LensCrafters 2015 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2015 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the consolidated financial statement as of December 31, 2015 Page 50 di 68

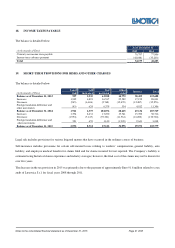

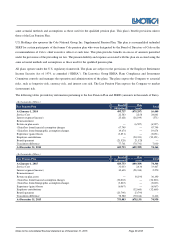

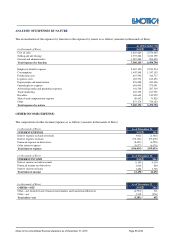

The sensitivity of the defined benefit obligation to changes in the significant assumptions is (amounts in thousands):

Impact on defined benefit obligation

(in thousands of Euro) Change inassumption Increase in assumption Decrease in assumption

Pension

Plan

SERPs

Pension

Plan

SERPs

Discount rate 1.0% (84,530)

(732)

108,151

840

Rate of compensation increase 1% for each age group 7,996

698

(7,138)

(512)

The sensitivity analyses are based on a change in an assumption while holding all other assumptions constant. In practice, this

is unlikely to occur. When calculating the sensitivity of the defined benefit obligations to significant actuarial assumptions, the

same method (present value of the defined benefit obligation calculated with the projected unit credit method at the end of the

reporting period) has been applied as when calculating the liabilities recognized within the statements of financial position.

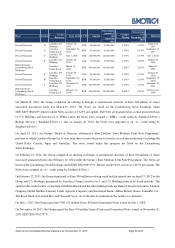

Plan Assets— The Plan’s assets are invested in accordance with an Investment Policy that describes the guidelines and

principles that the Luxottica Group ERISA Plans Compliance and Investment Committee intends to follow when making

decisions on the management and investment of assets of the Plan. The Plan’s long-term investment objectives are to generate

investment returns that provide adequate assets to meet the Plan’s benefit obligations and to maintain sufficient liquidity to pay

benefits and administrative expenses.

In 2015, a new investment policy was implemented which applies a dynamic asset allocation strategy. A dynamic asset

allocation strategy invests in both return-seeking assets and liability-hedging assets and the allocation between these asset

classes varies based upon the Plan’s funded ratio. Return-seeking assets consist of funds focused on U.S. equity, global equity,

non-US equity and global REITs. Liability-hedging assets are fixed income investments. As the funded ratio of the Plan

increases, the weight of liability-hedging assets increases. As of December 31, 2015, the Plan’s asset allocation was within the

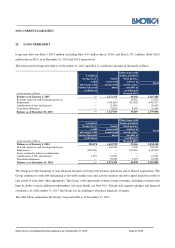

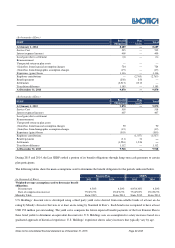

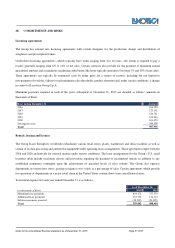

guidelines described in the investment policy. The table below shows the asset classes as percentage of total assets:

Asset Category

Asset Class as a

Percent of Total

Assets

Fixed income Funds 34%

U.S. Equity Funds 22%

International and Global Equity Funds 37%

Global real estate funds 6%

Money marlet funds 1%

Cash and Equivalents 0%

Plan assets are invested in various funds which employ both passive and active management strategies. Passive strategies

involve investment in an exchange-traded fund that closely tracks a particular index while active strategies employ investment

managers seeking to manage the fund’s performance. Certain transactions and securities are not authorized to be conducted or

held in the pension trusts, such as purchase or sale of commodity contracts, illiquid securities or real estate, nonagency

mortgage, and American Depositary Receipts (ADR) or common stock of the Company’s parent, Luxottica Group S.pA. Risk

is further controlled both at the asset class and manager level by assigning benchmarks and performance objectives. The

investment managers are monitored on an ongoing basis to evaluate performance against these benchmarks and performance

objectives.

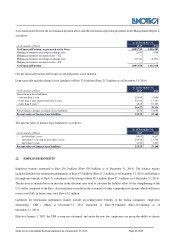

Contributions—U.S. Holdings expects to contribute Euro 44.1 million to its pension plan and Euro 0.5 million to the SERP

in 2016.