JCPenney 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc.12

Management’s Discussion and Analysis of Financial Condition and Results of Operations

value pricing and certain marketing events, including free ship-

ping. Sales reflected less reliance on Big Books and a focus on tar-

geted specialty books and Internet. Total Internet sales, which

are an integral part of the Company’s three-channel retailing

strategy, continued to increase. Internet sales were $617 million,

$409 million and $349 million in 2003, 2002 and 2001, respective-

ly. In 2002, Catalog/Internet was impacted by planned lower

page counts, lower circulation of catalogs, changes to payment

policies and fewer outlet stores.

Gross Margin

($ in millions) 2003 2002 2001

FIFO gross margin $6,614 $6,340 $ 6,073

LIFO credit/(charge) 6(6) 9

LIFO gross margin $6,620 $6,334 $ 6,082

As a percent of sales 37.2% 35.9% 33.6%

Gross margin improved for the third consecutive year and was

$6,620 million compared to $6,334 million in 2002 and $6,082

million in 2001. As a percent of sales, gross margin improved 130

basis points over last year and represents a 540 basis-point

increase over the past three years. Improvement reflects better

execution and continuing benefits from the centralized mer-

chandising model, which was initially rolled out in 2000, with

most components of the model substantially complete by the

end of 2003. Benefits of the centralized model have included

better merchandise offerings, a more integrated marketing plan,

more leverage in the buying and merchandising process and

more efficient selection and allocation of merchandise to indi-

vidual department stores. Inventory management, specifically

lower levels of Catalog/Internet liquidation merchandise, also

contributed to the improvement in 2002 over 2001.

Selling, General and Administrative (SG&A) Expenses

($ in millions) 2003 2002 2001

SG&A expenses $5,830 $5,634 $ 5,529

As a percent of sales 32.8% 32.0% 30.5%

SG&A expenses have increased over the past two years due

primarily to higher planned advertising, transition costs for the

new store support center (SSC) distribution network and higher

non-cash pension expense. The new SSC network for depart-

ment stores is a key component of the Company’s centralization

initiative. The Company began rolling out the SSCs in 2002, with

10 SSCs in operation by the end of 2002. The additional three

planned SSCs were in operation by mid-2003. The transition to

SSCs was consistent with the Company’s plan in both timing and

costs. As this new distribution process matures, the Company

expects to attain benefits through operational efficiencies and

the improved flow of merchandise. In 2002, expenses totaling

$17 million were recorded primarily for the severance for employ-

ees impacted by the transition to SSCs and Catalog/Internet dis-

tribution facilities that closed in 2003.

Also included in SG&A expense in 2003 is a $21 million charge

for costs related to the implementation of the first phase of the

Company’s previously announced cost savings initiative. See

Cost Savings Initiative below.

The Company recorded discretionary contributions to its

employee 401(k) savings plan of $19 million, $20 million and $48

million for 2003, 2002 and 2001, respectively, to reflect a match at

more competitive levels. The additional 2003 contribution, along

with the standard match, was made in cash in early 2004.

Partially offsetting these increased expenses were savings in

store labor costs, principally from the conversion to centralized

checkouts in the stores, progress toward the elimination of in-

store receiving, Catalog/Internet expense management and cen-

tralized store expense management. In 2002, SG&A expenses

were reduced by approximately $27 million from reductions in

Company contributions toward retiree medical costs. These sav-

ings continued in 2003 and annualized savings are expected to

continue at the same level.

Cost Savings Initiative

The Company has begun the first steps of a previously disclosed

cost savings initiative. When fully implemented, this initiative is

expected to reduce expenses by at least $200 million annually. The

first steps of the initiative include the following:

•Catalog Telemarketing Center: The Company will close its

Austin, Texas, telemarketing center in the second quarter of

2004 and reallocate the call volume to its remaining tele-

marketing centers. Approximately 450 positions will be

eliminated.

•SSC Network: The Company will assume the management

responsibility for the six SSCs that were initially out-

sourced to third parties.

•Corporate Organization: Certain functions in support areas

will be centralized, and resources devoted to certain activi-

ties will be eliminated.

•Marketing: The Company will be refining its marketing

investment by eliminating less productive expenditures and

reducing overall production costs. Some of the savings will

be reinvested in media that supports sales growth.

