JCPenney 2003 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 21

COMPANY STATEMENT ON FINANCIAL INFORMATION

The Company is responsible for the integrity and objectivity of the

consolidated financial statements and other information contained

in this Annual Report. The consolidated financial statements have

been prepared in accordance with accounting principles generally

accepted in the United States of America and present fairly, in all

material respects, the Company’s results of operations, financial posi-

tion and cash flows. Certain amounts included in the consolidated

financial statements are estimated based on currently available infor-

mation and judgment as to the outcome of future conditions and

circumstances. Financial information contained elsewhere in this

Annual Report is consistent with that included in the consolidated

financial statements.

The Company has established and maintains a system of internal

accounting controls that provides reasonable assurance as to the

integrity of the financial statements, the protection of assets from

unauthorized use or disposition, and the prevention and detection of

fraudulent financial reporting. The internal accounting control sys-

tem includes careful selection and development of employees,

appropriate division of duties, and written accounting and operating

policies and procedures. The system is enhanced by periodic reviews

by the Company’s internal auditors and independent auditors, and a

written Code of Ethics adopted by the Company’s Board of

Directors, applicable to and communicated to all management

employees of the Company. The system is continually reviewed,

evaluated and where appropriate, modified to accommodate cur-

rent conditions. In addition, the Company has an internal Disclosure

and Controls Review Committee, comprised of management from

each functional area within the Company, which performs a separate

review of the Company’s disclosure controls.

KPMG LLP, independent auditors, are appointed by the Audit

Committee of the Company’s Board of Directors and ratified by the

Company’s stockholders. They were engaged to render an opinion

regarding the fair presentation of the Company’s consolidated finan-

cial statements. Their audit, the report upon which appears below,

was conducted in accordance with auditing standards generally

accepted in the United States of America, and included a review of

the system of internal accounting controls to the extent they consid-

ered necessary to determine the audit procedures required to sup-

port their opinion.

The Audit Committee of the Board of Directors is composed sole-

ly of directors who are not officers or employees of the Company.

The Committee meets periodically with the independent auditors,

internal auditors and financial officers of the Company to review the

quality of the financial reporting of the Company, the internal

accounting controls and the scope and results of audits. In addition,

the Committee is responsible for the appointment, compensation,

retention and oversight of the Company’s independent auditors.

Both the internal auditors and the independent auditors have free

access to the Audit Committee without management present.

Robert B. Cavanaugh

Executive Vice President and Chief Financial Officer

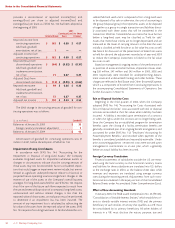

INDEPENDENT AUDITORS’ REPORT

To the Sto ckholders and Board of Directors of

J. C. Penney Company, Inc.:

We have audited the accompanying consolidated balance

sheets of J. C. Penney Company, Inc. and Subsidiaries as of

January 31, 2004 and January 25, 2003, and the related consoli-

dated statements of operations, stockholders’ equity and cash

flows for each of the years in the three-year period ended

January 31, 2004. These consolidated financial statements are

the responsibility of the Company’s management. Our responsi-

bility is to express an opinion on these consolidated financial

statements based on our audits.

We conducted our audits in accordance with auditing stan-

dards generally accepted in the United States of America. Those

standards require that we plan and perform the audit to obtain

reasonable assurance about whether the financial statements

are free of material misstatement. An audit includes examining,

on a test basis, evidence supporting the amounts and disclo-

sures in the financial statements. An audit also includes assess-

ing the accounting principles used and significant estimates

made by management, as well as evaluating the overall financial

statement presentation. We believe that our audits provide a

reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred

to above present fairly, in all material respects, the financial posi-

tion of J. C. Penney Company, Inc. and Subsidiaries as of January

31, 2004 and January 25, 2003, and the results of their operations

and their cash flows for each of the years in the three-year peri-

od ended January 31, 2004, in conformity with accounting prin-

ciples generally accepted in the United States of America.

As discussed in Note 1 of the Notes to the Consolidated

Financial Statements, the Company changed its method of

determining inflation/deflation rates used in the valuation of

LIFO inventories in fiscal year 2002, and the Company adopted

the provisions of the Financial Accounting Standards Board’s

Statement of Financial Accounting Standards No. 142, “Goodwill

and Other Intangible Assets,” in fiscal year 2002.

Dallas, Texas

February 26, 2004