LensCrafters 2015 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2015 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Report as of December 31, 2015 Page 4 of 35

We operate our retail distribution segment principally through our retail brands, which include, among others, LensCrafters,

Sunglass Hut, OPSM, Laubman & Pank, Oakley “O” Stores and Vaults, David Clulow, GMO and our Licensed Brands

(Sears Optical and Target Optical).

As a result of our numerous acquisitions and the subsequent expansion of our business activities in the United States

through these acquisitions, our results of operations, which are reported in Euro, are susceptible to currency rate fluctuations

between the Euro and the U.S. dollar. The Euro/U.S. dollar exchange rate has fluctuated to an average exchange rate of

Euro 1.00 = U.S. $1.1095 in 2015 and from Euro 1.00 = U.S. $1.3285 in 2014. Our results of operations are also susceptible

to currency fluctuations between the Euro and the Australian Dollar due to the Australian subsidiary OPSM group.

Additionally, we incur part of our manufacturing costs in Chinese Yuan; therefore, the fluctuation of the Chinese Yuan

could impact the demand of our products or our consolidated profitability. Although we engage in certain foreign currency

hedging activities to mitigate the impact of these fluctuations, they have impacted our reported revenues and expenses

during the periods discussed herein. The Group does not engage in long-term hedging activities to mitigate translation risk.

