LensCrafters 2015 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2015 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Report as of December 31, 2015 Page 11 of 35

depreciation and amortization in 2015 as compared to 2014 is mainly due to the strengthening of the major currencies (Euro

53.1 million), in particular the U.S. dollar, and to the acquisition completed in the period.

Non-cash stock-based compensation expense was Euro 49.7 million in 2015 as compared to Euro 31.8 million in 2014. The

increase in 2015 as compared to 2014 is was primarily due to (i) Euro 7.4 million related to the grant of free treasury shares

to the Group’s employees in Italy in honor of the 80th birthday of the Group’s Chairman and Founder, Mr. Leonardo Del

Vecchio and (ii) Euro 8.0 million related to the 2015 extraordinary PSP Plan.

The change in accounts receivable was Euro (108.6) million in 2015 as compared to Euro (41.3) million in 2014. The

change in 2015 as compared to 2014 was primarily due to the higher volume of sales in 2015 as compared to 2014. The

inventory change was Euro (85.2) million in 2015 as compared to Euro 7.3 million in 2014. The change in inventory in

2015 was due to an effort to improve the quality of the customer experience by having inventory levels in line with

customer demand. The change in other assets and liabilities was Euro (7.8) million in 2015 as compared to

Euro 21.2 million in 2014. The change in 2015 as compared to 2014 was primarily due to the change in reporting calendar

of certain retail subsidiaries of the Group, which resulted in a reduction of the net liability. The change in accounts payable

was Euro 115.6 million in 2015 as compared to Euro 24.6 million in 2014. The change in 2015 as compared to 2014 was

mainly due to the continuous improvement in payment terms and conditions and to the overall growth of the Group’s

business. Income tax payments in 2015 were Euro 565.9 million as compared to Euro 349.2 million in 2014. The increase in

income tax payments in 2015 as compared to 2014 was due to the payment of Euro 91.6 million related to the tax audit of

Luxottica S.r.l. for the tax years from 2008 to 2011 and to a general increase in the Group’s taxable income. Interest paid

was Euro 79.8 million in 2015 as compared to Euro 93.1 million in 2014. The change in 2015 as compared to 2014 was

mainly due to repayment of long-term debt in 2015 .

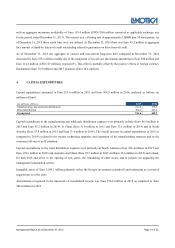

Investing Activities. The Company’s net cash used in investing activities was Euro 483.3 million and Euro 459.3 million in

2015 and 2014, respectively. The primary investment activities in 2015 were related to (i) the acquisition of tangible assets

for Euro 319.8 million, (ii) the acquisition of intangible assets for Euro 144.0 million, primarily related to IT infrastructure,

and (iii) the acquisition of Sunglass Warehouse for Euro 21.0 million. The primary investment activities in 2014 were

related to (i) the acquisition of tangible assets for Euro 280.8 million, (ii) the acquisition of intangible assets for

Euro 138.5 million, primarily related to IT infrastructure, (iii) the acquisition of glasses.com for Euro 30.1 million, and (iv)

and other minor acquisitions in the retail segment for Euro 11.0 million.

Financing Activities. The Company’s net cash (used in)/provided by financing activities was Euro (1,354.3) million in 2015

and Euro 72.3 million in 2014. Cash used by financing activities in 2015 consisted primarily of (i) Euro (649.3) million

related to the payment of existing debt, (ii) Euro (689.7) million used to pay dividends to the shareholders of the Company,

(iii) Euro 47.7 million related to the exercise of stock options, (iv) Euro (39.0) million related to the decrease in bank

overdrafts, and (iv) Euro (19.0) million related the acquisition of the remaining 49% of Luxottica Netherlands. Cash

provided by financing activities in 2014 consisted primarily of (i) Euro 500 million related to the issuance of new bonds,

(ii) Euro (318.5) million related to the payment of existing debt, (iii) Euro (308.3) million used to pay dividends to the

shareholders of the Company, (iv) Euro 70.0 million related to the exercise of stock options and (v) Euro 135.7 million

related to the increase in bank overdrafts.