JCPenney 2003 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 37

Notes to the Consolidated Financial Statements

pay considered in the calculation of benefits. The Supplemental

Retirement Plan also offers participants who leave the Company

between ages 60 and 62 benefits equal to the estimated social

security benefits payable at age 62. Participation in this plan is

limited to associates who were profit-sharing management asso-

ciates at the end of 1995. The Voluntary Early Retirement

Program was offered in 1997 to management associates who

were at least age 55 with a minimum of 10 years of service and

who elected to take early retirement. These plans were amended

in December 2003 to provide participants a one-time irrevocable

election to receive remaining unpaid benefits over a five-year

period in equal annual installments. The Company is in the

process of implementing this change, which may increase the

Company’s annual cash obligations in 2004 depending on partic-

ipant elections. Several other smaller plans and agreements are

also included.

Expense for Defined Benefit Retirement Plans —Expense is

based upon the annual service cost of benefits (the actuarial cost

of benefits attributed to a period) and the interest cost on plan

liabilities, less the expected return on plan assets for the primary

pension plan. Differences in actual experience in relation to

assumptions are not recognized immediately, but are deferred

and amortized over the average remaining service period. The

components of net periodic pension expense were as follows:

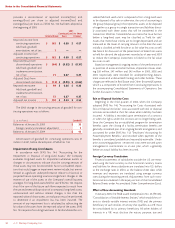

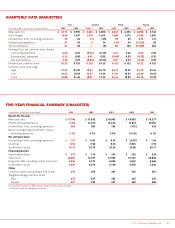

Primary Pension Plan Expense/(Income)

($ in millions) 2003 2002 2001

Service costs $75$71$83

Interest costs 195 187 183

Projected return on assets (249) (274) (337)

Net amortization 109 40 6

Curtailment gain ——11

Net periodic pension

plan expense/(income) $130 $24$ (76)

Supplemental Plans Expense

($ in millions) 2003 2002 2001

Service costs $3$2$3

Interest costs 23 19 21

Net amortization 896

Net supplemental

plans expense $34$30$30

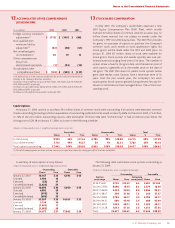

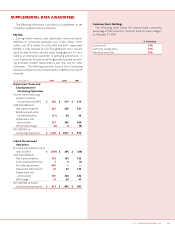

Assumptions – The weighted average actuarial assumptions used

to determine expense for 2003, 2002 and 2001 were as follows:

2003 2002 2001

Discount rate 7.10% 7.25% 7.75%

Expected return on

plan assets 8.9% 9.5% 9.5%

Salary increase 4.0% 4.0% 4.0%

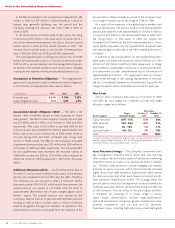

The discount rate used to measure pension expense each year

is the rate as of the beginning of the year (i.e., the prior measure-

ment date). The discount rate is based on a portfolio of high qual-

ity corporate bonds with similar average cash flow durations to

the pension liability. The rate as of the end of 2003, which will be

used to measure 2004 pension expense, was reduced to 6.35%. The

expected return on plan assets is based on the plan’s long-term

asset allocation policy, historical returns for plan assets and overall

capital markets, taking into account current and expected market

conditions. The actual one-year return on pension plan assets was

approximately 19.5% in 2003, compared to a 6.7% loss in 2002.

Given lower asset returns over the past few years and lower

expected future returns, the Company lowered the expected rate

of return on plan assets from 9.5% to 8.9% as of October 31, 2002,

which was used to develop the pension expense for 2003. The

combination of assumption changes and poor investment returns

in 2002 and 2001 resulted in an increase in 2003 pension expense

of $106 million. The Company used 9.5% to develop the 2002

pension expense, which was the expected rate of return as of

October 31, 2001.

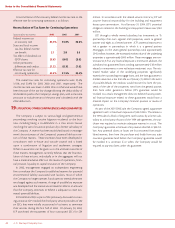

Funded Status – The table below provides a reconciliation of

benefit obligations, plan assets and the funded status of the

defined benefit pension and supplemental retirement plans. The

projected benefit obligation (PBO) is the present value of bene-

fits earned to date by plan participants, including the effect of

assumed future salary increases. Assets used in calculating the

funded status are measured at the fair value at October 31 (the

plan’s measurement date).

Assets and Obligations

Pension Plans Supplemental Plans

($ in millions) 2003 2002 2003 2002

Change in PBO

Beginning of year $2,839 $2,672 $339 $305

Service and

interest costs 270 258 26 21

Actuarial loss 379 89 67 40

Benefits (paid)(1) (186) (180) (27) (27)

End of year $3,302 $2,839 $405 $339

Change in fair

value of plan

assets

Beginning of year $2,886 $2,977 $—$—

Company

contributions 300 300 27 27

Actual return

on assets 523 (211) ——

Benefits (paid)(1) (186) (180) (27) (27)

End of year $3,523 $2,886 $—$—

Funded status

of plan

Excess of fair value

over projected

benefits $221 $47$(405) $(339)

Unrecognized

losses and prior

service cost 1,099 1,103 177 116

Prepaid pension

cost/(accrued

liability) $1,320 $1,150 $(228) $(223)

(1) Does not include plan administrative expenses.