JCPenney 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 13

Management’s Discussion and Analysis of Financial Condition and Results of Operations

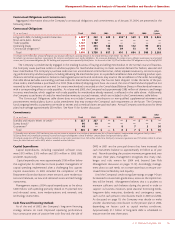

Operating Profit

($ in millions) 2003 2002 2001

Operating profit(1) $790 $700 $ 553

As a percent of sales 4.4% 3.9% 3.1%

(1) Excludes Interest Expense and Real Estate and Other.

Operating profit increased for the third straight year, primarily

as a result of comparable store sales gains and gross margin

improvement as the Company has realized some of the benefits

from implementing its centralization initiatives.

As the Company continues executing its turnaround strategy,

steps have been taken to continue to improve the merchandise

offerings, present a more integrated and powerful marketing

message and lower expenses. The Company’s financial goal is to

generate operating profit of 6% to 8% of sales in 2005. The suc-

cessful execution of the turnaround and progress toward

improving profitability is impacted by customers’ response to the

Company’s merchandise offerings, competitive conditions, the

effects of current economic conditions, continued improvement

in gross margin and the reduction of the expense structure.

Net Interest Expense

Net interest expense totaled $261 million, $226 million and

$231 million in 2003, 2002 and 2001, respectively. The increase in

2003 is primarily attributable to the increased debt level in 2003,

particularly the $600 million of debt issued early in the year, as

well as lower returns on short-term investments. Long-term

debt, excluding equipment financing, of approximately $442 mil-

lion and $920 million matured and was paid in 2003 and 2002,

respectively. See Note 2 for explanation of interest expense

allocated to Eckerd.

Real Estate and Other (Income)/Expense

($ in millions) 2003 2002 2001

Real estate activities $(28) $(25) $ (31)

Net gains from sale

of real estate (51) (16) (57)

Asset impairments, PVOL

and other unit closing costs 57 75 70

Centralized merchandising

process costs ——36

Other 525 30

Tot al $(17) $59$48

Real estate activities consist of operating income for the

Company’s real estate subsidiaries. The Company recognized net

gains on the sale of facilities that were no longer being used in

Company operations and investments in real estate partnerships.

In 2003, the Company recorded charges of $57 million for asset

impairments, the present value of lease obligations (PVOL) and

other unit closing costs. These costs consisted of $22 million of

accelerated depreciation for Catalog facilities closed in second

quarter of 2003, $26 million of asset impairments, $11 million of

unit closing costs related primarily to remaining lease obligations

and a $2 million reduction to a previously established reserve.

Impairments relate primarily to department stores and are the

result of the Company’s ongoing process to evaluate the

productivity of its asset base, as described under Valuation of

Long-Lived and Intangible Assets, Including Goodwill on page 8.

The Company recorded charges of $75 million in 2002 related

primarily to asset impairments and PVOL for certain department

stores, Catalog and other facilities.

The Company recorded charges of $70 million in 2001, com-

prised of asset impairments and PVOL, and included $28 million

of restructuring charges that principally represented adjustments

to the 2000 store closing plan and a modification to include two

additional units.

In 2001 the Company incurred $36 million of costs related to

the centralized merchandising process.

Other includes operating losses of $10 million in 2002 and $19

million in 2001 related to third-party fulfillment operations that

were discontinued in 2002.

Income Taxes

The overall effective tax rates for continuing operations were

33.2%, 31.5% and 33.4% for 2003, 2002 and 2001, respectively. The

income tax rate was lower in 2002 than what it otherwise would

have been because of a tax law change allowing the deductibility

of all dividends paid to the Company’s savings plan, with a one-

time provision to include certain of the prior year’s dividends.

Due to current income levels, certain state tax planning bene-

fits have not been utilized, resulting in a lower tax benefit. Based

on the short time periods for carryforwards in certain states, val-

uation allowances of $108 million and $80 million in 2003 and

2002, respectively, have been established for those benefits not

expected to be realized.

FINANCIAL CONDITION

Liquidity and Capital Resources

The Company implemented a long-term financing strategy in

2001 to help strengthen its liquidity position, ensure adequate

financial flexibility and enable opportunistic access to the capital

markets during the course of its turnaround. The strategy was

designed to allow sufficient time to restore the Company’s prof-

itability to more competitive levels, while at the same time pro-

viding the resources to support the operational and strategic

needs of the business. To date, this strategy has been successful.

The Company’s financial condition and liquidity has improved

steadily since the beginning of the turnaround in 2001, and that

trend continued in 2003. At year-end 2003, the Company had

approximately $3.0 billion of cash investments, which represent-

ed in excess of 55% of the $5.4 billion of outstanding long-term

debt, including current maturities. This compares with cash

investments of approximately $2.5 billion at the end of 2002. The

Operating Profit % of Sales

5.0%

4.0%

3.0%

2.0%

1.0%

0.0%

3.1%

3.9%

4.4%

2001 2002 2003