LensCrafters 2015 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2015 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the consolidated financial statement as of December 31, 2015 Page 44 di 68

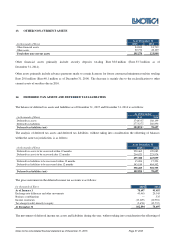

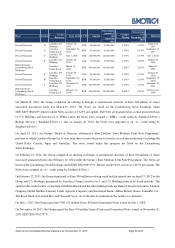

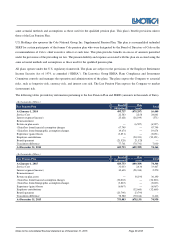

Type Series

Issuer/

Borrower

Issue Date

CCY

Amount

Outstanding

amount at

the

reporting

date

Coupon/

Pricing

Interest rate

as of

December 31,

2015

Maturity

Private Placement D Luxottica US

Holdings

January 29,

2010 USD 50,000,000

50,000,000

5.190%

5.190%

January 29,

2017

Private Placement G Luxottica

Group S.p.A.

September 30,

2010 EUR 50,000,000

50,000,000

3.750%

3.750%

September 15,

2017

Private Placement C Luxottica US

Holdings July 1, 2008 USD 128,000,000

128,000,000

6.770%

6.770%

July 1, 2018

Private Placement F Luxottica US

Holdings

January 29,

2010 USD 75,000,000

75,000,000

5.390%

5.390%

January 29,

2019

Bond (Listed on

Luxembourg Stock

Exchange)

Luxottica

Group S.p.A.

March 19,

2012 EUR 500,000,000

500,000,000

3.625%

3.625%

March 19,

2019

Private Placement E Luxottica US

Holdings

January 29,

2010 USD 50,000,000

50,000,000

5.750%

5.750%

January 29,

2020

Private Placement H Luxottica

Group S.p.A.

September 30,

2010 EUR 50,000,000

50,000,000

4.250%

4.250%

September 15,

2020

Private Placement I Luxottica US

Holdings

December 15,

2011 USD 350,000,000

350,000,000

4.350%

4.350%

December 15,

2021

Bond (Listed on

Luxembourg Stock

Exchange)

Luxottica

Group S.p.A.

February 10,

2014 EUR 500,000,000

500,000,000

2.625%

2.625%

February 10,

2024

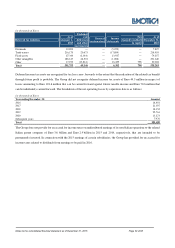

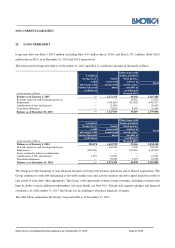

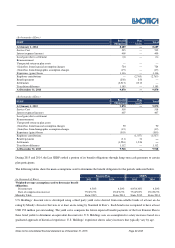

On March 19, 2012, the Group completed an offering in Europe to institutional investors of Euro 500 million of senior

unsecured guaranteed notes due March 19, 2019. The Notes are listed on the Luxembourg Stock Exchange under

ISIN XS0758640279. Interest on the Notes accrues at 3.625% per annum. The Notes are guaranteed on a senior unsecured basis

by U.S. Holdings and Luxottica S.r.l. When issued, the Notes were assigned a “BBB+” credit rating by Standard & Poor’s

Ratings Services (“Standard & Poor’s”) and, on January 20, 2014, the Notes were upgraded to an “A-” credit rating by

Standard & Poor’s.

On April 29, 2013, the Group’s Board of Directors authorized a Euro 2 billion “Euro Medium Term Note Programme”

pursuant to which Luxottica Group S.p.A. may from time to time offer notes to investors in certain jurisdictions (excluding the

United States, Canada, Japan and Australia). The notes issued under this program are listed on the Luxembourg

Stock Exchange.

On February 10, 2014, the Group completed an offering in Europe to institutional investors of Euro 500 million of senior

unsecured guaranteed notes due February 10, 2024 under the Group’s Euro Medium Term Note Programme. The Notes are

listed on the Luxembourg Stock Exchange under ISIN XS1030851791. Interest on the Notes accrues at 2.625% per annum. The

Notes were assigned an “A-” credit rating by Standard & Poor’s.

On February 27, 2015, the Group terminated its Euro 500 million revolving credit facility entered into on April 17, 2012 by the

Group and U.S. Holdings guaranteed by Luxottica Group, Luxottica S.r.l. and U.S. Holdings prior to its stated maturity. The

agent for this credit facility is Unicredit AG Milan Branch and the other lending banks are Bank of America Securities Limited,

Citigroup Global Markets Limited, Crédit Agricole Corporate and Investment Bank—Milan Branch, Banco Santander S.A.,

The Royal Bank of Scotland PLC and Unicredit S.p.A. As of the date of termination, the facility was undrawn.

On July 1, 2015, the Group repaid the USD 127 million Series B Senior Guaranteed Notes issued on July 1, 2008.

On November 10, 2015, the Group repaid the Euro 500 million Senior Unsecured Guaranteed Notes issued on November 10,

2010 (ISIN XS0557635777).