Microsoft 2011 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2011 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 34

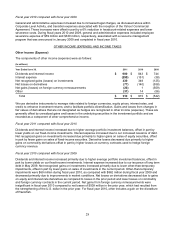

(c) These amounts represent undiscounted future minimum rental commitments under noncancellable facilities

leases.

(d) These amounts represent purchase commitments, including all open purchase orders and all contracts that

are take-or-pay contracts that are not presented as construction commitments above.

(e) We have excluded long-term tax contingencies, other tax liabilities, and deferred income taxes of $8.8 billion

and other long-term contingent liabilities of $276 million (related to the antitrust and unfair competition class

action lawsuits) from the amounts presented, as the amounts that will be settled in cash are not known and

the timing of any payments is uncertain. We have also excluded unearned revenue of $1.4 billion and non-

cash items of $279 million.

Other Planned Uses of Capital

We will continue to invest in sales, marketing, product support infrastructure, and existing and advanced areas of

technology. Additions to property and equipment will continue, including new facilities, data centers, and computer

systems for research and development, sales and marketing, support, and administrative staff. We have

operating leases for most U.S. and international sales and support offices and certain equipment. We have not

engaged in any related party transactions or arrangements with unconsolidated entities or other persons that are

reasonably likely to materially affect liquidity or the availability of capital resources.

Definitive Agreement with Skype

On May 10, 2011, we announced that we had entered into a definitive agreement with Skype Global S.à.r.l.

(“Skype”) under which we would acquire Skype, a leading internet communications company, for $8.5 billion in

cash. We anticipate the acquisition will extend Skype’s brand and reach of its network platform, while enhancing

our existing portfolio of real-time communications products and services. The acquisition is subject to regulatory

approvals and other customary closing conditions. We obtained regulatory approval in the U.S. and expect to

obtain all remaining required regulatory approvals during calendar year 2011.

Liquidity

We earn a significant amount of our operating income outside the U.S., which is deemed to be permanently

reinvested in foreign jurisdictions. As a result, as discussed above under Cash, Cash Equivalents, and

Investments, the majority of our cash, cash equivalents, and short-term investments are held by foreign

subsidiaries. We currently do not intend nor foresee a need to repatriate these funds. We expect existing

domestic cash, cash equivalents, short-term investments, and cash flows from operations to continue to be

sufficient to fund our domestic operating activities and cash commitments for investing and financing activities,

such as regular quarterly dividends, debt repayment schedules, and material capital expenditures, for at least the

next 12 months and thereafter for the foreseeable future. In addition, we expect existing foreign cash, cash

equivalents, short-term investments, and cash flows from operations to continue to be sufficient to fund our

foreign operating activities and cash commitments for investing activities, such as material capital expenditures,

for at least the next 12 months and thereafter for the foreseeable future.

Should we require more capital in the U.S. than is generated by our operations domestically, for example to fund

significant discretionary activities, such as acquisitions of businesses and share repurchases, we could elect to

repatriate future earnings from foreign jurisdictions or raise capital in the U.S. through debt or equity issuances.

These alternatives could result in higher effective tax rates, increased interest expense, or other dilution of our

earnings. We have borrowed funds domestically and continue to have the ability to borrow funds domestically at

reasonable interest rates.

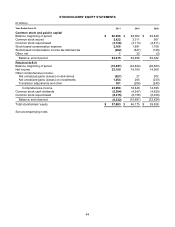

As a result of the special dividend paid in the second quarter of fiscal year 2005 and shares repurchased, our

retained deficit, including accumulated other comprehensive income, was $6.3 billion at June 30, 2011. Our

retained deficit is not expected to affect our future ability to operate, pay dividends, or repay our debt given our

continuing profitability and strong financial position.