JCPenney 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc.30

Notes to the Consolidated Financial Statements

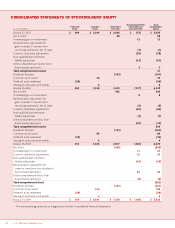

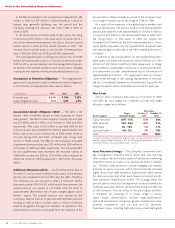

provides a reconciliation of reported income/(loss) and

earnings/(loss) per share to adjusted income/(loss) and

earnings/(loss) per share, as if SFAS No. 142 had been adopted at

the beginning of 2001:

2001

Earnings/(Loss) Per Share

Income/(Loss) Basic Diluted

Reported income from

continuing operations $182 $0.58 $ 0.57

Add back: goodwill

amortization, net of tax 1——

Adjusted income from

continuing operations $183 $0.58 $ 0.57

Reported (loss) from

discontinued operations $(84) $(0.32) $ (0.31)

Add back: goodwill and

tradename amortization,

net of tax 71 0.27 0.27

Adjusted (loss) from

discontinued operations $(13) $(0.05) $ (0.04)

Reported net income $98$0.26 $ 0.26

Add back: goodwill and

tradename amortization,

net of tax 72 0.27 0.27

Adjusted net income $170 $0.53 $ 0.53

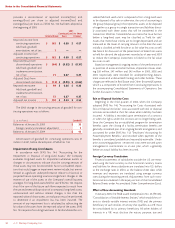

The 2003 change in the carrying amount of goodwill for con-

tinuing operations was as follows:

($ in millions) Goodwill

Balance as of January 25, 2003 $35

Foreign currency translation adjustment 7

Balance as of January 31, 2004 $42

Amortization of goodwill for continuing operations was $1

million in 2001, before the adoption of SFAS No. 142.

Impairment of Long-Lived Assets

In accordance with SFAS No. 144, “Accounting for the

Impairment or Disposal of Long-Lived Assets,” the Company

evaluates long-lived assets for impairment whenever events or

changes in circumstances indicate that the carrying amount of

those assets may not be recoverable. Factors considered impor-

tant that could trigger an impairment review include, but are not

limited to, significant underperformance relative to historical or

projected future operating results and significant changes in the

manner of use of the assets or the Company’s overall business

strategies. For long-lived assets held for use, SFAS No. 144 requires

that if the sum of the future cash flows expected to result from

the use and eventual disposition of a company’s long-lived assets,

undiscounted and without interest charges, is less than the

reported value of those assets, an evaluation must be performed

to determine if an impairment loss has been incurred. The

amount of any impairment loss is calculated by subtracting the

fair value of the assets from the reported value of the assets. SFAS

No. 144 requires that a long-lived asset to be abandoned be con-

sidered held and used until it is disposed of. For a long-lived asset

to be disposed of by sale or otherwise, the unit of accounting is

the group (disposal group) that represents assets to be disposed

of together as a group in a single transaction and liabilities direct-

ly associated with these assets that will be transferred in the

transaction. SFAS No. 144 establishes six criteria that must be met

before a long-lived asset may be classified as “held for sale.”

Assets that meet those criteria are no longer depreciated and are

measured at the lower of carrying amount at the date the asset

initially is classified as held for sale or its fair value less costs to sell.

See Note 2 for discussion of the presentation of Eckerd net assets

as held for sale and the adjustment recorded as of year-end 2003

to reduce the Company’s investment in Eckerd to the fair value

less costs to sell.

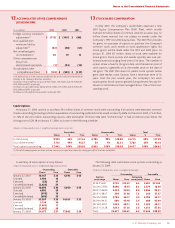

Based on management’s ongoing review of the performance of

its portfolio of stores and other facilities, impairment losses total-

ing $26 million, $47 million and $42 million in 2003, 2002 and

2001, respectively, were recorded for underperforming depart-

ment stores and underutilized Catalog and other facilities. These

charges are reflected in Real Estate and Other (Income)/Expense,

which is a component of Income from Continuing Operations in

the accompanying Consolidated Statements of Operations. See

further discussion in Note 16.

Exit or Disposal Activity Costs

Beginning in the third quarter of 2002, when the Company

adopted SFAS No. 146, “Accounting for Costs Associated with

Exit or Disposal Activities,” costs associated with exit or disposal

activities are recorded at their fair values when a liability has been

incurred. A liability is recorded upon termination of a contract

or when the rights under the contract are no longer being used.

Since the Company has an established program for termination

benefits upon the closing of a facility, termination benefits are

generally considered part of an ongoing benefit arrangement, and

accounted for under SFAS No. 112, “Employers’ Accounting for

Postemployment Benefits,” and recorded when payment of the

benefits is considered probable and reasonably estimable. Under

prior accounting guidance, certain exit costs were accrued upon

management’s commitment to an exit plan, which is generally

before an actual liability has been incurred.

Foreign Currency Translation

Financial statements of subsidiaries outside the U.S. are meas-

ured using the local currency as the functional currency. Assets

and liabilities for these subsidiaries are translated into U.S. dollars

at the exchange rates in effect at the balance sheet date, while

revenues and expenses are translated using average currency

rates during the reporting period. Adjustments from such trans-

lations are accumulated in the equity section of the Consolidated

Balance Sheets under Accumulated Other Comprehensive (Loss).

Effect of New Accounting Standards

In January 2003, the FASB issued Interpretation No. 46 (FIN 46),

“Consolidation of Variable Interest Entities,” which establishes cri-

teria to identify variable interest entities (VIE) and the primary

beneficiary of such entities. An entity that qualifies as a VIE must

be consolidated by its primary beneficiary. All other holders of

interests in a VIE must disclose the nature, purpose, size and