LensCrafters 2015 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2015 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270

|

|

Notes to the consolidated financial statement as of December 31, 2015 Page 67 di 68

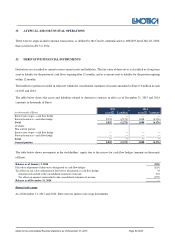

35. DIVIDENDS

In May 2015, the Company distributed aggregate dividends to its stockholders of Euro 689.7 million equal to Euro 1.44 per

ordinary share. Dividends distributed to non-controlling interests totaled Euro 2.1 million. During 2014, the Company

distributed aggregate dividends to its stockholders of Euro 308.3 million equal to Euro 0.65 per ordinary share. Dividends

distributed to non-controlling interests totaled Euro 3.7 million.

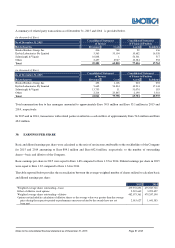

36. CAPITAL MANAGEMENT

The Group’s objectives when managing capital are to safeguard the Group’s ability to continue, as a going concern, to provide

returns to shareholders and benefit to other stockholders and to maintain an optimal capital structure to reduce the cost

of capital.

Consistent with others in the industry, the Group also monitors capital on the basis of a gearing ratio that is calculated as net

financial position divided by total capital. Net financial position is calculated as total borrowings (including short-term

borrowings and current and non-current portions of long-term debt) less cash and cash equivalents. Total capital is calculated as

equity, as shown in the consolidated statement of financial position, plus net financial position.

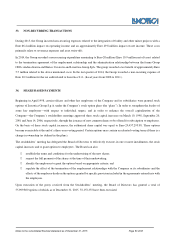

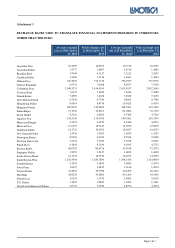

The table below provides the Group’s gearing ratio for 2015 and 2014 as follows:

(in million of Euro except percentages) 2015

2014

Total borrowings (notes 15 and 21) 1,870.4

2,466.5

Less cash and cash equivalents (864.9)

(1,453.6)

Net financial position 1,005.6

1,012.9

Total equity 5,417.7

4,928.8

Capital 6,423.3

5,941.7

Gearing ratio 15.7%

17.0%

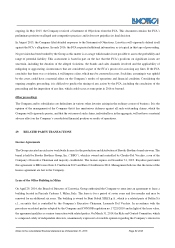

37. SUBSEQUENT EVENTS

On January 29, 2016, Mr. Adil Mehboob-Khan ceased as Director of the Company and as the Group’s CEO for Markets and

from his other administrative roles effective February 29, 2016. Pursuant to his termination agreement, Luxottica paid Mr.

Mehboob-Khan Euro 6.8 million in addition to severance pay linked to the termination of his employment relationship. In

addition, Luxottica paid Mr. Khan Euro 0.2 million in connection with a settlement and novation agreement as consideration

for his waiver of any claims or rights that he may have that are connected or related to his employment and administration

relationships with the Group or any other associated entity and any resolution thereof. No sums were awarded in connection

with Mr. Mehboob-Khan’s termination from the position of director and CEO for Markets of Luxottica Group S.p.A. At the

same time, the Board of Directors approved a modification to our governance structure by assigning responsibility for Markets,

a role formerly held by Mr. Adil Mehboob-Khan, to Mr. Leonardo Del Vecchio, the Company’s Chairman of the Board of

Directors and majority shareholder, as Executive Chairman. Massimo Vian continues in his role as CEO for Product &

Operations and will assist the Executive Chairman.