LensCrafters 2015 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2015 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270

|

|

Notes to the consolidated financial statement as of December 31, 2015 Page 48 di 68

same actuarial methods and assumptions as those used for the qualified pension plan. This plan’s benefit provisions mirror

those of the Lux Pension Plan.

U.S. Holdings also sponsors the Cole National Group, Inc. Supplemental Pension Plan. This plan is a nonqualified unfunded

SERP for certain participants of the former Cole pension plan who were designated by the Board of Directors of Cole on the

recommendation of Cole’s chief executive officer at such time. This plan provides benefits in excess of amounts permitted

under the provisions of the prevailing tax law. The pension liability and expense associated with this plan are accrued using the

same actuarial methods and assumptions as those used for the qualified pension plan.

All plans operate under the U.S. regulatory framework. The plans are subject to the provisions of the Employee Retirement

Income Security Act of 1974, as amended (“ERISA”). The Luxottica Group ERISA Plans Compliance and Investment

Committee controls and manages the operation and administration of the plans. The plans expose the Company to actuarial

risks, such as longevity risk, currency risk, and interest rate risk. The Lux Pension Plan exposes the Company to market

(investment) risk.

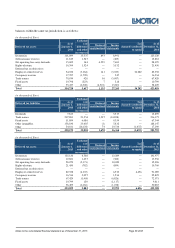

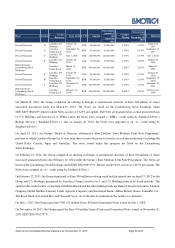

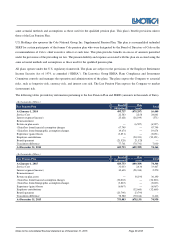

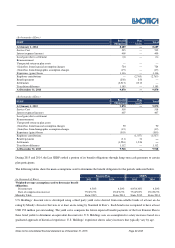

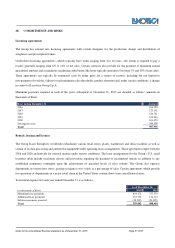

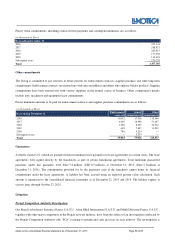

The following tables provide key information pertaining to the Lux Pension Plan and SERPs (amounts in thousands of Euro).

(In thousands of Euro)

Lux Pension Plan

Benefit

Obligation

Plan

Assets

Total

At January 1, 2014 495,737

(479,297)

16,440

Service Cost 22,583

2,258

24,841

Interest expense/(income) 25,628

(26,199)

(571)

Remeasurement:

Return on plan assets —

(6,597)

(6,597)

(Gain)/loss from financial assumption changes 67,749

—

67,749

(Gain)/loss from demographic assumption changes 19,674

—

19,674

Experience (gains)/losses (3,851)

—

(3,851)

Employer contributions —

(50,351)

(50,351)

Benefit payment (21,528)

21,528

—

Translation difference 77,761

(70,731)

7,030

At December 31, 2014 683,753

(609,389)

74,364

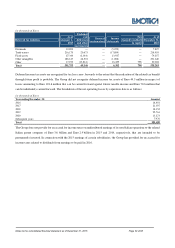

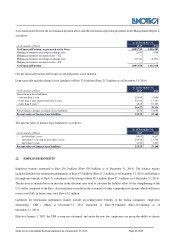

(In thousands of Euro)

Lux Pension Plan

Benefit

Obligation

Plan

Assets

Total

At January 1, 2015 683,753

(609,389)

74,364

Service Cost 31,033

2,434

33,467

Interest expense/(income) 30,603

(28,334)

2,270

Remeasurement:

Return on plan assets —

36,190

36,190

(Gain)/loss from financial assumption changes (36,263)

—

(36,263)

(Gain)/loss from demographic assumption changes (3,865)

—

(3,865)

Experience (gains)/losses (6,967)

—

(6,967)

Employer contributions

(32,660)

(32,660)

Benefit payment (23,790)

23,790

-

Translation difference 78,580

(70,164)

8,416

At December 31, 2015 753,083

(678,133)

74,950