LensCrafters 2015 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2015 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270

|

|

Notes to the consolidated financial statement as of December 31, 2015 Page 63 di 68

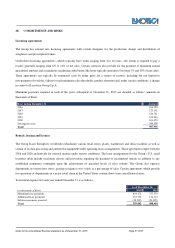

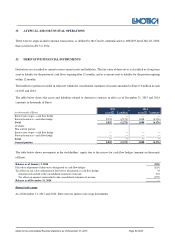

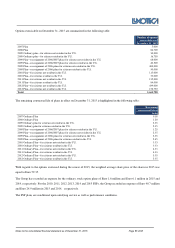

33. NON-RECURRING TRANSACTIONS

During 2015, the Group incurred non-recurring expenses related to the integration of Oakley and other minor projects with a

Euro 66.4 million impact on operating income and an approximately Euro 49.8 million impact on net income. These costs

primarily relate to severance expenses and asset write-offs.

In 2014, the Group recorded a non-recurring expenditure amounting to Euro 20 million (Euro 10.9 million net of taxes) related

to the termination agreement of the employment relationship and the administration relationship between the forme Group

CEOs Andrea Guerra and Enrico Cavatorta and Luxottica Group SpA. The group recorded a tax benefit of approximately Euro

5.5 million related to the above mentioned costs. In the last quarter of 2014, the Group recorded a non-recurring expense of

Euro 30.3 million for the tax audit related to Luxottica S.r.l. (fiscal years from 2008 to 2011).

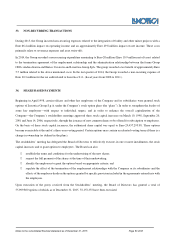

34. SHARE-BASED PAYMENTS

Beginning in April 1998, certain officers and other key employees of the Company and its subsidiaries were granted stock

options of Luxottica Group S.p.A. under the Company’s stock option plans (the “plans”). In order to strengthen the loyalty of

some key employees—with respect to individual targets, and in order to enhance the overall capitalization of the

Company—the Company’s stockholders meetings approved three stock capital increases on March 10, 1998, September 20,

2001 and June 14, 2006, respectively, through the issuance of new common shares to be offered for subscription to employees.

On the basis of these stock capital increases, the authorized share capital was equal to Euro 29,457,295.98. These options

become exercisable at the end of a three-year vesting period. Certain options may contain accelerated vesting terms if there is a

change in ownership (as defined in the plans).

The stockholders’ meeting has delegated the Board of Directors to effectively execute, in one or more installments, the stock

capital increases and to grant options to employees. The Board can also:

1 establish the terms and conditions for the underwriting of the new shares;

1 request the full payment of the shares at the time of their underwriting;

1 identify the employees to grant the options based on appropriate criteria; and

1 regulate the effect of the termination of the employment relationships with the Company or its subsidiaries and the

effects of the employee death on the options granted by specific provision included in the agreements entered into with

the employees.

Upon execution of the proxy received from the Stockholders’ meeting, the Board of Directors has granted a total of

55,909,800 options of which, as of December 31, 2015, 33,153,333 have been exercised.