JCPenney 2003 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc. 5

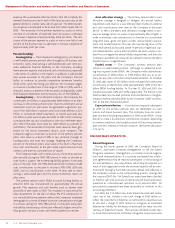

STRATEGIC PLAN

The Company’s strategic plan builds on the turnaround that

was begun three years ago. The Company continues to focus on

its five previously stated priorities, which are: to improve merchan-

dise assortments, invest in marketing, present an energized store

environment, achieve a competitive expense structure, and attract

and retain a qualified and experienced work force. The Company

is building on the JCPenney brand promise to deliver affordable

fashion and quality to the moderate customer. This strategic plan

is the result of completing extensive customer research and an in-

depth analysis of the Company and its competition.

The Company’s goals are both customer focused and financial-

ly oriented. One of the primary goals is to improve the perception

of JCPenney’s fashion, quality and value among its target customer

segments. The financial goals are to attain at least 2% annual com-

parable store sales growth and achieve a 6% to 8% operating

profit margin in fiscal 2005.

To re-est ablish and s o lidify the customer franchise, management

is focused on building clear reasons for the Company’s target cus-

tomers to choose JCPenney first, including:

•building on the Company’s leadership businesses, where

JCPenney has strong market share and powerful assort-

ments. These include Window, Bed and Bath, Men’s Clothing

and Furnishings, Special Sizes, Fine Jewelry and Intimate

Apparel;

• strengthening JCPenney’s Children’s business;

•becoming the moderate customer’s gift headquarters; and

•leveraging JCPenney’s strong private and exclusive brands.

To achieve the financial goals, the focus is on improving

execution and consistency in the centralized environment, increas-

ing the productivity of selling space, making continued gross

margin improvements and lowering the expense structure. These

initiatives include:

•implementing a store format for renewals and new stores

to execute more consistently and use space more effectively;

•allocating more space to the fastest growing and most impor-

tant merchandise categories;

•improving performance of stores identified as high poten-

tial with renewals and selectively increased inventory flow;

•developing an off-mall format to enter or expand the

Company’s presence in high potential markets (the first

three opened in late 2003 and eight are planned for 2004);

•continuing to realize the benefits of centralized buying

and allocation to improve sales and gross margin; and

•implementing the previously stated cost savings initiative

to reduce expenses by at least $200 million annually

(discussed further on page 12).

The Company is making investments in its Internet business,

which continues to experience strong growth, with over $600 mil-

lion in total sales in 2003. Internet generated sales increases of

50.8% (47.8% on a 52-week basis), 17.2% and 10% in 2003, 2002,

and 2001, respectively. In Catalog/Internet, the focus has been to

refine merchandise assortments and the quality and size of cata-

logs, introduce new and unique specialty catalogs and discontinue

unproductive catalog offerings, as well as streamlining the support

infrastructure. Management plans to improve cross-channel coor-

dination among Department Stores, Catalog and the Internet, by:

•putting Department Store pre-prints online;

•having more clear references to Catalog and Internet in the

store pre-prints;

•leveraging the Internet to extend the store assortments

through store signing and catalog references to extended

assortments online;

•growing the store referrals to Catalog and Internet; and

•better communicating the three-channel choice to target

customers.

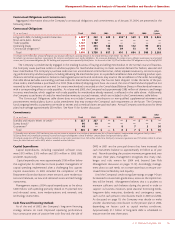

FINANCING STRATEGY

In 2001, management developed a financing strategy to

strengthen the Company’s liquidity position in order to provide

the time and resources necessary to implement its planned turn-

around. The execution of this strategy over the 2001-2003 period

has included more effective cash flow management, asset rational-

ization and monetization (i.e., selling non-strategic assets and

businesses) and opportunistic access to the capital markets. In

addition to financing the turnaround, the Company’s strategy has

provided the ability to fund near-term obligations such as season-

al working capital and debt maturities. Having a strong liquidity

position substantially mitigates the strategic business risk inherent

during the turnaround period.

The ultimate goal of achieving a competitive level of profitabili-

ty will enable the Company to generate a competitive level of cap-

ital resources for investment in its business on a sustainable basis.

Competitive operating profit margins are necessary to restore the

Company’s return on invested capital and return on stockholders’

equity to retail industry standards, and thereby enhance share-

holder value. In addition, management believes that it is important

to restore JCPenney’s credit ratings to investment-grade level and

thereby improve the Company’s access to the capital markets.

In 2004, capital expenditures are expected to be about $500 mil-

lion. In 2004 and beyond, additional capital is planned to be

allocated to new freestanding department stores, increased store

renewals and investments in technology. Additionally, the financ-

ing strategy considers debt maturities of $1.1 billion over the next

three years, as well as working capital needs and dividend pay-

ments. See discussion of financial condition, liquidity and capital

resources beginning on page 13.

As the Company proceeds with the divestiture of its drugstore

operations, management expects to use proceeds from such a

transaction to further strengthen the Company’s financial position

and capital structure. Through an appropriate mix of both com-

mon stock repurchases and debt retirements, management will

seek to deliver value to the Company’s shareholders and support

its long-term objective of improving the Company’s bond credit

ratings. Going forward, the Company will remain focused on

preserving both strong liquidity and financial flexibility as manage-

ment works to improve the performance of Department Stores

and Catalog/Internet. The ultimate use of proceeds will be subject

to approval by the Company’s Board of Directors. See further dis-

cussion of the transaction in Note 2 on page 31 and under Debt

Percent to Total Capital in MD&A on page 17.

STRATEGIC PLAN AND FINANCING STRATEGY