JCPenney 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc.14

Management’s Discussion and Analysis of Financial Condition and Results of Operations

increase in cash investments in 2003 was comprised principally of

$379 million of positive free cash flow from continuing opera-

tions (see table below) and $157 million of net additions to long-

term debt. These cash balances support the Company’s liquidity

needs during its turnaround, at a time when the Company has

limited access to the capital markets due to its credit ratings.

Credit Ratings

As of March 16, 2004, ratings were as follows:

Senior Long-term

Implied Debt

Moody’s Investors Service, Inc. Ba2 Ba3

Standard & Poor’s Ratings Services BB+ BB+

Fitch Ratings N/A BB

The Company has maintained Moody’s Investors Service’s

highest liquidity rating (SGL-1) as a result of its strong liquidity

position.

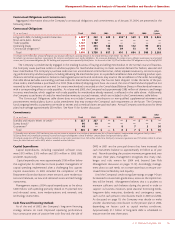

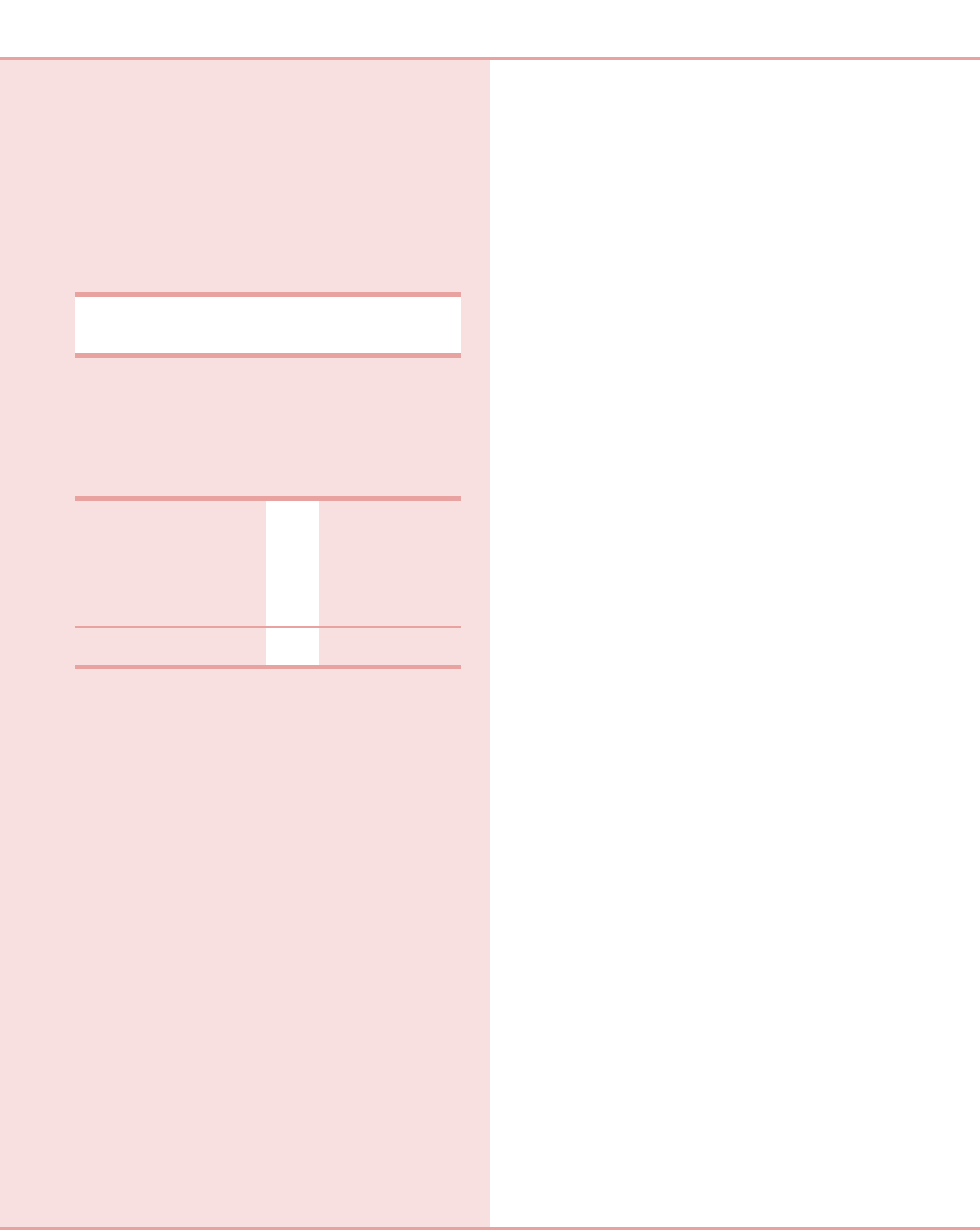

Free Cash Flow from Continuing Operations

($ in millions) 2003 2002 2001

Net cash provided by

operating activities $812(1) $522(1) $440

Less:

Capital expenditures (373) (315) (315)

Dividends paid (160) (161) (161)

Plus:

Proceeds from sale of assets 100 38 61

Free cash flow from

continuing operations(2) $379 $84$25

(1) Includes $300 million discretionary cash pension contributions in both 2003 and 2002.

