecurring basis, as the decline in their respective fair

values below their cost was determined to be other than temporary in all instances. At June 30, 2011 and 2010,

we held no common and preferred stocks that were required to be measured at fair value on a nonrecurring basis.

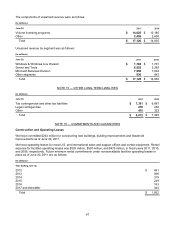

NOTE 7 — INVENTORIES

The components of inventories were as follows:

(In millions)

June 30, 2011 2010

Raw materials $ 232

$ 172

Work in process 56

16

Finished goods 1,084

552

Total $ 1,372 $ 740

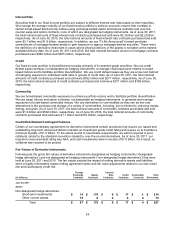

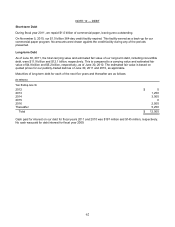

NOTE 8 — PROPERTY AND EQUIPMENT

The components of property and equipment were as follows:

(In millions)

June 30, 2011 2010

Land $ 533

$ 526

Buildings and improvements 6,521

6,087

Leasehold improvements 2,345

2,100

Computer equipment and software 6,601

5,673

Furniture and equipment 1,991

1,873

Total, at cost 17,991 16,259

Accumulated depreciation (9,829) (8,629)

Total, net $ 8,162

$ 7,630

During fiscal years 2011, 2010, and 2009, depreciation expense was $2.0 billion, $1.8 billion, and $1.7 billion,

respectively.