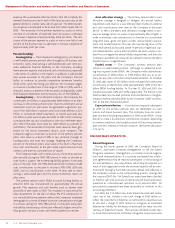

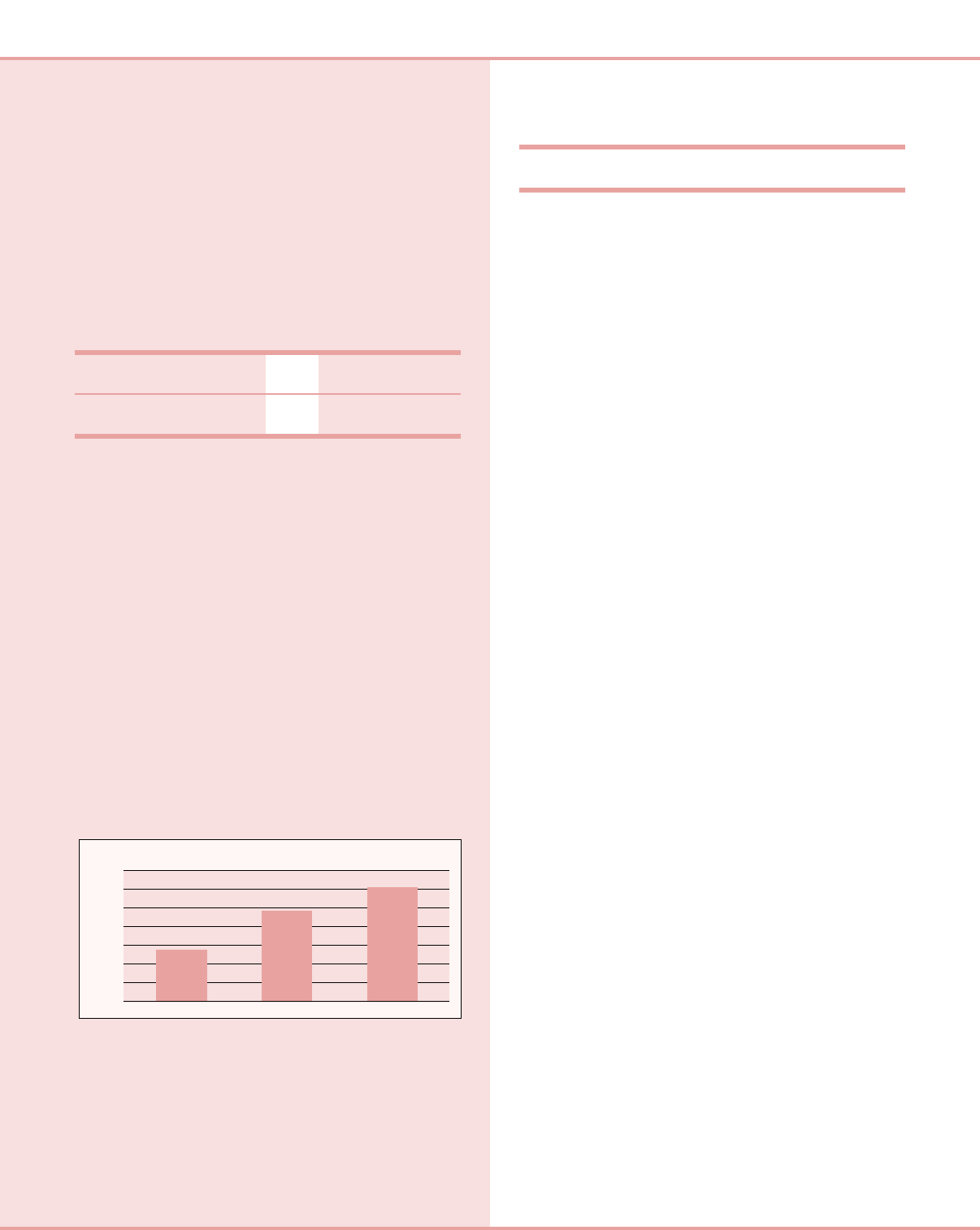

Gross Margin % of Sales

38.0%

37.0%

36.0%

35.0%

34.0%

33.0%

32.0%

31.0%

33.6%

35.9%

37.2%

2001 2002 2003