LensCrafters 2015 Annual Report Download - page 243

Download and view the complete annual report

Please find page 243 of the 2015 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

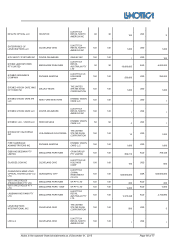

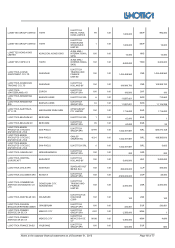

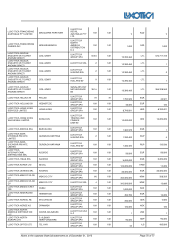

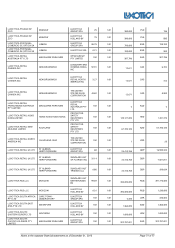

Notes to the separate financial statements as of December 31, 2015 Page 63 of 77

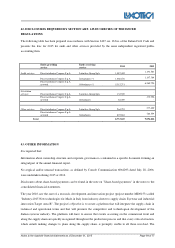

• With reference to the sale of finished goods to wholesale and retail distributors, the transactional net

margin method is used;

• With reference to the transactions where a Group company supplies logistics services acquiring title to

the product, the transactional net margin method is used;

• With reference to the provision of services, transfer price is established using the cost-plus method;

however, if the Company acts as a mere intermediary without adding any value, the transfer price is

determined as the cost charged by the service provider;

• In the case of licenses or sub-licenses of brands – relating to both point-of-sales signs and product

brands – the license fee is established using the method of comparable price on the open market from an

internal or external perspective.

The Group's Italian and foreign companies are under direction and coordination by Luxottica Group S.p.A.; such

activity has not been detrimental to the profitability of subsidiaries, or to the amount of their net assets; these

companies have benefited from membership of the Group as a result of the considerable associated synergies.

Further to a resolution adopted by the Board of Directors on October 29, 2004, Luxottica Group S.p.A. and its

Italian subsidiaries made a three-year group tax election under Section 117 et seq of the Italian Income Tax

Code. The "terms of consolidation" were renewed in 2007 and every three years thereafter, with the latest such

renewal on June 12, 2013.

This group tax election basically involves calculating a single taxable base for the participating group of

companies and makes the consolidating company at the head of the tax group responsible for determining and

settling the tax; adoption of this election gives rise to a series of economic and cash flows for the participating

companies. The group tax election only applies to IRES (Italian corporate income tax), while IRAP (Italian

regional business tax) continues to be paid separately by each individual company.

The company at the head of the tax group is required to calculate the consolidated taxable income arising from

the sum of the income reported by participating companies, taking into account any changes in tax legislation;

the tax group head then presents a single consolidated tax return for the group. Except for subjective liability for

tax, penalties and interest relating to the overall income of each participating company, the tax group head is

responsible for determining its own taxable income, and for all the requirements associated with determining the

group taxable income, and is severally liable for any sums owed by each subsidiary.

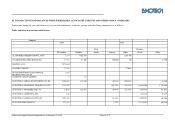

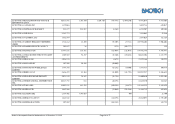

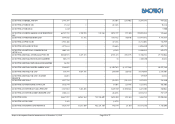

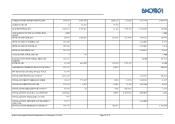

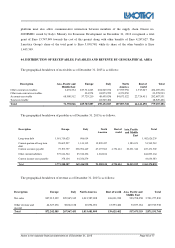

41. RELATED PARTY TRANSACTIONS

Related party transactions are neither atypical nor unusual, and are conducted in the ordinary course of the

business of Group companies. Such transactions are conducted on an arm's length basis, taking account of the

characteristics of the goods and services supplied. It is reported that the remuneration of key managers amounted

to Euro 44.5 million. For more details, please refer to the remuneration report prepared in accordance with

Section 123-ter of Italy's Consolidated Law on Finance.