JCPenney 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc.42

Notes to the Consolidated Financial Statements

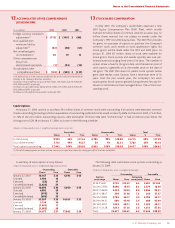

A reconciliation of the statutory federal income tax rate to the

effective rate for continuing operations is as follows:

Reconciliation of Tax Rates for Continuing Operations

(percent of pre-tax income) 2003 2002 2001

Federal income tax

at statutory rate 35.0% 35.0% 35.0%

State and local income

tax, less federal income

tax benefit 2.1 2.8 2.6

Tax effect of dividends on

ESOP shares (2.6) (6.0) (2.6)

Other permanent

differences and credits (1.3) (0.3) (1.6)

Effective tax rate for

continuing operations 33.2% 31.5% 33.4%

The overall tax rates for continuing operations were 33.2%,

31.5% and 33.4% for 2003, 2002 and 2001, respectively. The

income tax rate was lower in 2002 than it otherwise would have

been because of the tax law change allowing the deductibility of

all dividends paid to the Company’s savings plan, with a one-time

provision to include certain of the prior year’s dividends with the

2002 deduction.

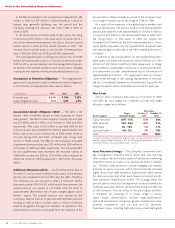

19 LITIGATION, OTHER CONTINGENCIES AND GUARANTEES

The Company is subject to various legal and governmental

proceedings involving routine litigation incidental to the busi-

ness, including being a co-defendant in a class action lawsuit

involving the sale of insurance products by a former subsidiary of

the Company. A reserve has been established based on manage-

ment’s best estimates of the Company’s potential liability in cer-

tain of these matters. These estimates have been developed in

consultation with in-house and outside counsel and is based

upon a combination of litigation and settlement strategies.

While no assurance can be given as to the ultimate outcome of

these matters, management currently believes that the final reso-

lution of these actions, individually or in the aggregate, will not

have a material adverse effect on the results of operations, finan-

cial position, liquidity or capital resources of the Company.

In 2002, management engaged an independent engineering

firm to evaluate the Company’s established reserves for potential

environmental liability associated with facilities, most of which

the Company no longer operates. Funds spent to remedy these sites

are charged against such reserves. A range of possible loss exposure

was developed and the reserve was increased in 2002 to an amount

that the Company continues to believe is adequate to cover esti-

mated potential liabilities.

In December 2003, as part of the previously discussed cost sav-

ings initiative, JCP notified the third-party service providers of the

six SSCs that were initially outsourced of its intent to terminate

their services during the first half of 2004. On January 30, 2004,

JCP purchased the equipment of four outsourced SSCs for $34

million. In accordance with the related service contracts, JCP will

assume financial responsibility for the building and equipment

leases upon termination. As of January 31, 2004, JCP’s potential

obligation related to the building and equipment leases was $120

million.

JCP, through a wholly owned subsidiary, has investments in 15

partnerships that own regional mall properties, seven as general

partner and eight as a limited partner. JCP’s potential exposure to

risk is greater in partnerships in which it is a general partner.

Mortgages on the seven general partnerships total approximately

$345 million; however, the estimated market value of the underlying

properties is approximately $600 million. These mortgages are non-

recourse to JCP, so any financial exposure is minimal. In addition, the

subsidiary has guaranteed loans totaling approximately $18 million

related to investments in one real estate investment trust. The esti-

mated market value of the underlying properties significantly

exceeds the outstanding mortgage loans, and the loan guarantee to

market value ratio is less than 6% as of January 31, 2004. In the event

of possible default, the creditors would recover first from the pro-

ceeds of the sale of the properties, next from the general partner,

then from other guarantors before JCP’s guarantee would be

invoked. As a result, management does not believe that any poten-

tial financial exposure related to these guarantees would have a

material impact on the Company’s financial position or results of

operations.

As part of the 2001 DMS sale, the Company signed a guarantee

agreement with a maximum exposure of $20 million. This relates to

the 1994 sale of a block of long-term care business by a former sub-

sidiary to a third party. As part of the 1994 sale agreement, the pur-

chaser was required to maintain adequate reserves in a trust. The

Company’s guarantee is the lesser of any reserve shortfall or $20 mil-

lion. Any potential claims or losses are first recovered from estab-

lished reserves, then from the purchaser and finally from any state

insurance guarantee fund before the Company’s guarantee would

be invoked. It is uncertain if, or when, the Company would be

required to pay any claims under this guarantee.