JCPenney 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc.18

Management’s Discussion and Analysis of Financial Condition and Results of Operations

controls and documentation to provide the assurance and

required reporting in fiscal 2004, when Section 404 becomes

effective.

Independent Support Functions — Internal Audit, Legal,

Controller’s/Finance and Treasurer’s support the Company’s risk

management function. They operate independently of the oper-

ating divisions of the Company. As an important component of

the Company’s control structure, the Internal Audit department

reports functionally to the Audit Committee of the Board of

Directors, and administratively to the Company’s General

Counsel. Internal Audit performs reviews and test work to ensure

that: (a) risks are appropriately identified and managed; (b) inter-

action with various internal governance groups, such as the legal

compliance team, occurs as needed; (c) significant financial, man-

agerial and operating information is reliable and timely; (d) asso-

ciates’ actions are in compliance with policies, standards,

procedures, and applicable laws and regulations; (e) resources are

acquired economically, used efficiently and adequately protected;

(f) quality and continuous improvement are fostered in the orga-

nization’s control process; and (g) significant legislative or regulato-

ry issues impacting the organization are recognized and addressed

appropriately. The legal compliance team is responsible for ensur-

ing that all areas of the Company have effective procedures in

place to comply with various laws and regulations and any changes

thereto.

Categories of Risk

Management defines risk as the potential deviation from

planned operating results that may have a negative impact on

investor enterprise value in the short or long term. The deviation

can arise from inadequate or ineffective internal processes or sys-

tems, external events or Company personnel. The Company’s key

risks and related risk mitigation/management practices are dis-

cussed below:

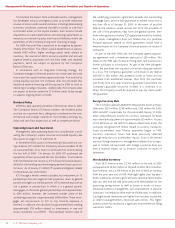

Business

•Strategic — The Company’s key business risk is the successful

execution of the five-year turnaround plan for Department

Stores and Catalog/Internet to achieve competitive levels of

profitability.

The Company has strategies and processes in place to

ensure that the turnaround is successful and progresses on tar-

get. The overriding goal is to re-establish and solidify the cus-

tomer franchise and strengthen customer confidence that

JCPenney consistently offers fashion-right, quality merchandise

at value prices. The primary initiatives for Department Stores

and Catalog/Internet are to improve the merchandise assort-

ments through more fashionable items with good quality and

value, support the offerings with compelling marketing pro-

grams, improve the visual appeal of the store environment and

catalogs, reduce the expense structure to more competitive

levels and focus on having the right people in the right jobs.

While results have been positive for the most recent three

years and indicate that the Company is on track in achieving

its financial targets, the turnaround is complex and the

Company will face continued challenges in the execution of

its strategic initiatives.

An important factor in the Company’s turnaround is the

ability of Department Stores to operate under a centralized

merchandising model. Certain information technology sys-

tems have been purchased (and others are in various stages of

development) to plan merchandise assortments, allocate

inventory and stock stores, better track sales trends to enable

prompt replenishment and manage pricing. To efficiently

handle inventory flow, the Company has completed the roll-

out of centralized logistics store support centers. The effec-

tiveness of these systems and processes is an important com-

ponent of the Company’s ability to have the right inventory

in the right place, at the right time and at the right price.

•Management — The Human Resources Committee ensures

that processes are in place to provide competitive compen-

sation packages, human resource development and training,

and management succession plans. As part of the strategy

to return the Company to competitive levels of profitability,

management has hired seasoned individuals, including

executive level and others with a breadth of experience in

merchandising, marketing, buying and allocation under a

centralized model, as well as to manage Catalog and Internet

operations.

Financial

•Financial Position and Liquidity — The Company’s strong

financial position and liquidity substantially mitigates the

strategic business risk inherent during the turnaround peri-

od. To support the Company’s previously stated turn-

around initiatives, in 2001 management developed a long-

term financing strategy to strengthen the Company’s liquid-

ity position. The primary goal of the Company’s strategy is

to ensure financial flexibility and access to capital over the

turnaround timeframe. This will allow adequate time to

restore the profitability of the Company to competitive

levels and to increase capital spending to fund

planned department store renewals, new freestanding

stores and relocations, and to make additional investments

in technology.

Achieving a competitive level of profitability will enable the

Company to generate a competitive level of capital resources

for investment in its businesses on a sustainable basis.

Competitive operating profit margins are necessary to restore

the Company’s return on invested capital and return on

stockholders’ equity to retail industry standards, and thereby

improve the Company’s access to the capital markets. In

addition, management believes that it is important to restore

the Company’s credit ratings to investment-grade levels and

thereby enhance shareholder value.

The Company’s financing strategy has been effectively exe-

cuted over the 2000-2003 period. As a result, the Company’s

financial position has strengthened significantly over this peri-