JCPenney 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J. C. Penney Company, Inc.28

Notes to the Consolidated Financial Statements

another significant assumption used in the actuarial model for

pension accounting and is determined based upon the

Company’s long-term plans for such increases. For retiree medical

plan accounting, the health care cost trend rates do not have a

material impact since dollar limits have been placed on Company

contributions.

Income Taxes

Income taxes are accounted for under the asset and liability

method. Deferred tax assets and liabilities are recognized for the

future tax consequences attributable to differences between the

financial statement carrying amounts of existing assets and liabil-

ities and their respective tax bases and operating loss and tax

credit carryforwards. Deferred tax assets and liabilities are meas-

ured using enacted tax rates expected to apply to taxable

income in the years in which those temporary differences are

expected to be recovered or settled. The effect on deferred tax

assets and liabilities of a change in tax rates is recognized in

income in the period that includes the enactment date. A valua-

tion allowance is recorded to reduce the carrying amounts of

deferred tax assets unless it is more likely than not that such

assets will be realized.

Earnings/(Loss) per Common Share

Basic earnings per share (EPS) is computed by dividing net

income/(loss) less dividend requirements on the Series B ESOP

Convertible Preferred Stock, net of tax as applicable, by the weight-

ed average number of common shares outstanding for the period.

Except when the effect would be anti-dilutive at the continuing

operations level, the diluted EPS calculation includes the impact of

restricted stock units and shares that could be issued under out-

standing stock options as well as common shares that would result

from the conversion of convertible debentures and convertible

preferred stock. In addition, the related interest on convertible

debentures (net of tax) and preferred stock dividends (net of tax)

are added back to income, since these would not be paid if the

debentures or preferred stock were converted to common stock.

Stock-Based Compensation

The Company has a stock-based compensation plan, which is

discussed more fully in Note 13. The Company accounts for the

plan under the recognition and measurement principles of

Accounting Principles Board Opinion No. 25, “Accounting for

Stock Issued to Employees” (APB 25), and related Interpretations.

No stock-based employee compensation cost is reflected in net

income for stock options, as all options granted under the plan

had an exercise price equal to the market value of the underlying

common stock on the date of grant. Compensation expense for

restricted stock awards with pro rata vesting is recorded on a

straight-line basis over the vesting period, which typically ranges

from one to five years.

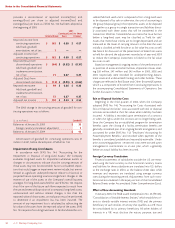

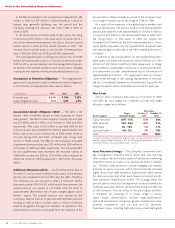

The following table illustrates the effect on net (loss)/income

and EPS as if the Company had applied the fair value recognition

provisions of SFAS No. 123, “Accounting for Stock-Based

Compensation,” to stock options.

($ in millions, except EPS) 2003 2002 2001

Net (loss)/income, as

reported $(928) $405 $ 98

Add: Stock-based employee

compensation expense

included in reported net

income, net of related tax

effects 535

Deduct: Total stock-based

employee compensation

expense determined under

fair value method for all

awards, net of related

tax effects (26) (23) (24)

Pro forma net (loss)/income $(949) $385 $ 79

(Loss)/earnings per share:

Basic—as reported $(3.50) $1.41 $ 0.26

Basic—pro forma $(3.58) $1.34 $ 0.19

Diluted—as reported $(3.13) $1.36 $ 0.26

Diluted—pro forma $(3.20) $1.30 $ 0.19

The Company used the Black-Scholes option-pricing model to

estimate the grant date fair value of its stock option grants for

the periods presented above. The following Black-Scholes

assumptions were used to estimate the grant date fair value of

stock options:

Option Assumptions 2003 2002 2001

Dividend yield 3.9% 3.9% 4.2%

Expected volatility 42.4% 40.0% 40.2%

Risk-free interest rate 3.4% 4.7% 4.8%

Expected option term 7 years 7 years 5 years

Weighted-average fair value

of options at grant date $6.07 $6.32 $ 4.36

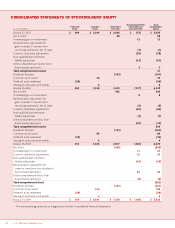

Comprehensive Income/(Loss)

Comprehensive income/(loss) consists of two components:

net income/(loss) and other comprehensive income/(loss).

Other comprehensive income/(loss) is the sum of currency trans-

lation adjustments, unrealized gains/(losses) on investments and

non-qualified plan minimum liability adjustments. Other com-

prehensive income/(loss) is presented in the Consolidated

Statements of Stockholders’ Equity.

Cash and Short-Term Investments

All highly liquid investments with original maturities of three

months or less are considered to be short-term investments. The

short-term investments consist primarily of eurodollar time

deposits and money market funds and are stated at cost, which

approximates fair market value.

Total cash and short-term investments were $2,994 million and

$2,474 million for 2003 and 2002, respectively, and included

restricted short-term investment balances of $87 million and $86

million for the same periods. Restricted balances are pledged as