LensCrafters 2015 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2015 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270

|

|

Notes to the consolidated financial statement as of December 31, 2015 Page 36 di 68

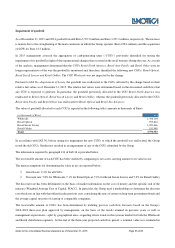

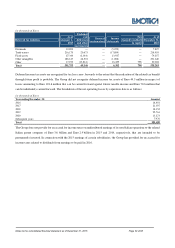

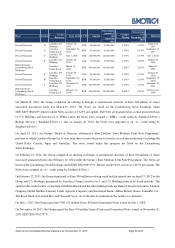

order to reflect the value of the CGU in future years. The terminal values were calculated as a perpetuity at the same growth rate

as described above and represent the present value, in the last year of the forecast, of all future perpetual cash flows. The

impairment test performed as of the balance sheet date resulted in a recoverable value greater than the carrying amount

(net operating assets) of the above mentioned CGUs. In percentage terms, the surplus of the recoverable amount of the CGU

over the carrying amount was equal to 502%, 72%, 98% and 100% of the carrying amount of the Wholesale, Retail Optical,

Retail Sun & Luxury and Retail Oakley CGUs, respectively. A reduction in the recoverable amount of the CGU to a value that

equals its carrying amount would require either of the following: (i) an increase in the discount rate to approximately 31.7% for

Wholesale, 10.3% for Retail Optical, 11.7% for Retail Sun & Luxury and 11.5% for Retail Oakley; or (ii) the utilization of a

negative growth rate for all the CGUs.

In addition, reasonable changes to the abovementioned assumptions used to determine the recoverable amount (i.e., growth rate

changes of +/−0.5 percent and discount rate changes of +/−0.5 percent) would not significantly affect the impairment

test results.

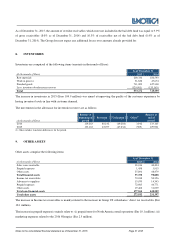

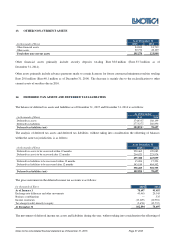

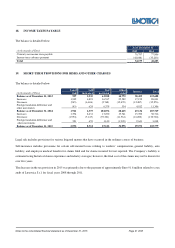

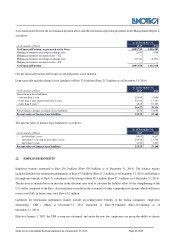

12. INVESTMENTS

Investments amounted to Euro 65.4 million (Euro 61.2 million as of December 31, 2014). The balance mainly related to the

investment in Eyebiz Laboratories Pty Limited (a joint venture formed in 2010 between Luxottica and Essilor International that

provides most of the Australian lab requirements) for Euro 6.0 million (Euro 5.4 million as of December 31, 2014) and the

acquisition of the 36.80% equity stake in Salmoiraghi & Viganò. The following tables provide a roll-forward of the Group’s

investment from the acquisition date as well as the assets, liabilities and net sales of Salmoiraghi & Viganò.

(in thousands of Euro)

As of January 1, 2015 42,583

Addition —

Share of profit from associate 3,430

As of December 31, 2015 46,013

(in thousands of Euro)

As of

December 31, 2015

Total assets 183,116

Total liabilities 136,865

Net sales 195,284

Share of profit 3,430

Percentage held 36.80%

The investment was analyzed under the applicable impairment test as of December 31, 2015 and it was determined that no loss

is to be recorded in the consolidated financial statements as of December 31, 2015.