JCPenney 2003 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 7

Management’s Discussion and Analysis of Financial Condition and Results of Operations

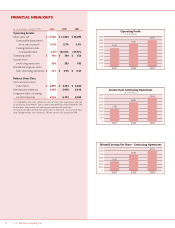

Strengthened liquidity — The Company ended 2003 with

approximately $3.0 billion of cash and short-term investments, in

excess of 55% of the $5.4 billion outstanding long-term debt. The

cash balance continues to provide liquidity and flexibility during

the Company’s turnaround.

HOLDING COMPANY

Effective January 27, 2002, J. C. Penney Company, Inc. changed its

corporate structure to a holding company format. As part of this

structure, J. C. Penney Company, Inc. changed its name to

J. C. Penney Corporation, Inc. (JCP) and became a wholly owned

subsidiary of a newly formed affiliated holding company (Holding

Company). The Holding Company assumed the name J. C. Penney

Company, Inc. All outstanding shares of common and preferred

stock were automatically converted into the identical number and

type of shares in the Holding Company. Stockholders’ ownership

interests in the business did not change as a result of the new

structure. Shares of the Company remain publicly traded under the

same symbol (JCP) on the New York Stock Exchange. The Holding

Company is a co-obligor (or guarantor, as appropriate) regarding

the payment of principal and interest on JCP’s outstanding debt

securities. The Holding Company and its consolidated subsidiaries,

including JCP, are collectively referred to in this Annual Report as

"Company" or "JCPenney," unless indicated otherwise. See Basis of

Presentation in Note 1 on page 26 for further discussion.

CRITICAL ACCOUNTING POLICIES

The application of accounting policies necessarily involves judg-

ment and, in certain instances, the use of estimates and assump-

tions. Different amounts could be reported under different condi-

tions or using different assumptions. Management believes that

the accounting policies used to develop estimates that are the

most critical to understanding and evaluating the Company’s

reported results relate to: inventory valuation under the retail

method of accounting; valuation of long-lived and intangible

assets, including goodwill; estimation of reserves and valuation

allowances, specifically related to closed stores, insurance, income

taxes, litigation and environmental contingencies; and pension

accounting.

Revenue recognition was included in the discussion of critical

accounting policies in the Company’s 2002 and 2001 Annual

Reports; however, based on the following analysis it is not includ-

ed as a critical accounting policy in this Report. In the SEC’s pub-

lished guidance, a critical accounting estimate is one that is both

(1) material due to the levels of subjectivity and judgment neces-

sary to account for highly uncertain matters or the susceptibility of

such matters to change; and (2) the effect of the estimate and/or

assumption on financial condition or operating performance is

material. While net retail sales are material, the Company’s busi-

ness is fairly straightforward. Customers purchase merchandise

and services with credit or debit cards, cash or gift cards, and rev-

enue is recognized at the point of sale when payment is made and

customers take possession of the merchandise in department

stores, at the point of shipment of merchandise ordered through

Catalog/Internet, or in the case of services, the customer has

received the benefit of the service, such as salon, portrait, optical

or custom decorating. Other than estimating returns, there is very

little subjectivity involved in determining when to recognize rev-

enue. Sales returns are not significant for retail stores due to the rel-

atively short timeframe in which returns are typically made and the

visibility of the merchandise to the customer. For Catalog/Internet,

however, the return period is longer and return rates higher due to

the nature of the business. The January 2002 changes in

Catalog/Internet payment and shipping policies led to lower

return rates. The Company records an allowance for estimated

returns based on the returns policy in place and historical experi-

ence. The majority of the allowance relates to estimated

Catalog/Internet returns and is considerably lower than the level

prior to the policy changes. While returns have historically been

within expectations and the recorded allowance has been ade-

quate, management reviews actual return experience periodically

and adjusts the allowance, as appropriate. As a result of this recon-

sideration of the SEC’s guidance, management has concluded that

revenue recognition is not a critical accounting estimate for the

Company.

The Company’s management has discussed the development

and selection of these critical accounting policies with the Audit

Committee of the Company’s Board of Directors, and the Audit

Committee has reviewed the Company’s disclosures relating to

these policies in this Management’s Discussion and Analysis.

Inventory valuation under the retail method:

Inventories are valued primarily at the lower of cost (using the

last-in, first-out or "LIFO" method) or market determined by the

retail method for department store and store support center (SSC)

inventory, and average cost for Catalog/Internet and the regional

warehouse inventory. Under the retail method, inventory is segre-

gated into groupings of merchandise having similar characteristics

and is stated at its current retail selling value. Inventory retail values

are converted to a cost basis by applying specific average cost fac-

tors for each grouping of merchandise. Cost factors represent the

average cost-to-retail ratio for each merchandise group based on

the beginning of period inventory plus the period’s purchase activ-

ity, as calculated on a monthly basis, for each store location.

Accordingly, a significant assumption under retail method

accounting is that the inventory in each group of merchandise is

similar in terms of its cost-to-retail relationship and has similar gross

margin and turnover rates. Management monitors the content of

merchandise in these groupings to ensure distortions that would

have a material effect on inventory valuation do not occur. The

retail method inherently requires management judgment and cer-

tain estimates that may significantly impact the ending inventory

valuation at cost as well as gross margin. Among others, two of the

most significant estimates are permanent reductions to retail

prices (markdowns) used to clear unproductive or slow-moving

inventory and shortage (shrinkage).

Permanent markdowns designated for clearance activity are

recorded at the point of decision, when the utility of inventory has

diminished, versus the point of sale. Factors considered in the

determination of permanent markdowns include: current and

anticipated demand, customer preferences, age of the merchan-

dise and fashion trends. The corresponding reduction to gross