LensCrafters 2015 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2015 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the consolidated financial statement as of December 31, 2015 Page 47 di 68

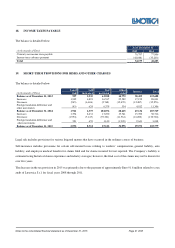

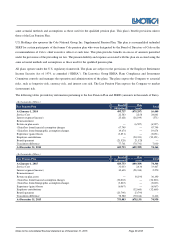

where the TFR compensation is invested, whereas such compensation otherwise would be directed to the National Social

Security Institute for Pension Funds. As a result, contributions under the reformed TFR system are accounted for as a defined

contribution plan. The liability accrued until December 31, 2006 continues to be considered a defined benefit plan. Therefore,

each year, the Group adjusts its accrual based upon headcount and inflation, excluding changes in compensation level.

This liability as of December 31, 2015 represents the estimated future payments required to settle the obligation resulting from

employee service, excluding the component related to the future salary increases.

Contribution expense to pension funds was Euro 22.2 million and Euro 20.6 million for the years 2015 and 2014, respectively.

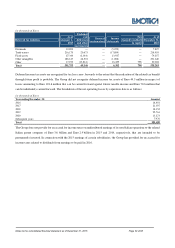

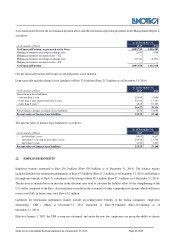

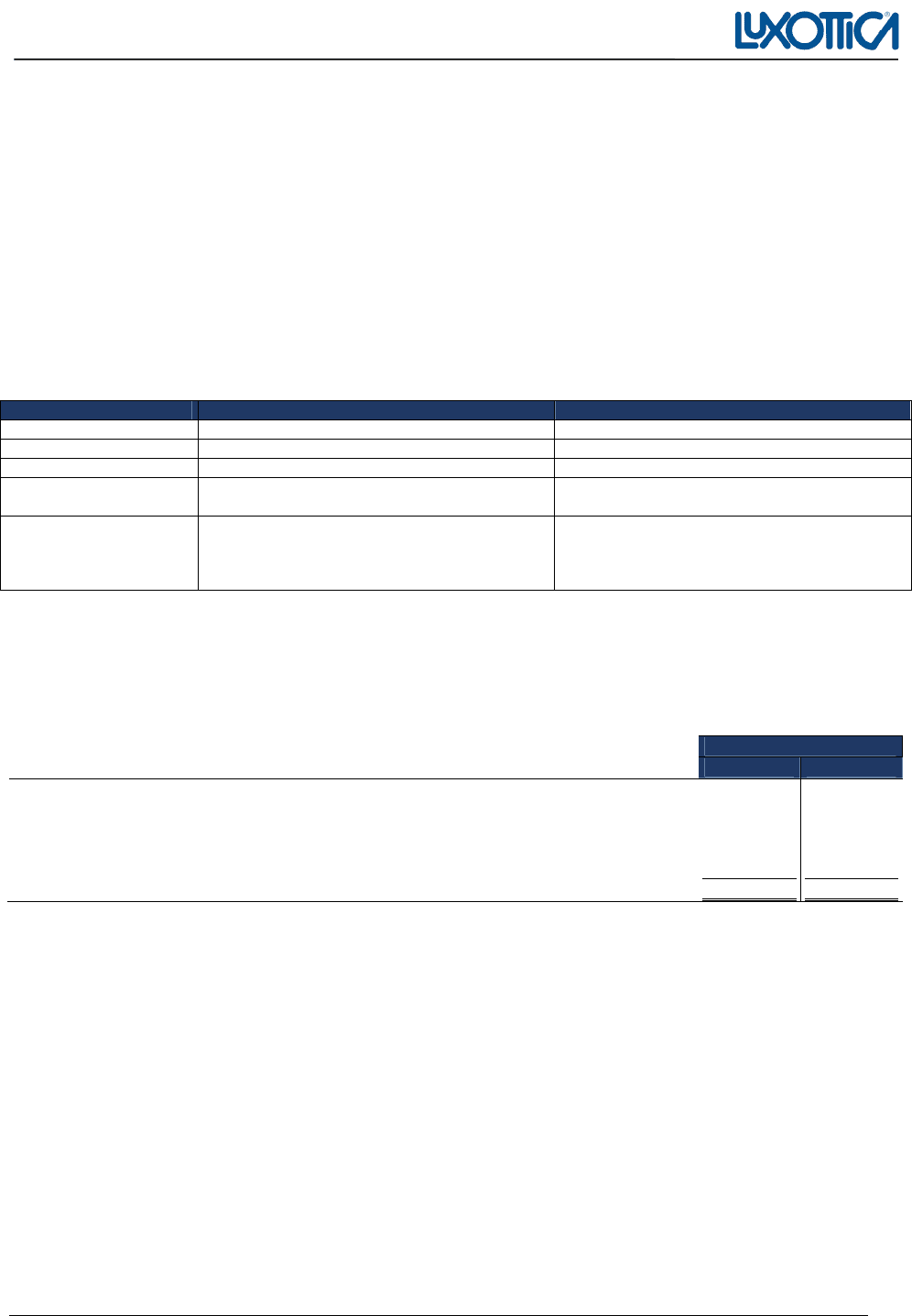

In application of IAS 19, the valuation of TFR liability accrued as of December 31, 2006 was based on the Projected Unit

Credit Cost method. The main assumptions utilized are reported below:

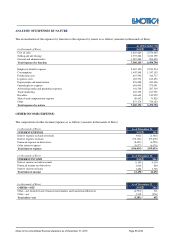

Economic Assumptions

2015

2014

Discount rate 2.00%

1.50%

Annual TFR increase rate

2.81%

2.81%

Mortality tables: Those determined by the General Accounting

Department of the Italian Government, named RG48

Those determined by the General Accounting

Department of the Italian Government, named RG48

Retirement probability:

Assuming the attainment of the first of the retirement

requirements applicable for the Assicurazione

Generale Obbligatoria (General Mandatory

Insurance)

Assuming the attainment of the first of the retirement

