JCPenney 2003 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 9

Management’s Discussion and Analysis of Financial Condition and Results of Operations

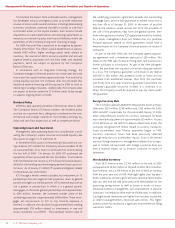

outcome of tax audits to have a material adverse effect on the

Company’s financial condition, results of operations or cash flow.

Many years of data have been incorporated into the determination

of tax reserves and the Company’s estimates have been reasonable.

The Company is involved in legal proceedings and governmen-

tal inquiries associated with employment and other matters. A

reserve has been established based on management’s best esti-

mates of the Company’s potential liability in these matters. This

estimate has been developed in consultation with in-house and

outside counsel and is based upon a combination of litigation and

settlement strategies. Management does not believe that these

proceedings and inquiries, either individually or in the aggregate,

will have a material adverse effect on the Company’s consolidated

financial position or results of operations. See further discussion in

Note 19.

Reserves for potential environmental liabilities related to facili-

ties, most of which the Company no longer operates, are adjusted

based on the Company’s experience, as well as consultation with

independent engineering firms and in-house legal counsel, as

appropriate. The reserve was increased in 2002 to an amount that

the Company continues to believe is adequate to cover estimated

potential liabilities.

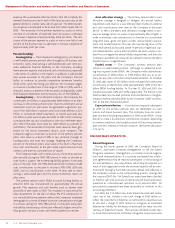

Pension:

Pension accounting — The Company sponsors a non-contrib-

utory qualified defined benefit pension plan (the primary pension

plan), supplemental retirement plans for certain management and

key associates and other postretirement benefit plans. Refer to

Note 15 for further discussion of these plans. Major assumptions

used in accounting for these plans include the expected long-term

rate of return on plan assets and the discount rate. Assumptions

are determined based on Company information and market indi-

cators, and are evaluated at each annual measurement date

(October 31). A change in any of these assumptions would have

an effect on the Company’s pension and other postretirement

benefit plan costs. These assumptions require significant judg-

ment, and the calculation of pension costs is relatively complex.

The Company utilizes third parties, including actuarial and invest-

ment advisory firms, to help evaluate annually the appropriateness

of the expected rate of return, the discount rate and other pension

plan assumptions. The following discussion relates to the primary

pension plan only, as it makes up the majority of recorded pension

expense and related asset/liability amounts in the consolidated

financial statements.

Market-related value of plan assets — In accounting for pen-

sion costs, the Company uses fair value, which is the market value

of plan assets as of the annual measurement date, to calculate the

expected return on assets and gain/loss amortization components

of net periodic pension expense. If the Company were to use a cal-

culated value, such as a three- or five-year moving average, to

determine the market-related value of plan assets and recognize

variances from expected results on a delayed basis, the amount of

pension expense or income recognized could vary significantly

from that recorded under the Company’s current methodology.

This would have been especially true in 2003 and 2002, given the

significant decline in the global equity markets. The fair value

approach, which is the Financial Accounting Standards Board’s

(FASB’s) preferred methodology, required the Company to reflect

this decline in the fair value of the plan’s assets. The impact on

2003 and 2002 earnings is discussed below.

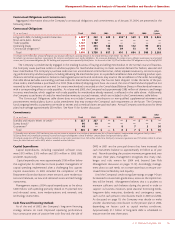

Return on plan assets — To develop its expected return on

plan assets, the Company considers its long-term asset allocation

policy, historical returns on plan assets and overall capital markets,

taking into account current and expected market conditions. The

Company’s primary pension plan is well diversified with an asset

allocation policy that provides for a 70%, 20% and 10% mix of equi-

ties (U.S., non-U.S. and private), fixed income (investment-grade

and high-yield) and real estate (private and public), respectively.

This allocation provides the pension plan with the appropriate bal-

ance of investment return and volatility risk, given the funded

nature of the plan, its present and future liability characteristics and

its long-term investment horizon. See further discussion of the

asset allocation strategy for plan assets in Note 15.

Since the inception of the Company’s primary pension plan in

1966 through the October 31, 2003 measurement date, the aver-

age annual return has been 9.3%. However, from 2000 to 2002, the

fair value of pension assets declined as a result of the poor per-

formance in the global equity markets. With the strong capital

market performance in 2003, the return on plan assets through

October 2003 was 19.5%, partially recovering the previous decline

in fair value. Because the fair value of plan assets is measured as of

a point in time, the change in fair value between measurement

dates affects the subsequent year’s net pension expense. The

decline in fair value from October 2000 to October 2002 of

approximately $700 million negatively impacted the net pension

expense trend from 2001 to 2003. In 2001, net periodic pension

income contributed $76 million to pre-tax earnings. In contrast,

pension expense of $24 million and $130 million was incurred in

2002 and 2003, respectively. Since inception, the Company’s pri-

mary pension plan has incurred cumulative pre-tax expense of

approximately $32 million. This is the result of cumulative pension

expense during the 1966-1984 period of $366 million, cumulative

pension income during the 1985-2001 period of $488 million, and

pension expense in 2002 and 2003 totaling $154 million. In 2002,

the Company lowered the expected rate of return from 9.5% to

8.9% to reflect lower historical and expected future rates of return

among all asset classes. See discussion of the impact on earnings

below.

Discount rate — The Company lowered the discount rate used

to measure the pension obligation from 7.10% to 6.35% in 2003,

and from 7.25% to 7.10% in 2002, based on the yield to maturity of

a representative portfolio of AA-rated corporate bonds as of the

October 31 measurement dates in 2003 and 2002, with average

cash flow durations similar to the pension liability. This methodol-

ogy is consistent with guidance in SFAS No. 87, “Employers’

Accounting for Pensions,” to use the rate currently available on

high quality bonds and the subsequent guidance issued by the

Securities and Exchange Commission that high quality bonds

should be those with at least AA rating by a recognized rating

agency.

Impact on earnings and sensitivity — As a result of asset per-

formance over the 2001 to 2002 timeframe, the Company incurred

a significant increase in net pension costs, which incrementally

reduced EPS by approximately $0.24 in 2003 and $0.20 in 2002.

While the improved returns on plan assets as well as the discre-

tionary contribution made in 2003 are expected to lower the 2004