JCPenney 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc.40

Notes to the Consolidated Financial Statements

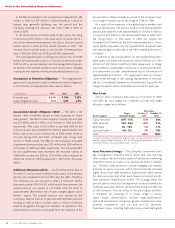

amount deductible for tax purposes. The Company does not

currently have minimum funding requirements, as set forth in

employee benefit and tax laws. All contributions made to the

funded pension plan for 2003 and 2002 were voluntary.

Contributions to the unfunded non-qualified supplemental

retirement plans are equal to the amount of benefit payments

made to retirees throughout the year, and for 2004 are anticipat-

ed to be approximately $28 million.

All benefit payments for other postretirement benefits are

voluntary, as the postretirement plans are not funded and are not

subject to any minimum regulatory funding requirements.

Benefit payments for each year represent claims paid for medical

and life insurance. The Company estimates the 2004 postretire-

ment plan payments will approximate $12 million and will be

made from cash generated from operations.

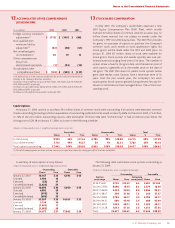

Defined Contribution Plans

The Company’s Savings, Profit-Sharing and Stock Ownership

Plan is a defined contribution plan available to all eligible associ-

ates of the Company and certain subsidiaries. Additionally, the

Company has a Mirror Plan, which is offered to certain manage-

ment associates. Associates who have completed at least 1,000

hours of service within an eligibility period (generally 12 consec-

utive months) and have attained age 21 are eligible to participate

in the plan. Vesting of Company contributions occurs over a five-

year period. The Company contributes to the plan an amount

equal to 4.5% of the Company’s available profits, as well as dis-

cretionary contributions designed to generate a competitive level

of benefits. Total Company contributions for 2003 and 2002

were $45 million and $47 million, respectively, of which discre-

tionary contributions were $19 million and $20 million in each

respective year. Associates have the option of reinvesting match-

ing contributions made in Company stock into a variety of

investment options, primarily mutual funds.

Tot al Com pany expense for defined contribution plans,

including the Mirror Plan, for 2003, 2002 and 2001 was $47 mil-

lion, $49 million and $60 million, respectively.

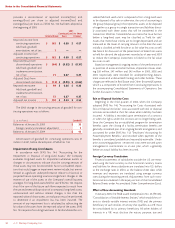

16 REAL ESTATE AND OTHER (INCOME)/EXPENSE

($ in millions) 2003 2002 2001

Real estate activities $(28) $(25) $ (31)

Net gains from sale of

real estate (51) (16) (57)

Asset impairments, PVOL and

other unit closing costs 57 75 70

Centralized merchandising

process (ACT) costs ——36

Other 525 30

Tot al $(17) $59$48

Real Estate Activities and Net Gains from Sale of Real Estate

Real estate activities consist of operating income for the

Company’s real estate subsidiaries. The Company recognized net

gains on the sale of facilities that were no longer being used

in Company operations and investments in real estate

partnerships.

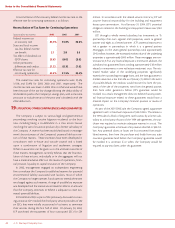

Asset Impairments, PVOL and Other Unit Closing Costs

In 2003 the Company recorded charges of $57 million for asset

impairments, the present value of lease obligations (PVOL) and

other unit closing costs. These costs consisted of $22 million of

accelerated depreciation for Catalog facilities closed in the

second quarter of 2003, $26 million of asset impairments and $11

million of unit closing costs related primarily to remaining lease

obligations. Costs were net of a $2 million reduction to a reserve

established as part of the Company’s sale of its proprietary cred-

it card receivables to General Electric Capital Corporation in

1999. This reserve was originally $20 million and was established

to cover potential bad debts on certain types of accounts.

Remaining reserve balances were $1 million as of January 31, 2004

and $3 million as of January 25, 2003.

The Company recorded charges of $75 million in 2002 related

primarily to asset impairments and PVOL for certain department

stores, catalog and other facilities. The impairment charges

resulted from the Company’s ongoing process to evaluate the

productivity of its asset base.

The Company recorded charges of $70 million in 2001, com-

prised of asset impairments and PVOL and including $28 million

of restructuring charges that principally represented adjustments

to the 2000 store closing plan and a modification to include two

additional units.

Centralized Merchandising Process (ACT) Costs

In 2001, the Company incurred $36 million of costs related to

Accelerating Change Together (ACT). ACT was a fundamental

rebuilding of the Department Store process and organization,

creating a centralized buying organization. ACT required process

and organizational restructuring throughout the Company’s cor-

porate and field structure for Department Stores. Incremental

ACT costs over the two-year transition period (2000-2001)

totaled $91 million. Including $20 million of capitalized hardware

and software costs, total ACT expenditures were $111 million.

Beginning in 2002, costs associated with centralized merchandis-

ing resulting from the ACT initiative are included in operating

results.

Other

Other includes operating losses of $10 million in 2002 and $19

million in 2001 related to third-party fulfillment operations that

were discontinued in 2002.