(2) Free cash flow from discontinued operations was $(48) million, $464 million and $189

million in 2003, 2002 and 2001, respectively.

Free cash flow is an important financial measure, which is widely

focused upon by investors. Although it is not a GAAP measure, it is

derived from components of the GAAP cash flow statement.

Positive free cash flow generated by a company indicates the amount

of cash available for reinvestment in the business, or cash that can be

returned to investors through increased dividends, stock repurchase

programs, debt retirements, or a combination of these. Conversely,

negative free cash flow indicates the amount of cash that must be

raised from investors through new debt or equity issues, reduction in

available cash balances, or a combination of these.

Free cash flow in 2003, including a $300 million discretionary

($190 million after tax) cash contribution to the Company’s pen-

sion plan, exceeded plan for the year and represented the fourth

consecutive year of positive free cash flow. Cash flow benefited

from improved operating results, prudent management of capital

expenditures after a challenging first quarter, and accounts payable

and accrued expense benefits associated with this year’s 53rd week.

Financing Transactions

During 2003, the Company retired $442 million of long-term

debt, principally debt issues that matured during 2003, and on

February 28, 2003, the Company issued $600 million principal

amount of unsecured 8.0% Notes Due 2010 at an effective rate of

8.125%.

Included in the 2003 retirements above are approximately $117

million of the $119 million 6.9% Debentures Due 2026 that were

put to the Company and retired in August.

During 2002, approximately $920 million of long-term debt

matured and was paid.

During 2002, the Company completed two transactions that

were part of its long-term financing strategy. In May 2002, the

Company executed a three-year $1.5 billion revolving credit agree-

ment (credit facility). Indebtedness incurred under the credit facil-

ity is collateralized by all eligible domestic inventory, as defined in

the credit facility agreement. This credit facility provides the

Company with an additional source of liquidity for working capital

needs and letter of credit support. No borrowings have been

made under this credit facility, other than the issuance of import

and standby letters of credit, which totaled $227 million as of year-

end 2003. The Company was in compliance with all financial

covenants of the credit facility as of January 31, 2004. See further

discussion of these covenants below.

In August 2002, the Company completed a debt exchange in

which certain bondholders tendered approximately $227 million

principal amount of three existing debt issues in exchange for new

9.0% Notes Due 2012 with a principal amount of approximately

$230 million. Bondholders exchanged $79 million principal

amount of the Company’s 6.125% Notes Due 2003, $67 million

principal amount of its 7.375% Notes Due 2004 and $81 million

principal amount of its 6.9% Debentures Due 2026. This transac-

tion effectively extended the maturity on amounts represented by

the exchanged notes and strengthened the Company’s liquidity.

During 2001, $250 million principal amount of notes matured

and was paid. The Company issued $650 million of 5% convertible

subordinated notes in a private placement in October 2001.

Debt Covenants and Other

Under the credit facility discussed above, the Company must

maintain an asset coverage ratio, defined as eligible inventory to

total revolving credit exposure, of at least 1.75 to 1.0. Given that

there were no borrowings other than the issuance of letters of cred-

it, this ratio was 14.1 to 1.0 at year-end 2003, far exceeding the

requirement.

Additionally, the credit facility includes a financial performance

covenant, which consists of a maximum ratio of total debt to con-

solidated EBITDA (leverage ratio, as defined in the credit agreement,

which includes Eckerd) as measured on a trailing four-quarters basis,

calculated at each quarter end. As of year-end 2003, the actual lever-

age ratio was 3.31 to 1.0, well within the prescribed limit of 4.25 to 1.0.

The Company has indentures covering approximately $755 mil-

lion of long-term debt that contain a financial covenant requiring

the Company to have a minimum of 200% net tangible assets to

senior funded indebtedness (as defined in the indenture, which

includes Eckerd). These indentures permit the Company to issue

additional long-term debt if it is in compliance with the covenant.

At year-end 2003, the Company’s percent of net tangible assets to

senior funded indebtedness was 245%.

The Company’s liquidity is enhanced by the fact that the current

debt portfolio and material lease agreements do not contain any

provisions that could trigger early payments, acceleration or collat-

eral support in the event of adverse changes in the Company’s

financial condition.

The 7.4% Debentures Due 2037, with a principal amount of $400

million, contain put options that allow the investor to elect to have

the debenture redeemed at par on April 1, 2005. For planning pur-

poses, the Company assumes these holders will exercise the put

option. Accordingly, these debentures are included as 2005 matu-

rities in the Contractual Obligations table and related discussion

on page 15.