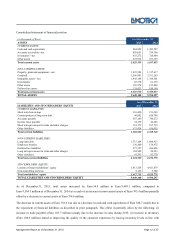

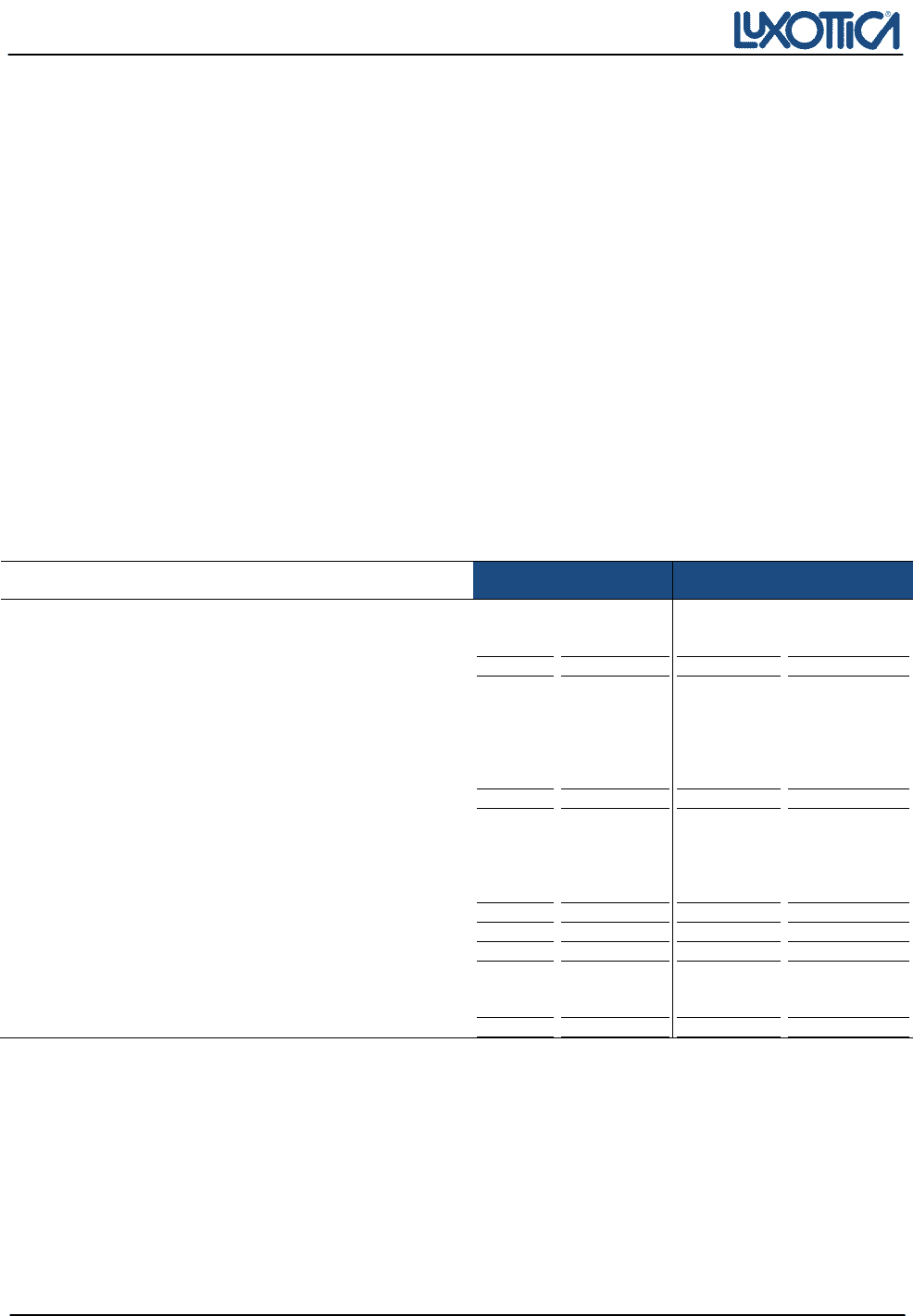

Results of operations

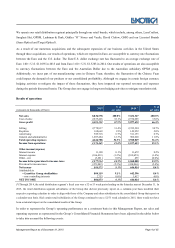

(Amounts in thousands of Euro) 2015

% of

net sales

2014 (*)

% of

net sales

Net sales

8,836,578

100.0%

7,652,317

100.0%

Cost of sales 2,835,426

32.1%

2,574,685

33.6%

Gross profit 6,001,152

67.9%

5,077,632

66.4%

Selling 2,778,837

31.4%

2,352,294

30.7%

Royalties

168,669

1.9%

149,952

2.0%

Advertising 589,718

6.7%

511,153

6.7%

General and administrative 1,087,484

12.3%

906,620

11.8%

Total operating expenses 4,624,708

52.3%

3,920,019

51.2%

Income from operations 1,376,445

15.6%

1,157,613

15.1%

Other income/(expense)

Interest income 11,190

0.1%

11,672

0.2%

Interest expense (106,439)

(1.2%)

(109,659)

(1.4%)

Other—net (3,281)

0.0%

455

(0.0%)

Income before provision for income taxes 1,277,914

14.5%

1,060,080

13.9%

Provision for income taxes (471,042)

(5.3%)

(414,066)

(5.4%)

Net income 806,873

9.1%

646,014

8.4%

Attributable to

—

Luxottica Group stockholders

804,119

9.1%

642,596

8.4

%

—non-controlling interests 2,753

0.0%

3,417

0.0%

NET INCOME 806,873

9.1%

646,014

8.4%

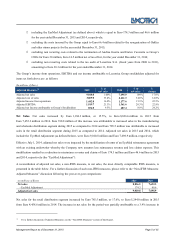

(*)Through 2014, the retail distribution segment’s fiscal year was a 52 or 53 week period ending on the Saturday nearest December 31. In

2015, the retail distribution segment subsidiaries of the Group that did not previously report on a calendar-year basis modified their

respective reporting calendars in order to align with those of the Company and other subsidiaries in the consolidated Group that report on

a calendar-year basis. Had certain retail subsidiaries of the Group continued to use a 52/53 week calendar in 2015, there would not have

been a material impact on the consolidated results of the Group.

In order to represent the Group’s operating performance on a consistent basis in this Management Report, net sales and

operating expenses as represented in the Group’s Consolidated Financial Statements have been adjusted in the tables below

to take into account the following events: