LensCrafters 2015 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2015 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Report as of December 31, 2015 Page 13 of 35

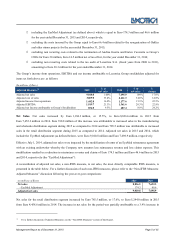

customer demand; (iii) increase in other assets (Euro 41.5 million) mainly due to tax receivables and prepaid expenses.

In 2015, non-current assets increased by Euro 393.4 million, due to increases in property, plant and equipment of

Euro 117.9 million, increases in intangible assets (including goodwill) of Euro 303.4 million. Those effects are partially

offset by the following: (i) decrease in other assets (Euro 18,3 million) mainly due to royalties advanced payments; (ii)

decrease in deferred tax assets (Euro 13.8 million) to be analyzed jointly with deferred tax liabilities. The net amount of

deferred tax liabilities increased by Euro 24 million mainly due to the positive effects of foreign currency fluctuations.

The increase in property, plant and equipment was due to additions that occurred in 2015 of Euro 362.4 million, to the

positive currency fluctuation effects of Euro 47.8 million, acquisitions of Euro 0.8 million, and which were partially offset

by depreciation and disposals for the period of Euro 273.5 million and Euro 19.7 million, respectively.

The increase in intangible assets was due to additions for the period of Euro 151.6 million, to the positive effects of foreign

currency fluctuations of Euro 338.9 million, acquisitions that occurred in the period for Euro 19.5 million and which were

partially offset by amortization of the period for Euro 203.4 million.

The increase in total liabilities of Euro 54.9 as of December 31, 2015 compared to prior period was due to an increase in

equity of Euro 488,9 million and an increase in non-current liabilities of Euro 47.8 million partially offset by a decrease in

current liabilities of Euro 481.8 million.

The decrease in current liabilities was mainly due to: (i) a decrease in financial liabilities (Euro 622.8 million) as described

in the following paragraph; (ii) a decrease in short-term provision for risks and other charges of Euro 68,9 million mainly

due to the payment made by Luxottica S.r.l. and related to a tax audit for fiscal years 2008 through 2011; (iii) an increase in

trade payables (Euro 182,9 million) mainly due to the growth of the business and to the strengthening of the foreign

currencies in which the Group operates compared to the Euro; and (iv) an increase in other liabilities (Euro 35.4 million)

mainly due to wages and salaries.

The increase in non-current liabilities was mainly due to an increase in long-term debt (Euro 26.7 million) as noted in the

following paragraph.

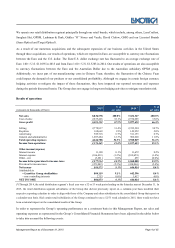

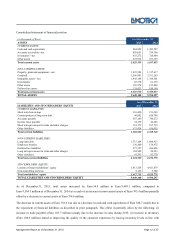

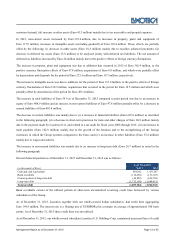

Our net financial position as of December 31, 2015 and December 31, 2014 was as follows:

As of December

(in thousands of Euro) 2015

2014

Cash and cash equivalents 864,852

1,453,587

Bank overdrafts (110,450)

(151,303)

Current portion of long-term debt (44,882)

(626,788)

Long-term debt (1,715,104)

(1,688,415)

Total net debt (1,005,584)

(1,012,918)

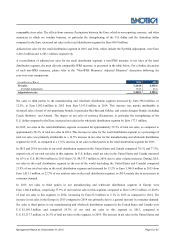

Bank overdrafts consist of the utilized portion of short-term uncommitted revolving credit lines borrowed by various

subsidiaries of the Group.

As of December 31, 2015, Luxottica together with our wholly-owned Italian subsidiaries, had credit lines aggregating

Euro 194.8 million. The interest rate is a floating rate of EURIBOR plus a margin on average of approximately 100 basis

points. As of December 31, 2015 these credit lines was not utilized.

As of December 31, 2015, our wholly-owned subsidiary Luxottica U.S. Holdings Corp. maintained unsecured lines of credit