LensCrafters 2015 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2015 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270

|

|

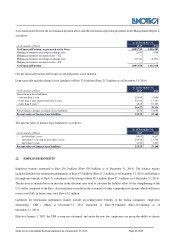

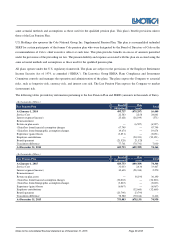

Notes to the consolidated financial statement as of December 31, 2015 Page 52 di 68

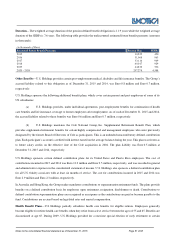

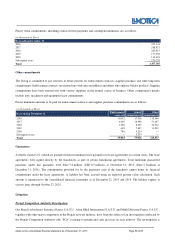

associates age 50 or older with 5 or more years of service. Benefits for this group are also discontinued at age 65 and the

resulting special termination benefit is immaterial.

The plan liability of Euro 1.1 million and Euro 1.3 million at December 31, 2015 and 2014, respectively, is included in other

non- current liabilities on the consolidated statement of financial position.

The cost of this plan in 2015 and 2014 as well as the 2016 expected contributions are immaterial.

For 2016, a 7.2% (8.0% for 2015) increase in the cost of covered health care benefits was assumed. This rate was assumed to

decrease gradually to 5% for 2024 and remain at that level thereafter. The health care cost trend rate assumption could have a

significant effect on the amounts reported. A 1.0% increase or decrease in the health care trend rate would not have a material

impact on the consolidated financial statements. The weighted-average discount rate used in determining the accumulated

postretirement benefit obligation was 4.5% at December 31, 2015 and 4.2% at December 31, 2014. A 1.0% increase or

decrease in the discount rate would not have a material impact on the postretirement benefit obligation.

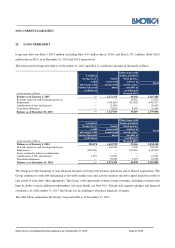

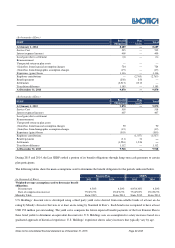

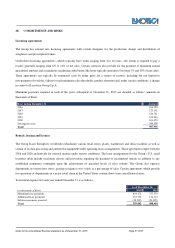

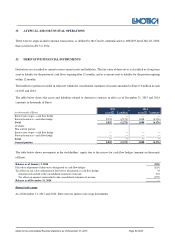

23. NON-CURRENT PROVISIONS FOR RISK AND OTHER CHARGES

The balance is detailed below (amounts in thousands of Euro):

(in thousands of Euro) Legal

risk

Self-

insurance

Tax

provision

Other

risks

Total

Balance as of December 31, 2013 9,944

23,481

45,556

18,563

97,544

Increases 4,712

5,287

5,424

1,955

17,378

Decreases (3,683)

(7,323)

(1,493)

(22,575)

(35,074)

Business combinations —

—

—

—

—

Translation difference and other movements (218)

3,102

(715)

17,207

19,376

Balance as of December 31, 2014 10,755

24,548

48,771

15,149

99,223

Increases 3,734

10,547 4,863

8,365

27,509

Decreases (2,787)

(11,093) (386)

(10,379)

(24,644)

Translation difference and other movements (1,759)

2,919

(17,608)

18,868

2,420

Balance as of December 31, 2015 9,943

26,922

35,640

32,003

104,508

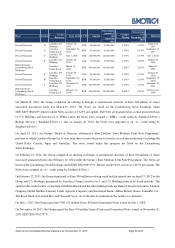

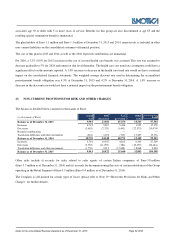

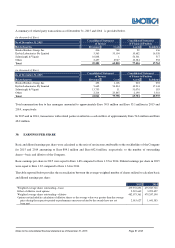

Other risks include (i) accruals for risks related to sales agents of certain Italian companies of Euro 5.8 million

(Euro 5.7 million as of December 31, 2014) and (ii) accruals for decommissioning the costs of certain subsidiaries of the Group

operating in the Retail Segment of Euro 0.5 million (Euro 0.4 million as of December 31, 2014).

The Company is self-insured for certain types of losses (please refer to Note 19 “Short-term Provisions for Risks and Other

Charges” for further details).