JCPenney 2003 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc.6

MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with a

discussion of Eckerd, Mexico department stores and Direct

Marketing Services discontinued operations beginning on page

10, an explanation of the Company’s critical accounting policies

beginning on page 7, the accompanying consolidated financial

statements and notes thereto beginning on page 22, along with

the unaudited Five-Year Financial Summary on page 43.

CORPORATE GOVERNANCE AND FINANCIAL REPORTING

Corporate governance and financial reporting have received

considerable attention over the past several years. Because of

JCPenney’s strong heritage in this area, many of the requirements

of new regulations enacted in 2003 and 2002 were already main-

stays of the way the Company does business. Moreover, man-

agement has enhanced the Company’s well-established pro-

grams and policies to ensure continued compliance with the

highest levels of corporate governance. For example, manage-

ment developed a reporting matrix that requires written certifi-

cations from a cross-discipline team of key members of manage-

ment who have the greatest responsibility for verifying and

reporting corporate results.

The Company also has a long history of integrity in financial

reporting and remains committed to increasing the transparency

to provide shareholders with a balanced view of the Company’s

financial position and operating results. Significant enhance-

ments were made and additional pages were included in last

year’s Annual Report, with additional disclosures in the areas of

strategic initiatives and financial goals, pension accounting and

funding, stock option accounting, and forward-looking informa-

tion related to operating results, cash flow and financing. This

2003 Annual Report continues the trend with the addition of an

executive overview, discussion of corporate governance prac-

tices, risk management processes and additional pension

disclosures. Management believes that the Company has made

further progress toward the overall goal of transparency and

informative financial disclosures and reporting.

EXECUTIVE OVERVIEW

2003 Accomplishments

Increased comparable store sales — Comparable depart-

ment store sales increased 0.9% in 2003, representing the third

consecutive year of improvement.

Achieved Catalog/Internet sales growth — Catalog/Internet

sales increased 3.3% in 2003 after two years of significant sales

declines. Internet sales continue to experience strong growth,

increasing by 50.8% in 2003.

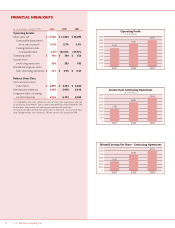

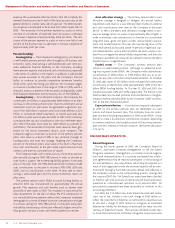

Operating Results from Continuing Operations

($ in millions, except EPS) 2003 2002 2001

Gross margin $6,620 $6,334 $ 6,082

SG&A expenses 5,830 5,634 5,529

Operating profit(1) 790 700 553

Net interest expense 261 226 231

Real estate and

other (income)/expense (17) 59 48

Income from continuing

operations before income taxes 546 415 274

Income tax expense 182 130 92

Income from

continuing operations $364 $285 $ 182

Diluted earnings per share

from continuing operations $1.21 $0.95 $ 0.57

Comparable department

store sales(2) increase 0.9% 2.7% 3.4%

Catalog/Internet sales

increase/(decrease) 3.3%(3) (22.0)% (19.7)%

(1) Management evaluates the performance of the Company’s Department Stores,

Catalog and Internet based on revenues and expenses that are considered to be part

of normal ongoing operations. Accordingly, excluded from management’s assessment

are items such as real estate activities, gains and losses on the sale of real estate prop-

erties, and asset impairments and other charges associated with closing Store and

Catalog facilities. Such items are recorded in Real Estate and Other in the Consolidated

Statements of Operations.

(2) Comparable store sales include the sales of stores after having been open for 12

consecutive fiscal months. Stores become comparable on the first day of the 13th

fiscal month. Comparable store sales are presented on a 52-week basis. In 2003,

the 53rd week accounted for department store sales of $158 million.

(3) Includes the effect of $46 million of sales for the 53rd week of 2003. On a 52-week

basis, total Catalog/Internet sales increased 1.5% and Internet sales increased 47.8%.

Improved profitability — Operating profit for 2003 increased

13% compared to 2002, primarily as a result of gross margin

improvements from better execution in a centralized environ-

ment. Diluted earnings per share (EPS) from continuing opera-

tions of $1.21 for 2003 improved 27% compared to 2002.

Generated positive free cash flow — The Company generated

$379 million of free cash flow from continuing operations in 2003.

Free cash flow from continuing operations is defined as cash pro-

vided by operating activities less dividends and capital expendi-

tures, net of proceeds from the sale of assets.

While free cash flow is a non-GAAP financial measure, manage-

ment believes it is important in evaluating the Company’s financial

performance and measuring the ability to generate cash without

incurring additional external financing. Free cash flow should be

considered in addition to, rather than as a substitute for, cash pro-

vided by operating activities. The following table reconciles cash

provided by operating activities (GAAP) to free cash flow from

continuing operations (non-GAAP measure):

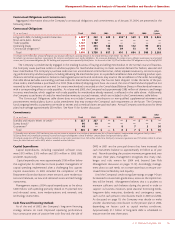

Free Cash Flow from Continuing Operations

($ in millions) 2003 2002 2001

Net cash provided by

operating activities (GAAP) $812(1) $522(1) $440

Less:

Capital expenditures (373) (315) (315)

Dividends paid (160) (161) (161)

Plus:

Proceeds from sale of assets 100 38 61

Free cash flow from

continuing operations(2) $379 $84$25

(1) Includes $300 million discretionary cash pension contributions in both 2003 and 2002.

(2) Free cash flow from discontinued operations was $(48) million, $464 million and

$189 million in 2003, 2002 and 2001, respectively.