JCPenney 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 31

Notes to the Consolidated Financial Statements

activity of the VIE as well as their maximum exposure to losses as

a result of involvement with the VIE. FIN 46 was revised in

December 2003 and is effective for financial statements of public

entities that have special-purpose entities, as defined, for periods

ending after December 15, 2003. For public entities without

special-purpose entities, it is effective for financial statements for

periods ending after March 15, 2004. The Company does not

have any special-purpose entities, as defined (other than an enti-

ty within its discontinued operations that was established for the

purpose of selling securitized receivables and is fully described in

the 2002 Annual Report), and is currently evaluating the provi-

sions of this statement. The Company does not expect FIN 46 to

have a material effect on its financial statements.

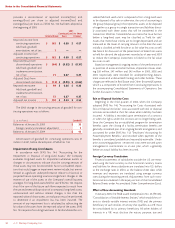

2DISCONTINUED OPERATIONS

Eckerd Drugstores

During the fourth quarter of fiscal 2003, the Company’s Board of

Directors authorized Company management to sell the Eckerd

Drugstore operation. Management is currently in active negotia-

tions with interested parties. Having met the criteria of SFAS No.

144, Eckerd’s net assets have been classified as "held for sale" and

their results of operations and financial position presented as a dis-

continued operation as of year-end 2003. All prior periods

presented have been reclassified to conform to this accounting

treatment.

For fiscal 2003, the $1,275 million loss from Eckerd discontin-

ued operations, net of tax, includes a non-cash charge of $450

million to reflect the investment in Eckerd at its estimated fair

value less costs to sell and a charge of $875 million to recognize

an estimated deferred tax liability for the excess of estimated fair

value over the tax basis of Eckerd’s net assets. The tax basis of

Eckerd is lower than its book basis because the Company’s drug-

store acquisitions were largely tax-free transactions. See further

discussion of management’s evaluation of potential goodwill

impairment under SFAS No. 142 in Note 1.

The fiscal 2003 loss from discontinued operations excludes

the future operating results and any future gains or losses result-

ing from the pending sale of Eckerd. The final financial impact

of the pending sale of Eckerd is dependent upon the results of

the final negotiations with the ultimate buyer(s).

Mexico Department Stores

Effective November 30, 2003, the Company closed on the sale

of its six Mexico department stores to Grupo Sanborns S.A. de

C.V. of Mexico City. The stock sale transaction, which included

the Mexico holding company and operating companies com-

prising JCPenney’s Mexico department store operation, resulted

in a loss of $14 million, net of a $27 million tax benefit. The loss

was principally related to currency translation losses of $25 mil-

lion accumulated since operations began in 1995 that were pre-

viously reflected as reductions to stockholders’ equity.

Additional components of the loss include potential liability on

certain store leases, inventory shrinkage and transaction costs.

Direct Marketing Services

In 2001, the Company closed on the sale of its J. C. Penney

Direct Marketing Services, Inc. (DMS) assets, including its

J. C. Penney Life Insurance subsidiaries and related businesses, to a

U.S. subsidiary of AEGON, N.V. DMS was reflected as a discon-

tinued operation in the 2000 Annual Report, with an estimated

net loss of $296 million on a planned sale. In 2001, the transaction

closed earlier than anticipated, resulting in an additional loss of

$16 million. In 2002, tax regulation changes enabled the Company

to take additional capital loss deductions, resulting in a $34 mil-

lion gain on the sale of discontinued operations for the year. In

2003, the tax liability was reduced by $4 million because of a tax

audit.

The Company’s financial statements have been presented to

reflect Eckerd, Mexico and DMS as discontinued operations for all

periods presented. Results of the discontinued operations are

summarized below:

Discontinued Operations

($ in millions) 2003 2002 2001

Eckerd

Net sales $15,137 $14,643 $ 13,847

Gross margin 3,487 3,419 3,113

Selling, general and

administrative expenses (3,196) (3,007) (2,905)

Interest expense(1) (163) (161) (153)

Acquisition amortization (40) (42) (120)

Other (7) (5) 1

Fair value adjustment (450) ——

(Loss)/income before

income taxes (369) 204 (64)

Income tax expense 906(2) 75 1

Eckerd (loss)/income

from operations (1,275) 129 (65)

Mexico (loss) from operations,

net of income tax expense/

(benefit) of $1, $8 and $(4)(3) (7) (43) (3)

(Loss) on sale of Mexico, net of

income tax (benefit) of $(27) (14) ——

Gain/(loss) on sale of DMS,

net of income tax (benefit)

of $(4), $(34) and $(6) 434 (16)

Tot al discontinued operations $(1,292) $120 $ (84)

(1) Eckerd interest expense consists primarily of interest on the intercompany loan

between Eckerd and JCPenney. The loan balance was initially based on the alloca-

tion of JCPenney debt to the Eckerd business to reflect a competitive capital structure

within the drugstore industry. Since inception, the loan balance has fluctuated based

on Eckerd cash flow requirements. The loan balance, together with accrued interest

and other intercompany payables, was $1,212 million, $1,151 million and $1,597 mil-

lion at the end of 2003, 2002 and 2001, respectively. The loan bears interest at

JCPenney’s weighted average interest rate on its net debt (long-term debt net of short-

term investments) calculated on a monthly basis. The weighted average interest rate

was 13.76% for 2003, 12.05% for 2002 and 9.05% for 2001.

(2) Includes $875 million of deferred income tax expense for the book/tax basis difference.

(3) Components of Mexico operations are not presented due to immateriality.