JCPenney 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 27

Notes to the Consolidated Financial Statements

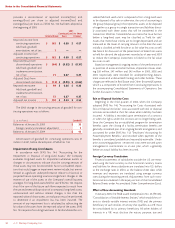

Advertising

Advertising costs, which include newspaper, television, radio and

other media advertising, are expensed either as incurred or the first

time the advertising occurs, and were $1,118 million, $1,028 mil-

lion and $893 million for 2003, 2002 and 2001, respectively. These

totals include catalog book costs of $264 million, $260 million and

$269 million for 2003, 2002 and 2001, respectively. Catalog book

preparation and printing costs, which are considered direct

response advertising, are charged to expense over the productive

life of the catalog, not to exceed eight months. Included in other

assets are deferred catalog book costs of $77 million as of January

31, 2004 and $73 million as of January 25, 2003.

Vendor Allowances

The Company receives vendor support in the form of cash

payments or allowances through a variety of programs, including

cooperative advertising, markdown reimbursements, vendor

compliance and defective merchandise. The Company has

agreements in place with each vendor setting forth the specific

conditions for each allowance or payment. Depending on the

arrangement, the Company either recognizes the allowance as a

reduction of current costs or defers the payment over the period

the related merchandise is sold. If the payment is a reimburse-

ment for costs incurred, it is offset against those related costs;

otherwise, it is treated as a reduction to the cost of merchandise.

For cooperative advertising programs, the Company generally

offsets the allowances against the related advertising expense.

Many of these programs require proof-of-advertising to be pro-

vided to the vendor to support the reimbursement of the

incurred cost. Programs that do not require proof-of-advertising

are monitored to ensure that the allowance provided by each

vendor is a reimbursement of costs incurred to advertise for that

particular vendor. If the allowance exceeds the advertising costs

incurred on a vendor specific basis, then the excess allowance for

the vendor is recorded as a reduction of merchandise cost.

Markdown reimbursements are negotiated by the buying team

after the related merchandise is sold and the markdown informa-

tion is known; consequently, they are credited directly to cost of

goods sold in the period received.

Vendor compliance charges reimburse the Company for incre-

mental merchandise handling expenses incurred due to a ven-

dor’s failure to comply with the Company’s established shipping

or merchandise preparation requirements. Due to the strict

recordkeeping requirements and related cost/benefit considera-

tions, vendor compliance arrangements entered into after

December 31, 2002 are recorded as a reduction of the cost of the

merchandise. Allowances or cash from vendor compliance

arrangements entered into prior to December 31, 2002 are

recorded as a reduction of merchandise handling costs.

The accounting policices described above are in compliance

with Emerging Issues Task Force 02-16, “Accounting by a

Customer (Including a Reseller) for Certain Consideration

Received from a Vendor,” and were adopted by the Company in

the first quarter of 2003. This adoption resulted in lower net

income of $9 million in 2003 compared to 2002.

Pre-Opening Expenses

Costs associated with the opening of new stores are expensed

in the period incurred.

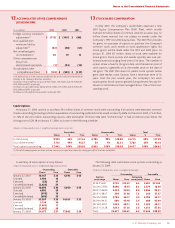

Retirement-Related Benefits

In December 2003, the Financial Accounting Standards Board

(FASB) issued Statement of Financial Accounting Standards

(SFAS) No. 132 (revised 2003), “Employers’ Disclosures About

Pensions and Other Postretirement Benefits.” This statement

revises employers’ disclosures about pension plans and other

postretirement benefit plans. It does not change the measure-

ment or recognition of those plans required by SFAS No. 87,

“Employers’ Accounting for Pensions,” SFAS No. 88, “Employers’

Accounting for Settlements and Curtailments of Defined Benefit

Pension Plans and for Termination Benefits,” and SFAS No. 106,

“Employers’ Accounting for Postretirement Benefits Other Than

Pensions.” This statement retains the disclosure requirements

contained in SFAS No. 132, “Employers’ Disclosures about

Pensions and Other Postretirement Benefits,” which it replaces. It

requires additional disclosures to those in the original SFAS No.

132 about the assets, obligations, cash flows, and net periodic

benefit cost of defined benefit pension plans and other defined

benefit postretirement plans. The required information should

be provided separately for pension plans and for other postre-

tirement benefit plans. Most provisions of this statement are

effective for financial statements with fiscal years ending after

December 15, 2003. The Company implemented the required

provisions of SFAS No. 132 (revised 2003) for the year ended

January 31, 2004, and has early adopted the disclosures relating to

estimated future benefit payments for the qualified pension plan.

See Note 15.

The Company accounts for its defined benefit pension plans

and its non-pension postretirement benefit plans using actuarial

models required by SFAS No. 87 and SFAS No. 106. These models

effectively spread changes in asset values, the pension obligation

and assumption changes systematically and gradually over the

employee service periods. One of the principal components of

the net periodic pension calculation is the expected long-term

rate of return on plan assets. The required use of the expected

long-term rate of return on plan assets may result in recognized

pension income that is greater or less than the actual returns on

those plan assets in any given year. Over time, however, the

expected long-term returns are designed to approximate the

actual long-term returns, and therefore, result in a pattern of

income and expense that more closely matches the pattern of

services provided by employees. Differences between actual and

expected returns are recognized gradually in net periodic pension

expense or offset by future gains or losses.

The Company uses long-term historical actual return data, the

mix of investments that comprise plan assets and future esti-

mates of long-term investment returns by reference to external

sources to develop its expected return on plan assets.

The discount rate assumptions used for pension and non-pension

postretirement benefit plan accounting reflect the rates available

on AA-rated corporate bonds on the October 31 measurement

date of each year. The rate of compensation increase is