LensCrafters 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the consolidated financial statement as of December 31, 2015 Page 35 di 68

Impairment of goodwill

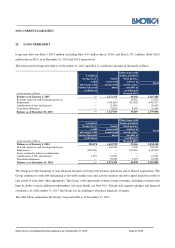

As of December 31, 2015 and 2014 goodwill totaled Euro 3,597.0 million and Euro 3,351.3 million, respectively. The increase

is mainly due to the strengthening of the main currencies in which the Group operates (Euro 228.4 million) and the acquisition

of SGW for Euro 18.3 million.

In 2015 management assessed the aggregation of cash-generating units (“CGUs”) previously identified for testing the

impairment of its goodwill in light of the organizational changes that occurred in the retail business during the year. As a result

of the analysis, management determined that the CGUs Retail North America, Retail Asia-Pacific and Retail Other were no

longer representative of the way the goodwill is monitored and, therefore, identified the following new CGUs: Retail Optical,

Retail Sun & Luxury and Retail Oakley. The CGU Wholesale was not impacted by the change.

Pursuant to IAS 36—Impairment of Assets, the goodwill was reallocated to the CGUs affected by the change based on their

relative fair values as of December 31, 2015. The relative fair values were determined based on the discounted cash flows that

any CGU is expected to generate. In particular, the goodwill previously allocated to the CGU Retail North America was

reallocated to Retail Optical, Retail Sun & Luxury and Retail Oakley, whereas the goodwill previously allocated to the CGUs

Retail Asia-Pacific and Retail Other was reallocated to Retail Optical and Retail Sun & Luxury.

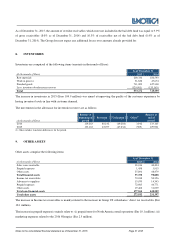

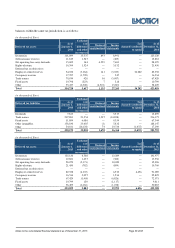

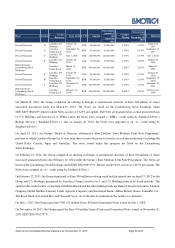

The value of goodwill allocated to each CGU is reported in the following table (amounts in thousands of Euro):

(in thousands of Euro) 2015

Wholesale 1,398,104

Retail Optical 995,864

Retail Sun & Luxury 1,021,066

Retail Oakley 181,949

Total 3,596,983

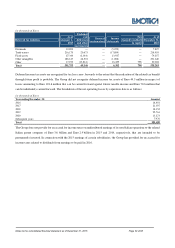

In accordance with IAS 36, before testing for impairment the new CGUs to which the goodwill was reallocated, the Group

tested the old CGUs. Neither test resulted in an impairment of any of the CGUs identified by the Group.

The information required by paragraph 134 of IAS 36 is provided below.

The recoverable amount of each CGU has been verified by comparing its net assets carrying amount to its value in use.

The main assumptions for determining the value in use are reported below:

1 Growth rate: 2.4% for all CGUs

1 Discount rate: 7.8% for Wholesale, 7.1% for Retail Optical, 7.2% for Retail Sun & Luxury and 7.0% for Retail Oakley

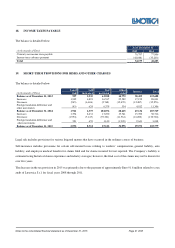

The discount rate has been determined on the basis of market information on the cost of money and the specific risk of the

industry (Weighted Average Cost of Capital, WACC). In particular, the Group used a methodology to determine the discount

rate which was in line with that utilized in the previous year, considering the rates of return on long-term government bonds and

the average capital structure of a group of comparable companies.

The recoverable amount of CGUs has been determined by utilizing post-tax cash flow forecasts based on the Group’s

2016-2018 three-year plan approved by management, on the basis of the results attained in previous years as well as

management expectations—split by geographical area—regarding future trends in the eyewear market for both the Wholesale

and Retail distribution segments. At the end of the three-year projected cash flow period, a terminal value was estimated in