LensCrafters 2015 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2015 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

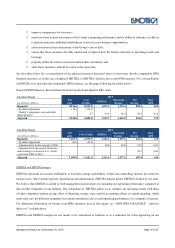

Report on corporate governance and ownership structure as of December 31, 2015 Page 4 of 45

on statutory audits, the process of collecting financial information, the effectiveness of the internal auditing

and management risk system, the auditing of accounts and the independence of the statutory auditor. The

Luxottica Group Board of Statutory Auditors also acts as the Audit Committee pursuant to SOX;

1 the meeting of stockholders (“Meeting of Stockholders”), which has the power to vote – both in ordinary and

extraordinary meetings – among other things, upon (i) the appointment and removal of the members of the

Board of Directors and of the Board of Statutory Auditors and their remuneration, (ii) the approval of the

annual financial statements and the allocation of profits, (iii) amendments to the Company’s by-laws; (iv) the

appointment of the function responsible for the statutory auditing of accounts, upon the recommendation of the

Board of Statutory Auditors; (v) adoption of equity incentive plans.

The task of auditing is assigned to an audit firm (“Audit Firm”) listed on the special CONSOB register and appointed

by the Meeting of Stockholders.

The powers and responsibilities of the Board of Directors, of the Board of Statutory Auditors, of the Ordinary Meeting

of Stockholders and of the Audit Committee are illustrated more in detail later in the Report.

The Company’s share capital is made up exclusively of ordinary, fully paid-up voting shares, entitled to voting rights

both at the ordinary and extraordinary meeting of stockholders. As at January 31, 2016 the share capital was

29,019,754.98 Euro, made up of 483,662,583 shares each with a nominal value of Euro 0.06.

There are no restrictions on the transfer of shares. No shares have special controlling rights. There is no employee

shareholding scheme.

The Company’s stockholders with an equity holding greater than 2% of Luxottica’s share capital are stated below, and

it is specified that, in the absence of a more recent direct announcement to the Company, the percentage communicated

to CONSOB, pursuant to article 120 of the Italian Consolidated Financial Law, is given:

1 Delfin S.à.r.l., with 61.595% of the share capital as at January 31, 2016;

1 Deutsche Bank Trust Company Americas, with 5.492% of the share capital as at January 31, 2016; the shares

held by Deutsche Bank Trust Company Americas represent ordinary shares that are traded in the U.S. financial

market through issuance by the Bank of a corresponding number of American Depositary Shares; these

ordinary shares are deposited at Deutsche Bank S.p.A., which in turn issues the certificates entitling the

holders to participate and vote in the meetings.

1 Giorgio Armani, with 4.955%, of which 2.947% is held in the form of ADRs at Deutsche Bank and therefore

included in Deutsche Bank’s shareholding; it is specified that these percentages correspond to the last filing

made on March 30, 2006, and are equal to 4.698% and 2.794% respectively of the share capital as at January

31, 2016, assuming that the number of shares held is unchanged.

The Chairman Leonardo Del Vecchio controls Delfin S.à r.l.

The Company is not subject to management and control as defined in the Italian Civil Code. The Board of Directors

made its last assessment in this respect on January 29, 2016, as it deemed that the presumption indicated in article 2497-

sexies of the Italian Civil Code was overcome, as Delfin S.à.r.l. (“the parent holding company”) acts as a holding

company and from an operational and business perspective there is no common managing interest with Luxottica nor

with the other affiliates of Luxottica. In particular, in the aforesaid Board meeting it was deemed that no management

and coordination activities on the part of the parent holding company existed as: (a) the parent holding company does