requirements applicable for the Assicurazione

Generale Obbligatoria (General Mandatory

Insurance)

The tax on revaluation of TFR increased from 11% in 2013 to 17% in 2014. The increase did not have a significant impact on

the TFR liability as of December 31, 2014. The tax on revaluation did not change in 2015.

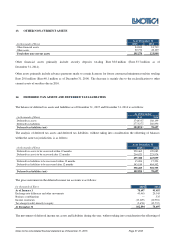

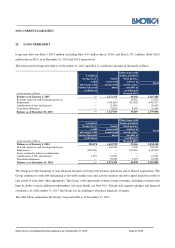

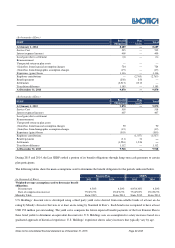

Movements in liabilities during the course of the year are detailed in the following table:

As of December 31,

(in thousands of Euro) 2015

2014

Liabilities at the beginning of the period 41,771

38,095

Expenses for interests 614

1,160

Change in the revaluation rate

(750)

Actuarial loss (income) (2,611)

5,804

Benefits paid (1,755)

(2,538)

Liabilities at the end of the period 38,019

41,771

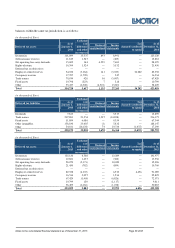

Pension funds

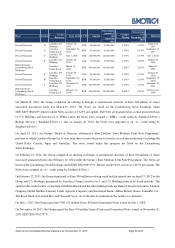

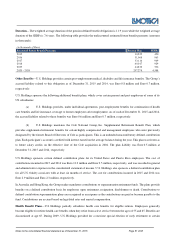

Qualified Pension Plans—U.S. Holdings sponsors a qualified noncontributory defined benefit pension plan, the Luxottica

Group Pension Plan (“Lux Pension Plan”), which provides for the payment of benefits to eligible past and present employees of

U.S. Holdings upon retirement. Pension benefits are gradually accrued based on length of service and annual compensation

under a cash balance formula. Participants become vested in the Lux Pension Plan after three years of vesting service as defined

by the Lux Pension Plan. In 2013, the Lux Pension Plan was amended so that employees hired on or after January 1, 2014

would not be eligible to participate.

Nonqualified Pension Plans and Agreements—U.S. Holdings also maintains a nonqualified, unfunded supplemental executive

retirement plan (“Lux SERP”) for participants of its qualified pension plan to provide benefits in excess of amounts permitted

under the provisions of prevailing tax law. The pension liability and expense associated with this plan are accrued using the